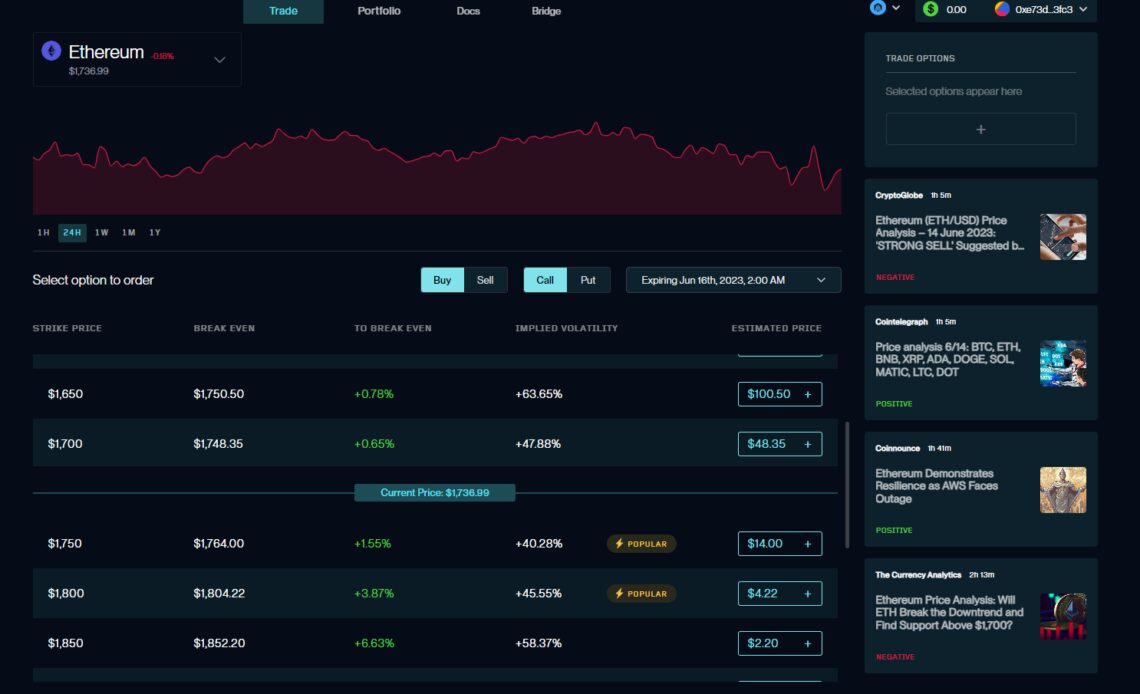

A DeFi options platform launched that uses social logins and undercollateralized trading to draw in liquidity providers, according to a June 15 announcement . The protocol, called “Synquote,” is capable of handling large trades with much less slippage than previous options platforms, the team claimed.

According to the announcement, Synquote did over $25 million of notional volume in its beta period, which began on March 17. The largest trade during this period was for $1 million in notional volume, which was executed without any detectable slippage, developers told Cointelegraph.

In a conversation with Cointelegraph, Synquote founder Ahmed Attia explained the strategy the protocol uses to attract liquidity. First, it doesn’t use an automated market maker (AMM) to determine prices. Instead, an off-chain, peer-to-peer request for quote (RFQ) protocol matches buyers and sellers. This helps to allow greater flexibility in terms of the types of orders that can be placed by market makers.

Second, the protocol allows liquidity providers to make undercollateralized trades. For example, they can issue or sell options with “as little USDC [US Dollar Coin] as 1/10 of the underlying asset’s value if [they’re] selling a short-dated naked call.” This is in contrast to most DeFi options protocols that require full collateralization.

Attia argued that allowing undercollateralized trades is the only way to attract large institutions to the DeFi space, stating:

“We launched a fully collateralized platform before, and we saw that activity was limited by the amount of size market makers were willing to trade on-chain with a fully collateralized [position]. So this is a huge improvement that unlocks the ability for them to trade with size and have capital efficiency on-chain.”

Social logins have also been implemented as part of the public launch, the Synquote founder stated. Both market makers and traders can now login using their Google credentials, without needing to download a wallet or copy down seed words. This is possible because of the Web3Auth platform, a type of new wallet tech that allows for seedless wallets.

Related: Anon-powered options: DeFi platform Premia goes live

In the past, some undercollateralized platforms have suffered liquidity crises during large swings in the market. For example, the Vires.Finance lending app on Waves suffered frozen withdrawals in April, 2022, as its liquidation mechanism was…

Click Here to Read the Full Original Article at Cointelegraph.com News…