Key takeaways:

-

XRP open interest has dropped 30%, signaling cooling futures activity.

-

A fair value gap at $2.33–$2.65 is a key demand zone if selling pressure persists.

-

Elevated whale inflows hint at profit-taking, but XRP’s long-term uptrend toward $5 in 2025 remains intact.

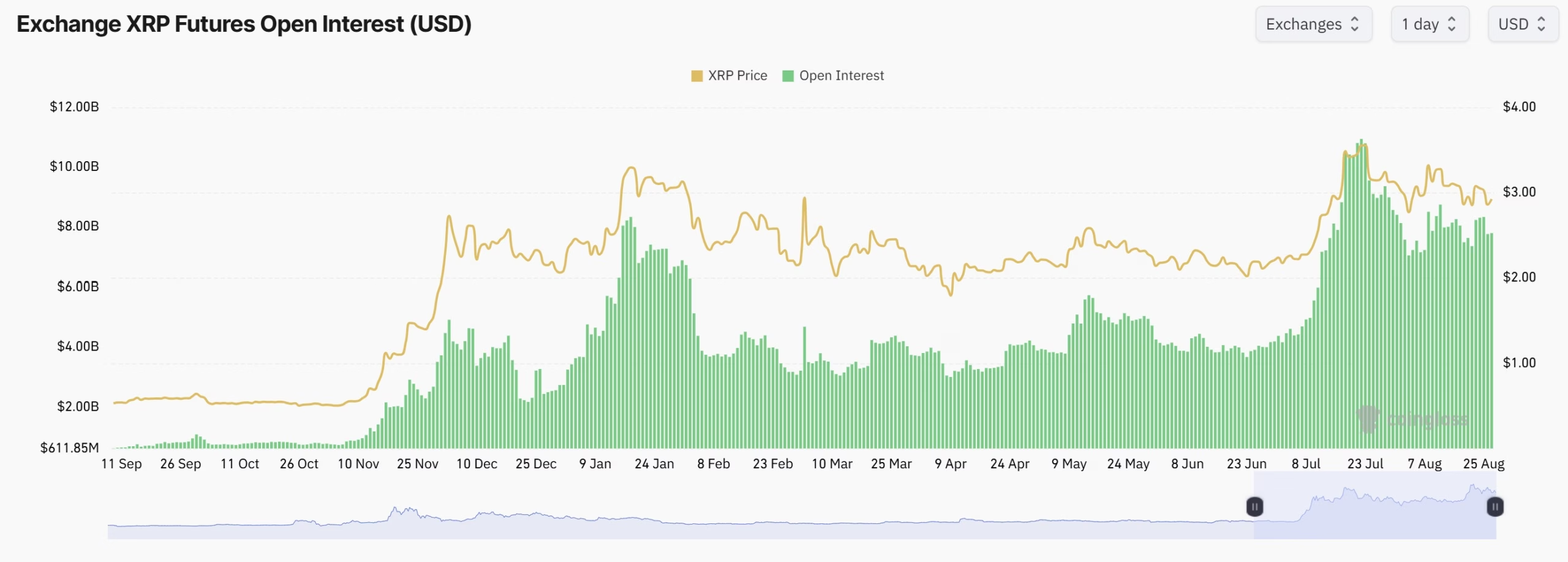

XRP (XRP) futures open interest (OI) has decreased by 30% over the past month, falling to $7.7 billion from $11 billion, while prices have retreated from a peak of $3.66. A decline in open interest typically reflects a dip in speculative activity, signaling either profit-taking or waning conviction among leveraged traders.

A similar outcome occurred in Q1, with XRP’s OI plummeting to $3 billion from $8.5 billion, a steep 65% drawdown, with spot prices falling more than 50%. The current setup echoes that trend, though with less severity, suggesting traders could exhibit accumulation once OI finds a new base range.

Technically, XRP has a daily fair value gap between $2.33 and $2.65, making this range a probable demand zone if open interest continues to decline. A moderation in OI often precedes periods of price stabilization or a fresh accumulation phase, which historically has offered attractive re-entry points before renewed rallies.

