Bitcoin (BTC) attempted to break away from its boring sideways price action on July 13 following Ripple’s legal victory over the United States Securities and Exchange Commission, but the enthusiasm proved to be short-lived. Sellers pulled the price back into the range on July 14, indicating that they remain active at higher levels. However, a positive sign is that the bulls have kept Bitcoin’s price above $30,000.

Market observers are expected to closely follow the review process for the various exchange-traded fund (ETF) proposals for a spot Bitcoin ETF, prominent being the proposal by BlackRock. Interestingly, out of 550 ETF applications by BlackRock, only one has been rejected, according to Bloomberg Intelligence’s Eric Balchunas and James Seyffart.

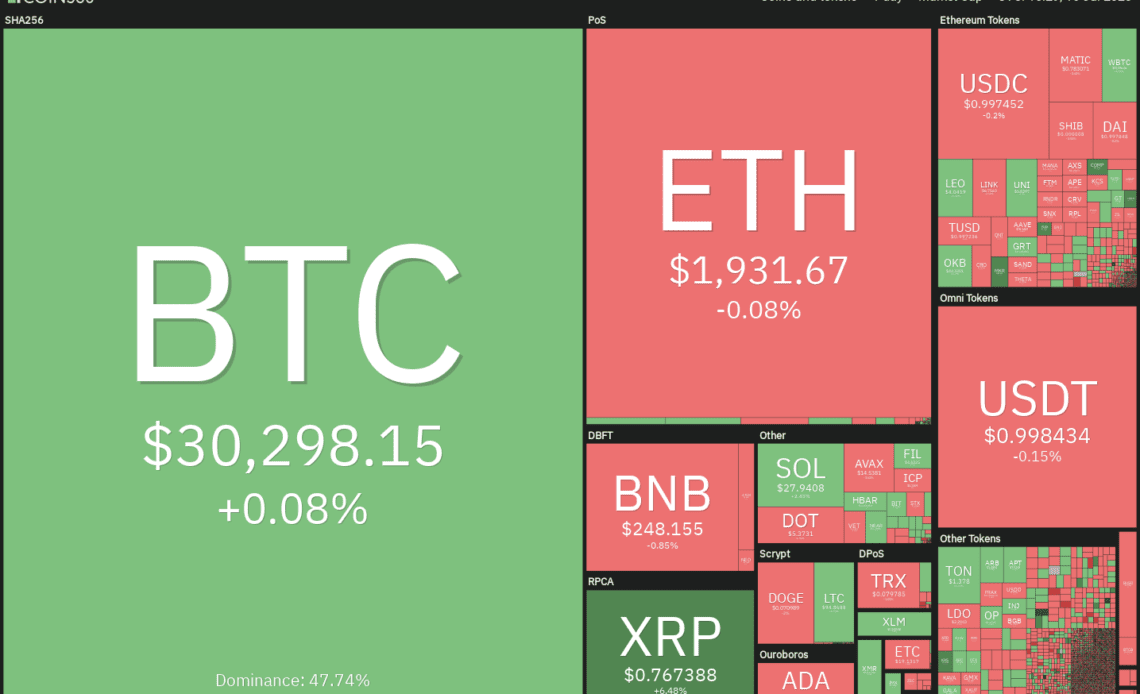

Even as Bitcoin consolidates waiting for its next catalyst, several altcoins are witnessing solid buying. This has pulled Bitcoin’s market dominance below 50%, suggesting that the focus could be shifting to the altcoins in the near term.

Could Bitcoin start a trending move in the short term or will it remain stuck inside the range? What are the altcoins that are looking strong on the charts? Let’s study the charts of top-5 cryptocurrencies that could be on trader’s radar in the next few days.

Bitcoin price analysis

Bitcoin closed above $31,000 on July 13 but that proved to be a bull trap because the bears yanked the price back below the level on July 14. This shows that the bears are fiercely defending the zone between $31,000 and $32,400.

The price action of the past few days has formed a bearish divergence on the RSI. This indicates a weakening bullish momentum. The bears will try to build upon their advantage by pulling the price below the 20-day exponential moving average ($30,187). If they manage to do that, the BTC/USDT pair could descend to the 50-day simple moving average ($28,631).

If bulls want to prevent the decline, they will have to quickly push and sustain the price above $31,000. The pair could then climb to $32,400. A break and close above this level will clear the path for a potential run to $40,000 as there are no major resistances in between.

The pair has dropped below the moving averages on the 4-hour chart, indicating that demand dries up at higher levels. The bears will have to sink and sustain the price below $29,500 to start a deeper correction. The…

Click Here to Read the Full Original Article at Cointelegraph.com News…