While Arbitrum’s governance token ARB has been in a consistent downturn since the airdrop in late March, its ecosystem shows healthy growth.

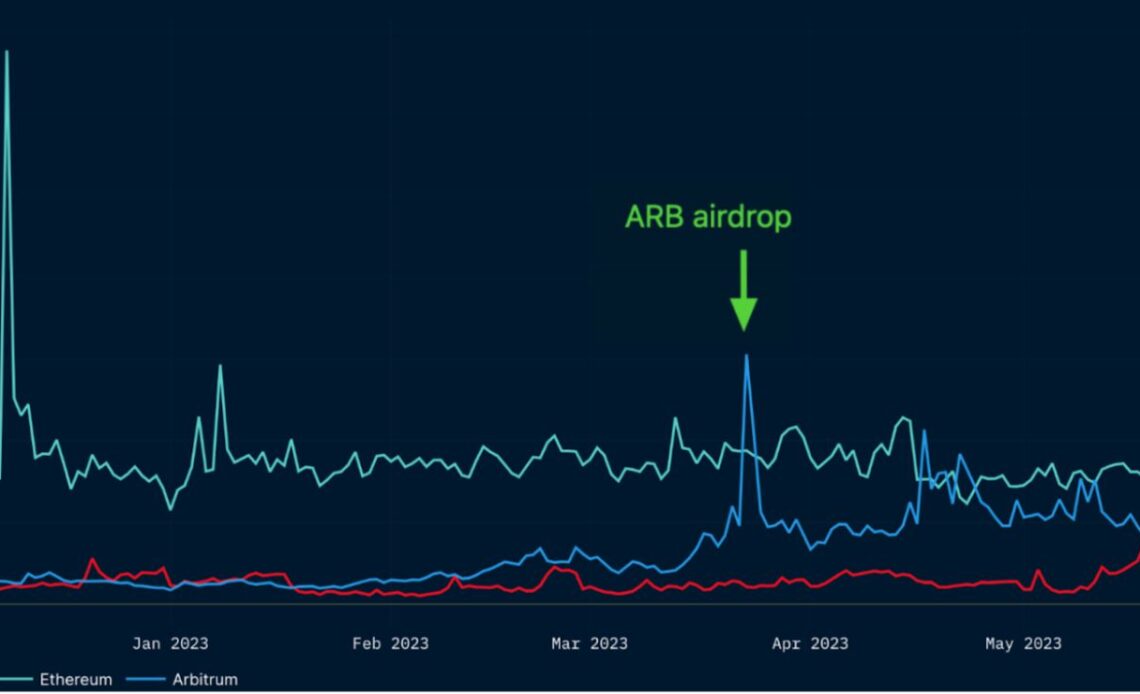

A recent Nansen report shows that Arbitrum’s activity improved after the airdrop, stabilizing “at a level higher” than before the airdrop. The daily active users, gas fees and transaction count maintained consistent higher levels on the Ethereum rollup since April 2023.

The gap between the number of active users on Arbitrum and Optimism widened after the Aribtrum airdrop, closing in on Ethereum.

The trading volume on Arbitrum-based decentralized exchanges paint a similar picture, showing an evident rise in volume after the airdrop.

Moreover, Nansen’s report showed that only ARB airdrop recipients only accounted for around 5% of the activity on the blockchain and showed that Arbitrum has attracted considerably more new users to Arbitrum after the airdrop.

Potential catalysts for ARB upside

Moreover, an upcoming update on Ethereum in the second half of 2023, dubbed as Cancun-Deneb (Dencun), will include EIP-4844 (Proto-Danksharding), which will reduce the transaction fees on Arbitrum, increasing the blockchain’s value proposition.

Additionally, the Arbitrum Foundation recently revealed accumulated data from its Sequencer, a part of the L2 fees paid by users for posting the data onto Ethereum.

The Foundation has decided to pass on the Sequencer’s earnings, totalling 3,352 ETH or $5.4 million, to the Arbitrum DAO which will be managed by ARB holders.

https://twitter.com/arbitrum/status/1656090371061956610

A revenue source for the DAO can potentially create yields for ARB holders if the community votes to direct the rewards holders. It remains to be seen how the funds are managed by the foundation and the DAO.

“Smart money” is holding ARB

Nansen’s data shows that the “smart money” and funds who accumulated ARB after the airdrop still haven’t sold, which is encouraging. The on-chain analytics firm tags Ethereum addresses of high-volume and profitable traders as “smart money.”

The funding rate for ARB perpetual swap contracts turned negative like the rest of the crypto market after the SEC brought lawsuits against the industry’s largest exchanges, Binance and Coinbase, per…

Click Here to Read the Full Original Article at Cointelegraph.com News…