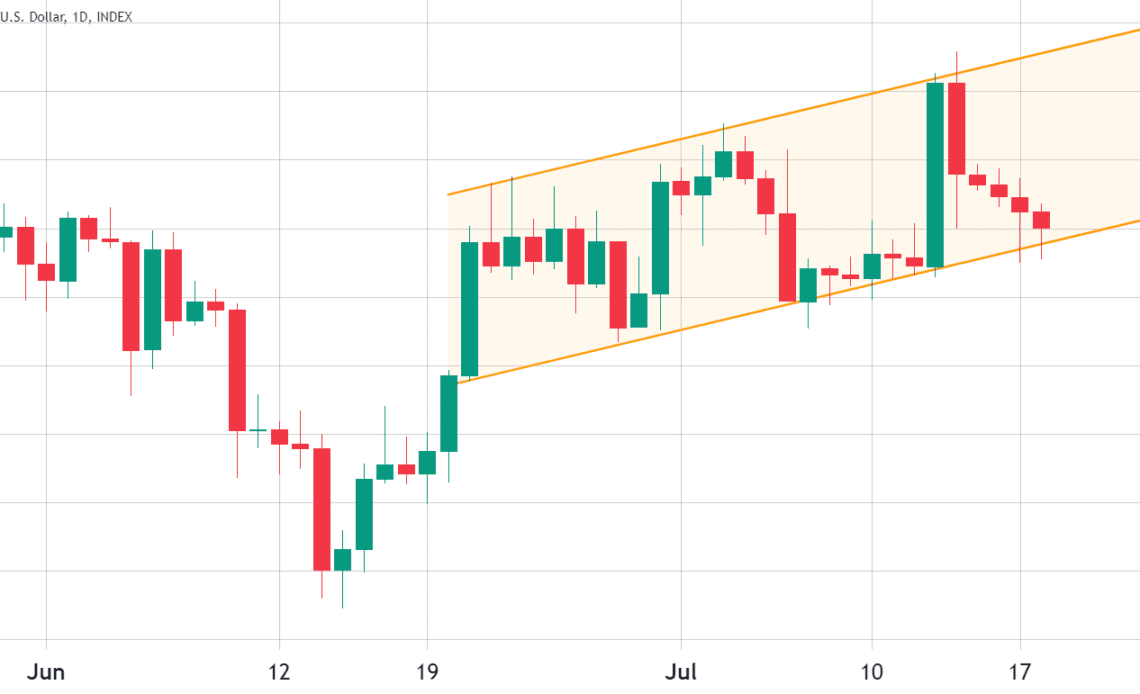

Fidelity Digital Assets released a ‘Q2 2023 Signals Report’ on July 18, which claimed that Ether’s (ETH) outlook for the next 12 months and the long term is positive. Year-to-date, Ether price has gained 62% but while the investment firm might be ‘short-term’ bullish on Ether, that does not mean they believe that the month-long bullish channel will be sustained.

While institutional investors like Fidelity Digital Assets may have a bullish longer-term vision of ETH price, let’s compare their analysis against network and market data to see if they’re on the money.

Beyond the technical indicators, the rationale behind Fidelity’s report bullish outlook for Ether is the networks’ higher burn rate versus coin issuance, the “new address momentum” and a growth in the number of network validators.

According to the Fidelity report, the net issuance since The Merge in September 2022 resulted in a net supply decrease of more than 700,000 Ether. Additionally, the analysts claim that Glassnode’s increasing Ethereum addresses that transacted for the first time ever proves a healthy network adoption.

The report also points to a 15% increase in the number of active Ethereum validators in the second quarter.

The expectation around the EIP-1153 is also building momentum for the Ethereum network, as the “transient storage opcode” improves smart contracts efficiency, reduces costs and amplifies the Ethereum Virtual Machine (EVM) design. The change is especially meaningful for the decentralized exchanges (DEX), where Ethereum network’s dominance declined to 46% from 60% six months prior, according to DefiLlama data.

Dencun upgrade expected to reduce transaction costs

Another potentially bullish factor for the Ethereum network is the anticipated upgrade on the leading DEX, Uniswap. According to a July 17 presentation at Ethereum CC, the upcoming Uniswap V4 will allow users to build unlimited types of pools using programmable buttons (hooks), native ETH support, and a singleton contract that performs internal transactions before settling final balances.

The announcement fueled the likelihood that EIP-1153 will be included in the next “Dencun” upgrade, which triggered Slingshot and DefiPulse co-founder Scott Lewis:

i had missed the news that uniswap labs got eip1153 into cancun.

they kept the details for wanting eip1153 secret from…

Click Here to Read the Full Original Article at Cointelegraph.com News…