Key takeaways:

-

Bitcoin price needs to hold above $110,000 to avoid further losses.

-

The Taker-Buy-Sell-Ratio is down to levels last seen in November 2021, when BTC price reached its cycle peak.

Bitcoin’s (BTC) price saw modest gains on Wednesday, rising 0.9% over 24 hours to trade at around $111,000.

Several analysts said the next most crucial support remains $110,000, and the price must hold it to avoid a deeper correction.

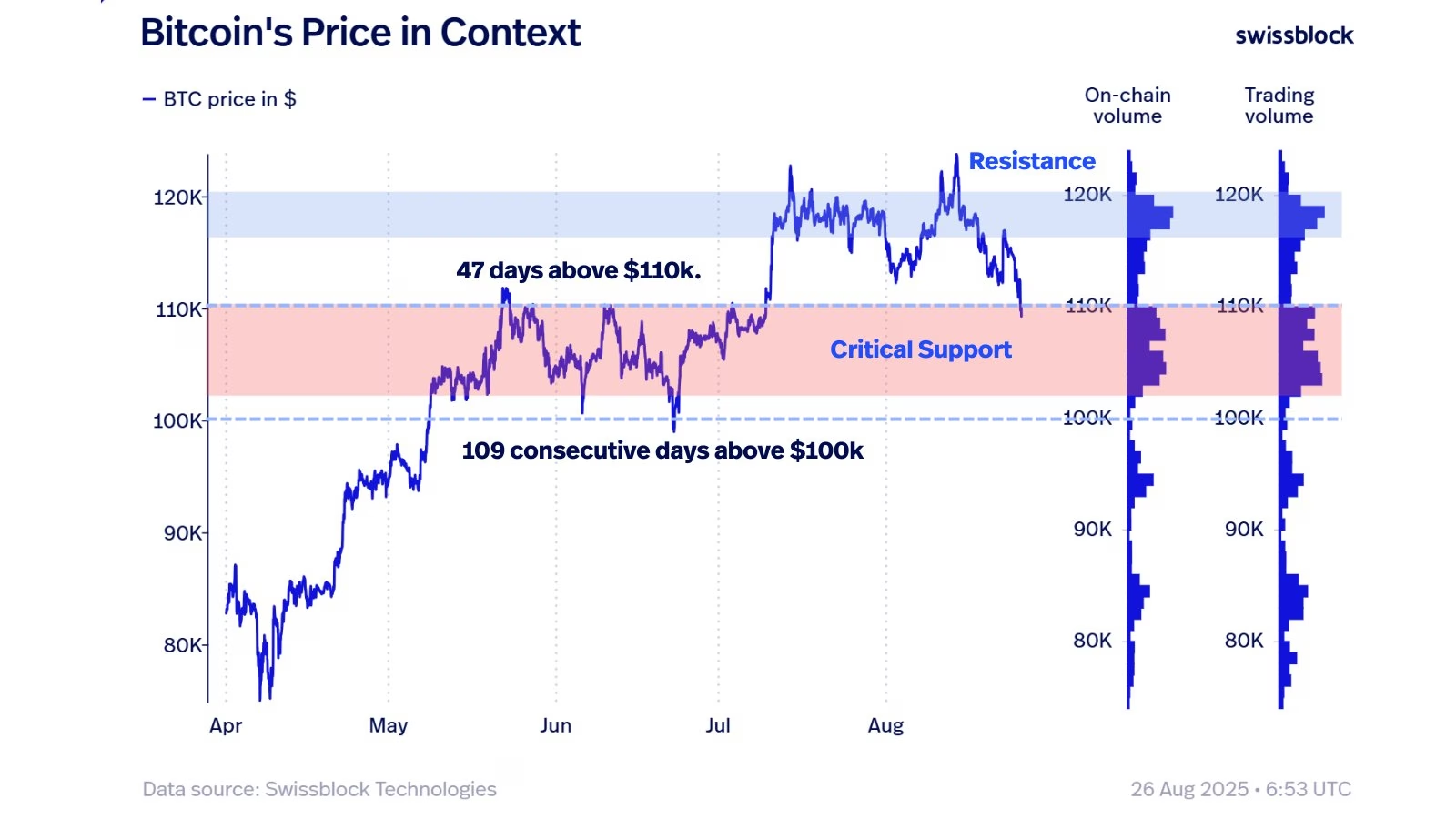

“BTC is at a make-or-break level,” said Swissblock in a Wednesday post on X.

The private wealth manager asserted that Bitcoin’s “lifeline support” sits at $110,000, a level bulls must hold to ensure the bullish trend continues.

“BTC has proven resilience above $100K, but survival above $110K will decide if the trend continues bullish or tips into structural weakness.”

Popular Bitcoin analyst AlphaBTC shared a chart showing that the area between $110,000 and $112,000 was key for Bitcoin.

According to the analyst, a four-hour candlestick close above this area was required for the BTC price high to rebound; otherwise, a drop to $105,000 is likely.

“Until we get a four-hour close above $112K, I still feel $105K is in play, so I will be watching that level closely.”

📈#Bitcoin game plan 📈

Lower time frame view as $BTC attempts to break back out of the June / July range.

For me, until we get a H4 close above 112K I still feel 105K is in play, so I will be watching that level closely.#Crypto #BTC https://t.co/pUUFtwwVDX pic.twitter.com/vCfRVF7s5s

— AlphaBTC (@mark_cullen) August 27, 2025

Bitcoin price is currently holding the $110,000–$112,000 support, which “remains the key battleground,” said investor and trader Crypto Storm, adding:

“As long as this zone holds, a rebound toward the highs is still possible.”

Bitcoin taker buy-sell ratio flashes a “peak” signal

Unfortunately for the bulls, several bearish signs suggest BTC could fall below $110,000 in the following days or weeks.

Bitcoin’s price has deviated approximately 11% from its all-time high above $124,500 reached on Aug. 14, per Cointelegraph Markets Pro and TradingView data.

This drawdown has kept investors on the back seat, “reflecting a perception that the market may be overextended,” according to CryptoQuant analyst Gaah.

The Bitcoin Taker-Buy-Sell-Ratio, a metric gauging market sentiment, was at -0.945. When the metric dips below 1, it indicates that bears are in control of the market, and when the metric is…

Click Here to Read the Full Original Article at Cointelegraph.com News…