Investment advisers are the largest trackable cohort outside of retail that are buying Bitcoin and Ether exchange-traded funds, according to new data from Bloomberg Intelligence.

Bloomberg ETF analyst James Seyffart said in an X post on Wednesday that investment advisers are “dominating the known holders” of Ether ETFs, investing over $1.3 billion or 539,000 Ether (ETH) in Q2 — an increase of 68% from the previous quarter.

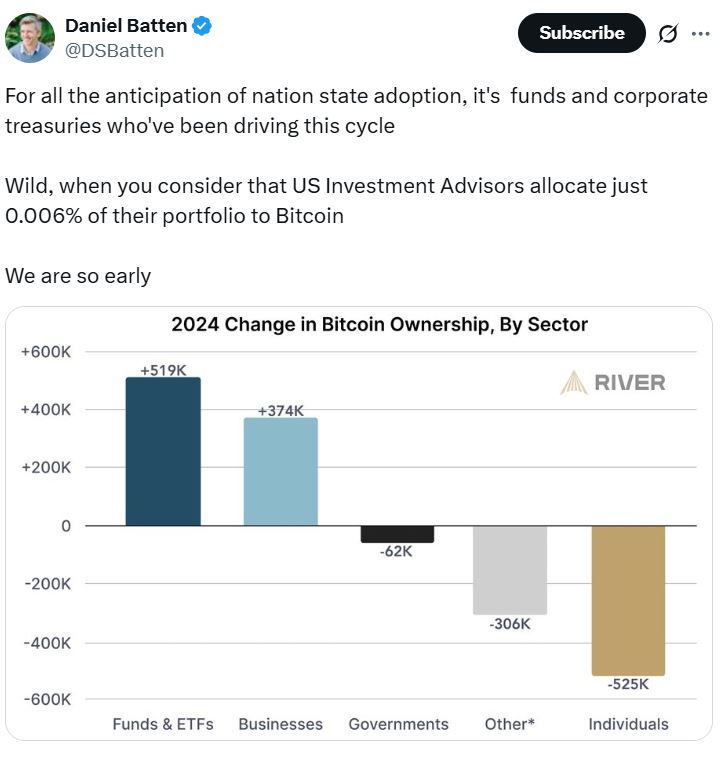

The same was observed in US spot Bitcoin ETFs. Seyffart said on Monday that “advisers are by far the biggest holders now,” with over $17 billion of exposure in 161,000 Bitcoin (BTC).

In both cases, the exposure from investment advisers was nearly twice that from hedge fund managers.

However, Seyffart said this was based on data filed with the SEC, which represents only a fraction of all the spot Bitcoin ETF holders.

“This data is mostly 13F data. It only accounts for about 25% of the Bitcoin ETF shares. The other 75% are owned by non-filers, which is largely going to be retail,” he added.

Crypto ETF data tells a story, analysts say

Vincent Liu, the chief investment officer at Kronos Research, said the data signals a shift from speculative flows to long-term, portfolio-driven allocations.

“As the top holders, their strategic positioning provides deeper liquidity and a lasting foundation for crypto’s integration into global markets,” he told Cointelegraph.

Liu said that as more advisers adopt Bitcoin and Ether ETFs, crypto will be recommended and recognized as a long-term diversification tool within traditional portfolios, complementing equities, bonds, and other mainstream assets.

“As more altcoins join the ETF space and yield-bearing assets like staked Ether gain approval, advisers can use crypto not just to diversify portfolios but also to generate returns, driving broader and longer-term adoption.”

Room for advisers to lean further into crypto ETFs

Some have speculated that the number of financial advisers in crypto ETFs could explode as regulations come into force. In July, Fox News Business predicted that trillions of dollars could flood the market through financial advisers.

Pav Hundal, lead market analyst at Australian crypto broker Swyftx, told Cointelegraph that investment adviser holdings in Bitcoin ETFs have grown by about 70% since June, triggered by softening in the US regulatory context, coupled with an almost unprecedented demand for risk-on…

Click Here to Read the Full Original Article at Cointelegraph.com News…