Importantly, liquidations remain relatively subdued. Only $22 million in longs were wiped out on Monday, and $56 million during the 6% pullback on Aug. 14. Compared to typical washouts in overheated markets, these figures highlight a controlled leverage flush, reducing the risk of cascading sell pressure.

Overall, while the drop in open interest does raise caution, it also leaves room for a price bottom. If XRP holds the $2.33–$2.65 zone, traders may interpret the cooling leverage backdrop as a potential springboard for the next leg higher, rather than a breakdown to new lows.

Related: XRP price fails to overcome $3: Is a breakout still possible?

XRP whale inflows keep price under near-term pressure

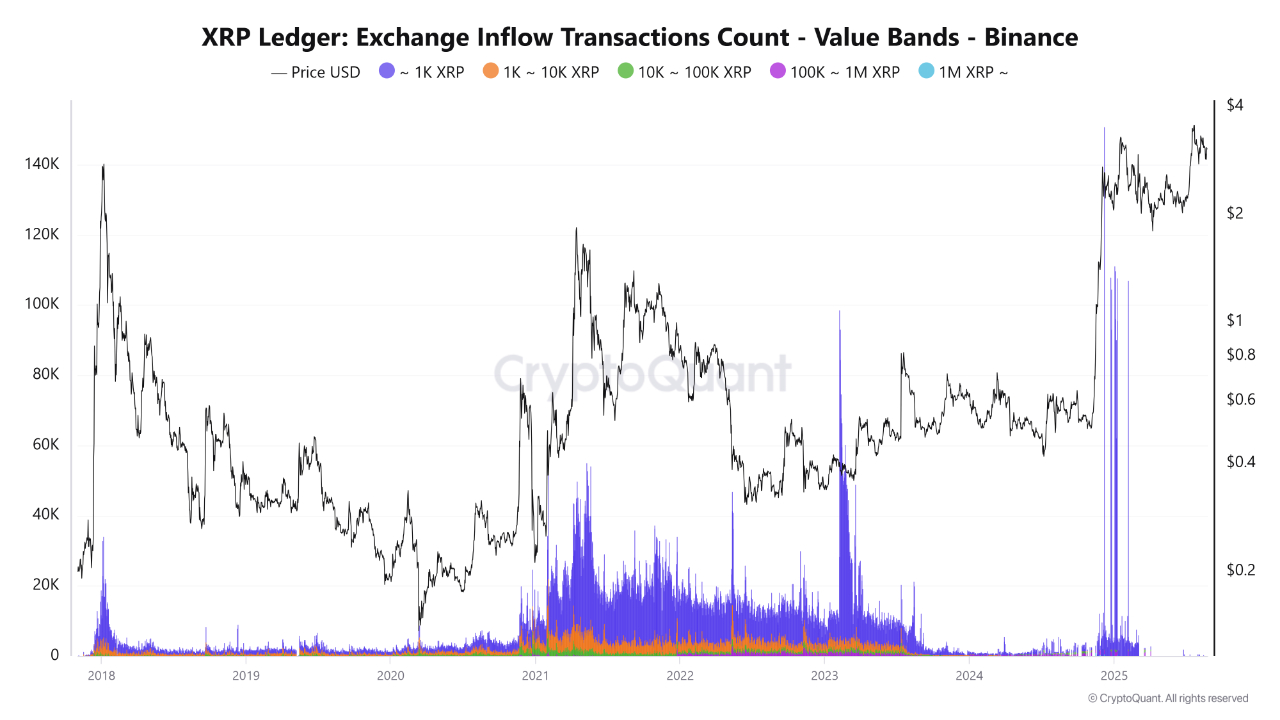

Data from CryptoQuant indicates XRP’s recent rally to $3.66 was accompanied by significant inflows to exchanges across all value bands, with the largest activity coming from whale cohorts holding 100,000 to 1 million XRP. Historically, such spikes in exchange inflows have preceded major market tops, as seen in 2018 above $3, in 2021 near $1.90, and around $0.90 in 2023, suggesting that large investors are again positioning to take profits.

Click Here to Read the Full Original Article at Cointelegraph.com News…