With the Bitcoin (BTC) halving event less than a year away, several financial giants have filed applications for a spot Bitcoin exchange-traded fund (ETF) — a scenario last seen before the 2020 to 2021 bull run.

Institutional interest in the sector dried up after major crypto giants such as FTX collapsed amid a prolonged crypto winter in 2022. Bitcoin and many other cryptocurrencies traded largely sideways as several crypto exchanges fell under regulatory scrutiny.

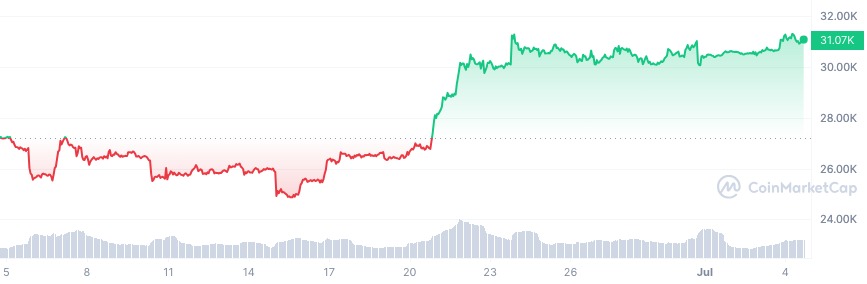

However, on news that major financial institutions such as BlackRock, Fidelity, Valkyrie and others were filing applications to list a spot Bitcoin ETF, the price of BTC recovered to over $30,000, spurring investment into the crypto market again.

While several institutional giants have filed spot Bitcoin ETF applications with the United States Securities and Exchange Commission (SEC) in the past, all have either withdrawn their applications or faced outright rejections from the regulator.

The SEC approved the first Bitcoin futures ETF in October 2021 — the ProShares Bitcoin Strategy ETF — which debuted on the New York Stock Exchange on Oct. 19, 2021.

However, the spot Bitcoin ETF filing by the asset management giant BlackRock has increased the chances of the SEC approving the first spot Bitcoin ETF. That’s according to Bloomberg senior ETF analyst Eric Balchunas, who gives BlackRock a 50% chance of getting its spot Bitcoin ETF approved.

The most recent spate of ETF filings began with BlackRock’s filing with the SEC on June 16. WisdomTree, Invesco and Valkyrie also filed in the days and weeks that followed.

Recent: Chibi Finance $1M alleged rug pull: How it happened

On June 28, ARK Invest, which previously filed for a spot Bitcoin ETF in June 2021, amended its filing to make it similar to that of BlackRock. The next day, asset manager Fidelity Investments also filed for a spot Bitcoin ETF. In total, seven institutional giants have now filed for a spot Bitcoin ETF to date.

Some industry observers believe 2023 to 2024 will be crucial for approving a spot Bitcoin ETF. Robert Quartly-Janeiro, chief strategy officer of the cryptocurrency exchange Bitrue, told Cointelegraph that the timing is right, as “inflation is rampant and the money supply is a mixed picture, interest rates are high, and businesses are seeing decent revenues, which means crypto will need to perform in an economic environment where rates and inflation are key…

Click Here to Read the Full Original Article at Cointelegraph.com News…