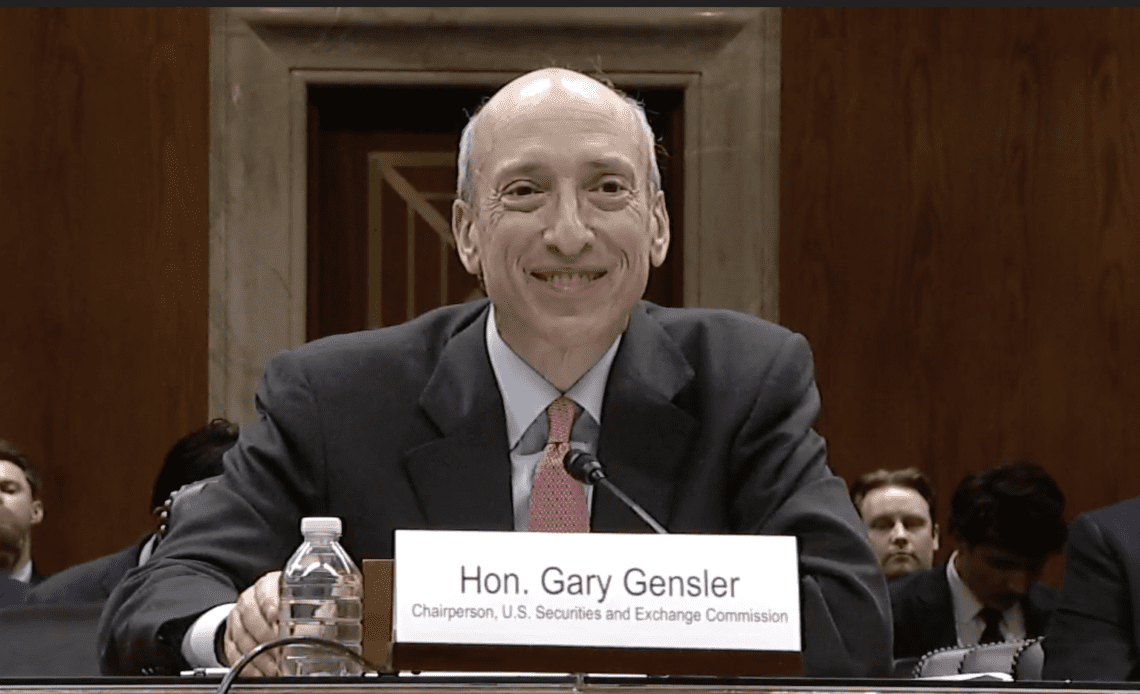

United States Securities and Exchange Commission (SEC) chair Gary Gensler has called for “new tools, expertise, and resources” aimed at addressing misconduct in the crypto space in the regulator’s 2024 budget request.

In prepared testimony for a July 19 hearing of the Subcommittee on Financial Services and General Government with the U.S. Senate Appropriations Committee, Gensler said he supported the Biden administration’s request allocating more than $2.4 billion to the SEC for the 2024 fiscal year. The SEC chair cited the “Wild West of the crypto markets” that was “rife with noncompliance” as part of the reasons behind the budgetary request.

With the funding, Gensler said he expected the SEC to increase the number of full-time positions from 4,685 in 2023 to 5,139 in 2024. According to SEC data, the commission’s enforcement division brought more than 750 enforcement actions in 2022, but “rapid technological innovation” had led to misconduct in the crypto space.

“Our authorities at the SEC are quite robust — we could always use some more resources,” said Gensler in response to questions raised by Illinois Senator Dick Durbin. “If this committee were to see fit and want us to have more resources, we could use them.”

Related: US lawmakers propose SEC chair consider legislation, not enforcement approach to crypto

The SEC chair said he hoped to get an additional $70 million in funding to an agreed-upon budget to add another 170 people to the commission, some of whom would focus on enforcement. He also faced questioning from lawmakers on the SEC’s role in overseeing bankruptcy crypto exchange FTX.

Gensler’s remarks followed a ruling in the SEC v. Ripple lawsuit in which a federal judge said XRP was not necessarily a security. Though the SEC chair said the commission would be assessing the case, his testimony before the committee suggested that his position may not have changed on regulation by enforcement.

Magazine: Crypto regulation: Does SEC Chair Gary Gensler have the final say?

Click Here to Read the Full Original Article at Cointelegraph.com News…