Bitcoin (BTC) may see a “parabolic curve” begin thanks to U.S. dollar weakness as the greenback falls to three-month lows.

In a tweet on July 11, popular trader Moustache suggested that the time is right for BTC price history to repeat itself.

DXY “most important chart” for Bitcoin this year

Bitcoin’s formerly strong inverse correlation to dollar strength has waned this year, but its latest movements are a talking point among traders.

Data from Cointelegraph Markets Pro and TradingView shows the U.S. dollar index (DXY) on the way to testing support at 100 for the first time in months.

Previously above 105, the greenback has faced stiff resistance after last year’s twenty-year highs.

As a result of its newfound bearish behavior — which would cement itself further should the 100 mark be lost — Bitcoin stands to win, Moustache believes.

“Calm before the storm. Big Move is still loading,” he summarized alongside a chart showing DXY challenging the bottom of a Gaussian channel on weekly timeframes.

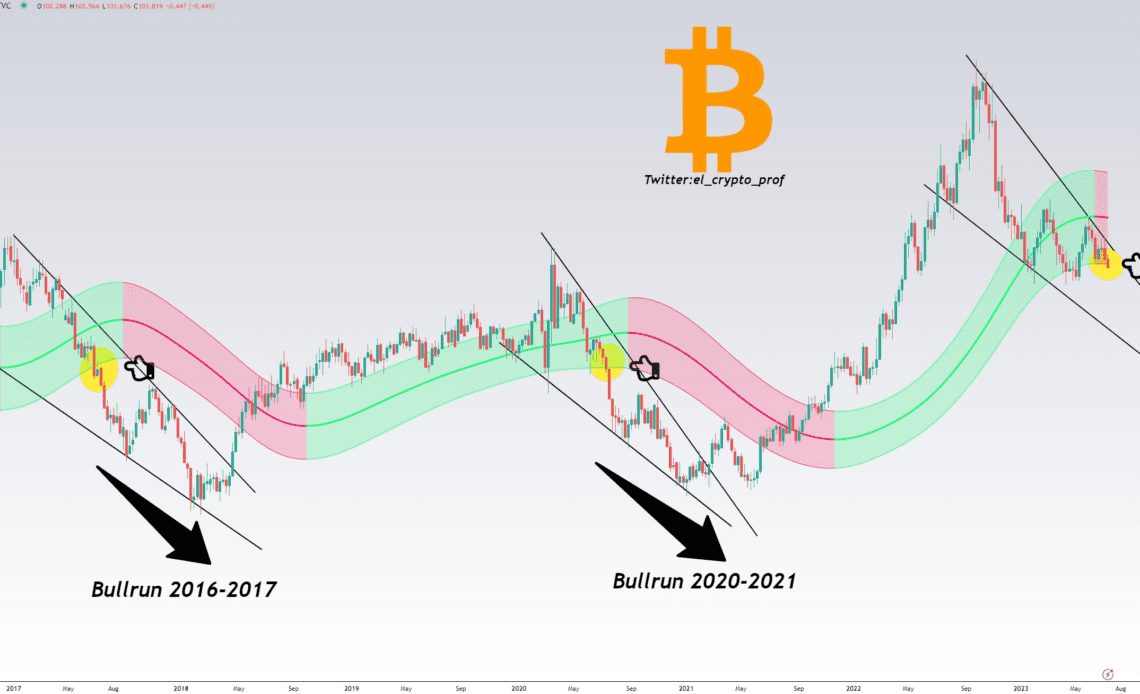

“First candle of the DXY (Dollar) now falls OUT of the channel. This is the point where you want to be positioned. In 2016-2017 and 2020-2021 this led to the parabolic curve in $BTC.”

The dollar’s cause has not been helped by markets keen to tap a potential reversal in U.S. interest rate hikes. With inflation abating, this looks ever more likely despite a Hawkish Federal Reserve.

The July 12 release of the Consumer Price Index (CPI) for the month prior came in below expectations, providing further fuel for risk assets.

Fellow trader Mikybull Crypto predicted that the downward DXY trend would continue, with BTC/USD hitting $35,000 as a result.

Bears in disbelief

90 next on DXY#Bitcoin to 35k$ pic.twitter.com/TczJMGKh5I

— Mikybull Crypto (@MikybullCrypto) July 12, 2023

Continuing the historical comparison, meanwhile, popular trader Josh Olszewicz called DXY the “single most important chart” for Bitcoin into 2024.

“DXY showing technical weakness coupled with a programmatic supply reduction of Bitcoin issuance may lead to an outsized price reaction for Bitcoin post-halving. Similar DXY moves from 100 to 90 after the previous two halvings provided a tailwind for significant multi-month bullish rallies,” he wrote in a TradingView update.

“DXY is currently forming a high timeframe descending triangle, which holds a bearish bias. This chart pattern becomes invalidated with any higher…

Click Here to Read the Full Original Article at Cointelegraph.com News…