Ben.eth, the pseudo-anonymous memecoin creator behind at least three controversial token launches in recent weeks could fall under the crosshair of United States regulators, crypto lawyers suggest.

A previously little-known personality in the crypto community, Ben.eth has seen his Twitter following blow up nearly five-fold in May. The influencer has launched at least three memecoins in recent weeks — Ben Coin (BEN), PSYOP, and LOYAL.

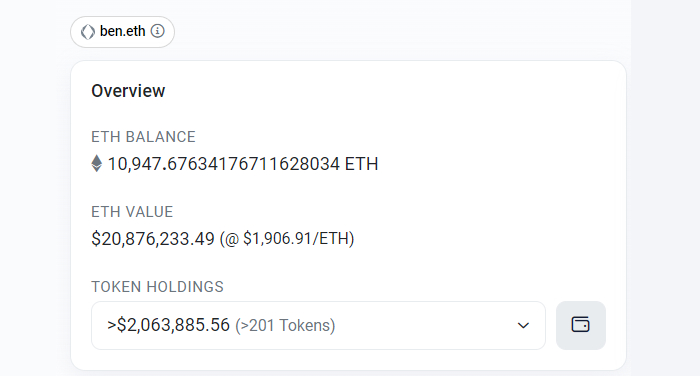

Pre-sales of these memecoins — which require Ether (ETH) to be sent directly to the creator himself — have allowed Ben.eth to gather thousands of ETH. Currently, his wallet holds 10,946 ETH, equivalent to $20.8 million.

While Ben.eth’s supporters have defended the legitimacy of the token sales, others warn that the influencer’s actions could face the wrath of regulators and disgruntled investors alike.

Michael Kanovitz, a partner at Loevy & Loevy told Cointelegraph, the Psyop launch “is a classic example of the concerns the SEC has identified in actions like those against Kim Kardashian and Paul Pierce.”

Kanovitz recently sent a profanity-laden letter via NFT to Ben.eth threatening a class-action suit against him alleging he “used a manipulative launch strategy” in the PSYOP presale.

To @eth_ben and @psyopeth :

My law firm, Loevy & Loevy, will be filing a class action against you in your IRL name if you do not refund all of the $PSYOP presale purchasers immediately.

Our settlement demand letter has served as an NFT to your ben.eth address, viewable here:… pic.twitter.com/qaxhECDUhb— Mike Kanovitz (@MikeKanovitz) May 19, 2023

Kanovitz alleged Ben promised Psyop’s returns on investment would be “several fold or greater” and claimed he “coordinated with other influencers to spread misinformation” and potentially manipulated the token’s price.

Pointing to BEN and LOYAL, Kanovitz said he’s “continuing to gather evidence” on the alleged scheme.

In comments to Cointelegraph, Michael Bacina, a lawyer and partner at Piper Alderman said the legal trouble Ben could find himself in depends on if the sales are investigated and what U.S. regulator carries out that investigation.

The Securities and Exchange Commission (SEC), for example, might believe the tokens are investment contracts — as it does with most other cryptocurrencies — and could consider them unregistered securities which could see Ben face possible fines…

Click Here to Read the Full Original Article at Cointelegraph.com News…