The risk/reward ratio or risk/return ratio is a commonly used metric in trading that compares the potential profit of a trade with the potential loss. That said, it’s the reward traders stand to make for the risk they take.

For example, an investment with a risk/reward ratio of 1:3 would mean that for every dollar the investor spends, they gain three dollars if the trading goes in their favor. The risk/reward ratio is decisive to cryptocurrency trading, whether for daily trades or crypto investment for the long run, known as “hodling.”

To gain a better understanding, let’s consider it in the context of crypto trading.

How to calculate the risk/reward ratio

Assuming that the prevailing price of Ether (ETH) is $2,000, a crypto trader might decide to enter a long position (buy) with the following parameters:

Entry price: $2,000

The price at which they purchase ETH.

Stop-loss: $1,800

Should the price of ETH go down, which is not in the trader’s favor, the stop-loss point is where they would sell the ETH acquired (for a loss) and avoid further losses. In other words, they’re risking $200 per ETH bought at $2000.

Take profit: $3,000

If the price of ETH goes up, the take profit price is the point they would sell the ETH, which, in this case, would be for a profit of $1000, a reward of $1000 per ETH.

Plenty of risk/reward ratio calculators are available online for cryptocurrency trading. Using the above example, here’s how to manually calculate the risk/reward ratio:

- The initial risk is $200 per ETH (the distance between the entry price of $2,000 and the stop-loss price of $1,800).

- The take-profit level offers a reward of $1,000 per ETH, which gives a risk-reward ratio of 1:5 ($200 risk divided by $1,000 reward).

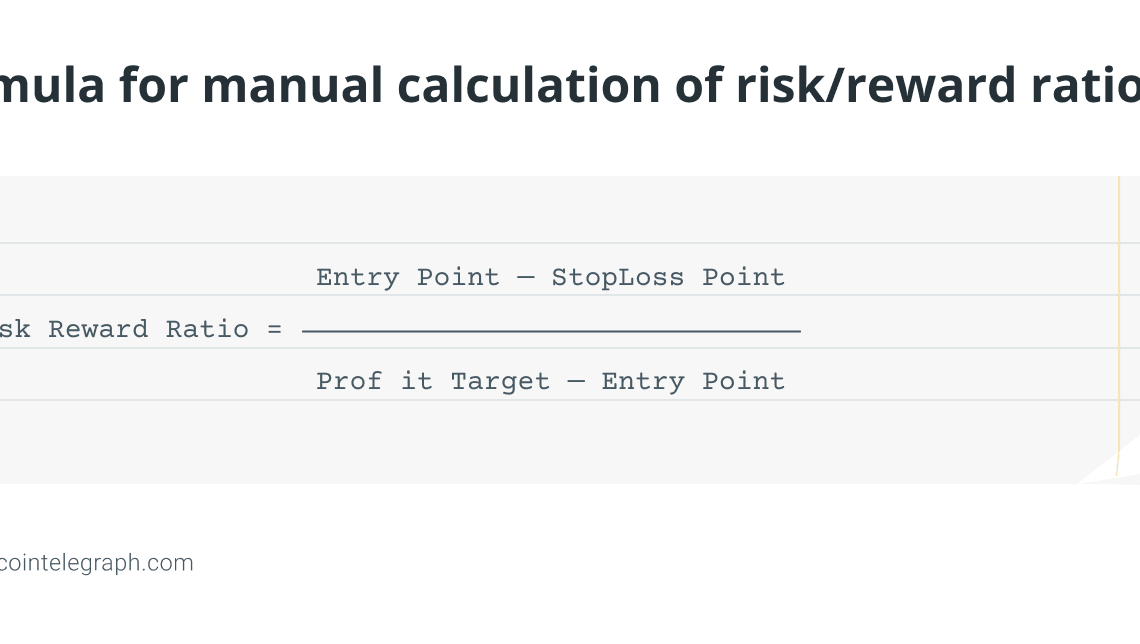

Here is the formula for the risk/reward ratio:

Related: What is a trading journal, and how to use one

What are the pros, cons, buts and howevers of the risk/reward ratio?

The risk/reward ratio helps traders evaluate a trade’s potential risks and rewards, and make decisions accordingly. It allows traders to manage risk effectively by setting stop-loss orders and take-profit levels, limiting potential losses while maximizing profits.

However, the risk/reward ratio is a measure for managing risk and does not guarantee success in trading because:

- It is based on assumptions about an asset’s future price movement, which may not always hold.

- It can be oversimplified and may not consider other important factors, such as market conditions, liquidity and…

Click Here to Read the Full Original Article at Cointelegraph.com News…