Bitcoin (BTC) starts a new week in volatile territory as news of an oil supply cut delivers a choppy start to the week.

Still caught at major historical resistance, BTC/USD delivered an unappetizing weekly close on the back of news that oil production cuts will now enter.

A subsequent rebound may show bulls’ mettle, but the question for analysts is what happens next — will oil prices dictate market moves or can Bitcoin break through $30,000?

Under the hood, the picture is as rosy as ever — network fundamentals are due to hit new all-time highs this week, while dormant supply is also increasing.

Cointelegraph takes a look at the state of Bitcoin markets as the world digests the latest move from Opec+.

Oil cut boosts dollar as inflation concerns return

A key event over the weekend, which is now upending macro conditions, is a decision to cut global oil output.

Opec+ has announced voluntary cuts in production totaling 1.65 million barrels per day, and the impact was felt immediately — the U.S. dollar is rising along with energy costs.

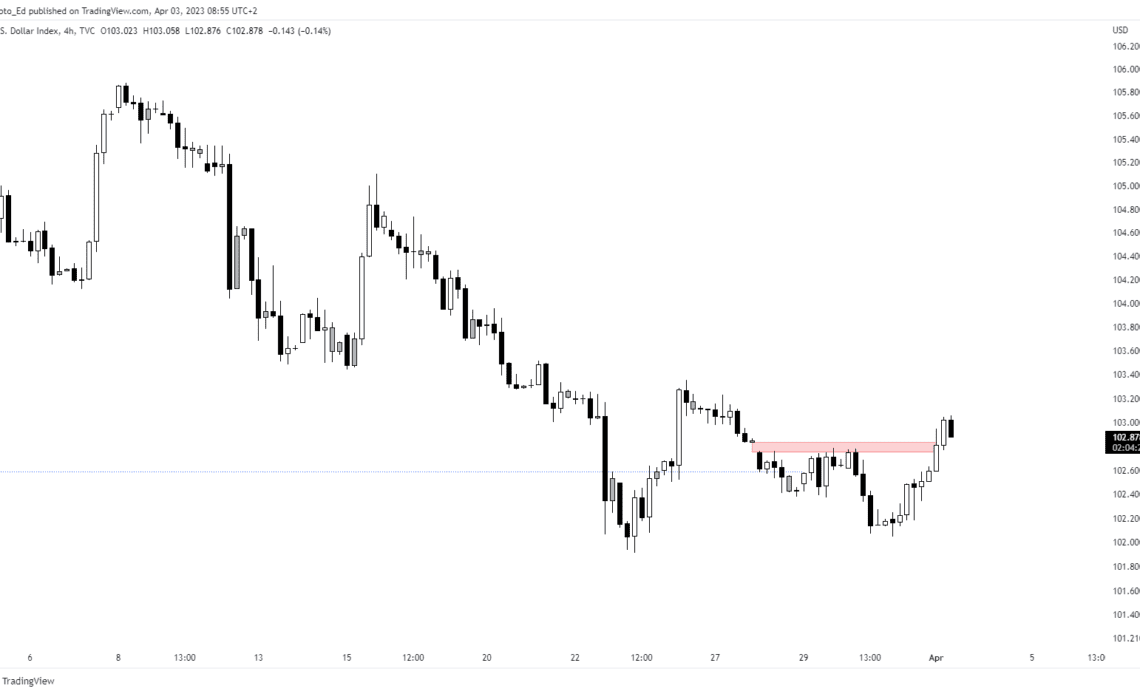

A classic headwind for risk assets including crypto, the U.S. dollar index (DXY) traded above 102.7 at the time of writing, up from April lows of 102.04.

“Eyes on DXY this morning…. This bounce could be just a gap fill as I spoke about last week. I was waiting for this fill,” popular trader Crypto Ed reacted, uploading an explanatory chart to Twitter.

“It’s time for DXY to show its direction (which should effect BTC’s PA).”

While the Opec+ move took its toll on assets from Bitcoin to gold, Alasdair Macleod, head of research for Goldmoney, argued that governments would have to inject liquidity to offset any energy price rises, thus once again boosting risk-asset performance.

WTI oil is up $3.60 this on ME and Asia cutting output. Market reaction is gold falls $13. Markets incorrectly believing it’s “deflationary”. But anyone with half a brain knows that central banks will just print faster and faster to pay for higher energy prices…

— Alasdair Macleod (@MacleodFinance) April 3, 2023

“Markets will soon react to the surprise OPEC production cut from this weekend,” financial commentary resource The Kobeissi Letter continued in its own dedicated analysis.

“Oil prices will likely rise back above $80.00, an unwelcomed development by central banks attempting to fight inflation. Supply-side inflation is set to worsen on this news.”

Higher inflation…

Click Here to Read the Full Original Article at Cointelegraph.com News…