The crypto market remains volatile after the June 14 Federal Open Market Committee (FOMC) announcement and presser with Fed Chairman Jerome Powell revealed that the central bank would pause rate hikes for June.

While this move aligned with investors’ expectations, the crypto market has yet to show any bullish momentum. Powell also mentioned that at least two more rate hikes would be needed in the future.

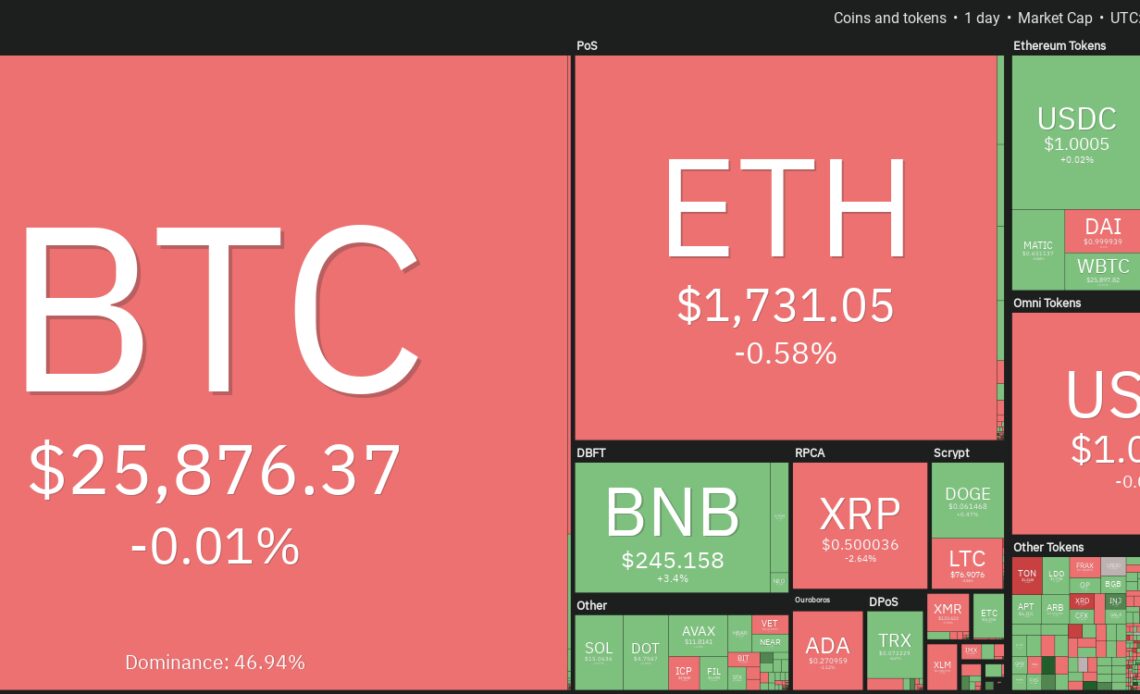

Bitcoin price started the day up, trading above $26,000, but it has since retraced to a 24-hour low of $25,791 after the FOMC announcement. Some analysts are predicting that a drop to $25,000 is inevitable based on the current state of BTC derivatives data.

The muted crypto price action and lack of a bullish response to today’s rate hike pause could be the lingering effect of the SEC’s charges against Binance and Coinbase exchange.

Related: ‘Holy shit, I’ve seen that!’ — Coldie’s Snoop Dogg, Vitalik and McAfee NFTs

FOMC tanks crypto and some equities

The stock market dropped sharply on June 14 after the FOMC decision with the Dow dropping 200 points minutes after the announcement. Another major equity index, the S&P 500 hit a 13-month high.

While Powell decided to pause interest rate hikes, the Federal Reserve reiterated the focus to bring down elevated inflation.

In the policy issuance, the Federal Reserve stated,

“In determining the extent of additional policy firming that may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

The wording shows a potential return to interest rate hikes in the future. To date, crypto prices are still highly correlated with the Dow and S&P 500 and most major banks still expect the U.S. to experience a sharp recession at some point in 2023. This has not stopped major stock indices from reaching yearly highs after the United States debt ceiling deal.

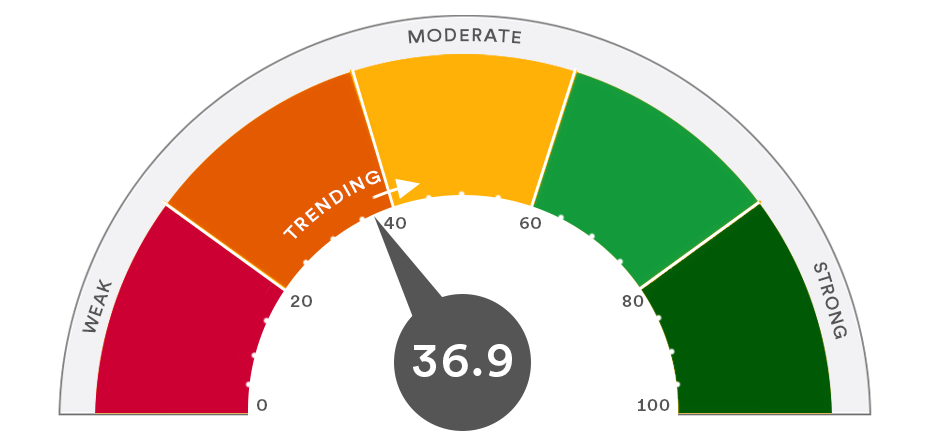

According to U.S. Bank analysis which incorporates more than 1,000 data points, investor sentiment about the current state of the economy remains low.

According to Robert Haworth, Senior Investment Strategy Director at U.S. Bank,

“Overall, the U.S. economy is slowing, but not reaching recession.”

The pausing of rate hikes is causing volatility across…

Click Here to Read the Full Original Article at Cointelegraph.com News…