Key takeaways:

-

Solana struggles to sustain $200 as onchain activity weakens and leveraged demand remains subdued.

-

A spot ETF approval and institutional support could lift SOL, but current fundamentals suggest limited rally potential.

Solana’s native token (SOL) has repeatedly failed to hold levels above $200 over the past six weeks, leading traders to question what is limiting the upside. The concern is heightened by the fact that competitors Ether (ETH) and BNB (BNB) recently reached new all-time highs.

The potential approval of a Solana spot exchange-traded fund (ETF) in the United States, combined with companies signaling intentions to add SOL to their corporate reserve strategies, could push the token above $250. However, three conditions must be met before a sustainable rally can take hold.

Sluggish onchain and futures data makes investors cautious

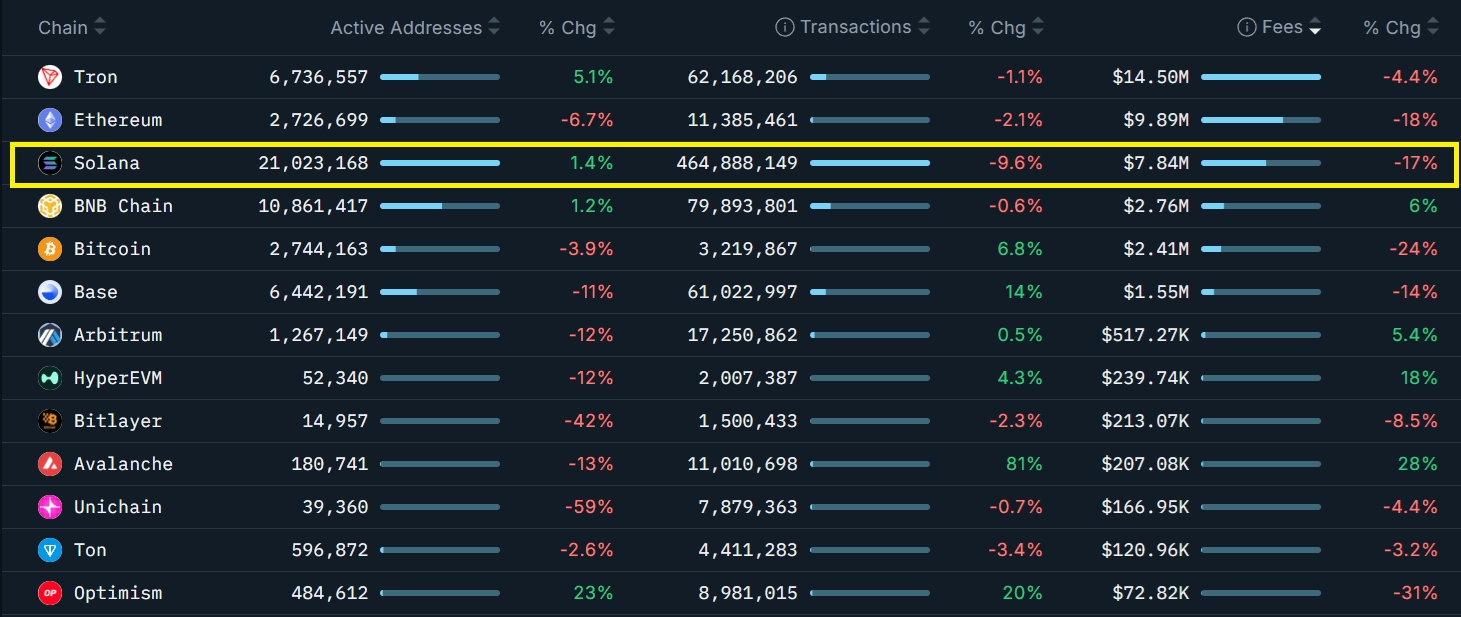

For SOL buyers to regain confidence, onchain activity on Solana must strengthen. Network fees fell 17% compared with the prior week, while the number of transactions dropped 10%. Meanwhile, fees on BNB Chain rose 6%, while transaction levels remained flat. Ethereum’s layer-2 activity also showed growth, with transactions on Base rising 14% and Arbitrum gaining 20%.

In relative terms, Solana’s fee levels remain notable given the network’s $12.5 billion in total value locked (TVL), compared with Ethereum’s nearly $100 billion. Still, Solana’s chain revenue has declined 91% from January’s peak, a downturn that coincided with the launch of the Official Trump (TRUMP) token and the broader memecoin frenzy.

The lack of demand for bullish leverage on SOL futures adds to the cautious sentiment.

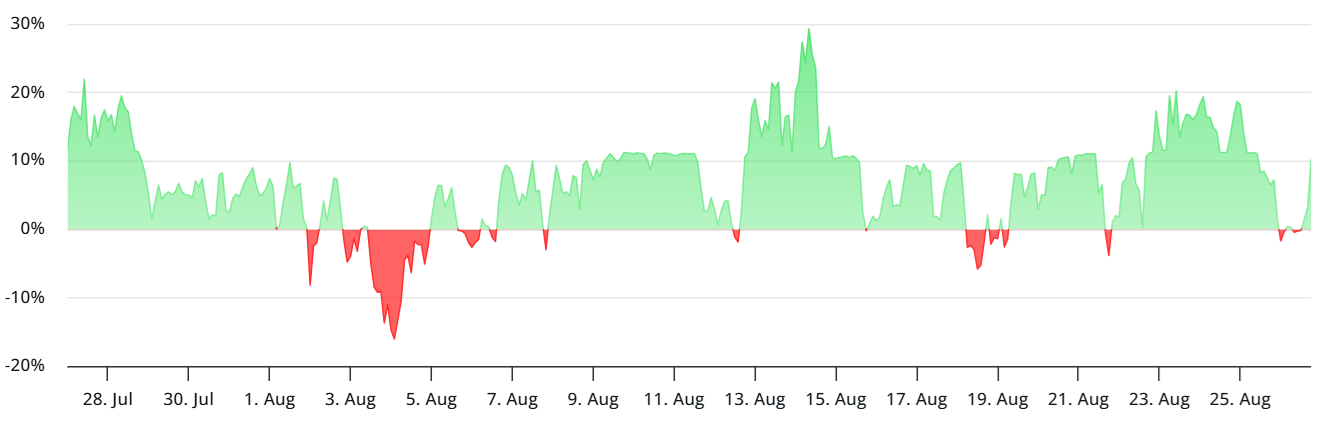

In neutral conditions, perpetual futures typically show an annualized premium between 8% and 14%, reflecting capital costs and counterparty risk. The current 10% rate indicates balanced demand, which is not inherently negative, but it is mildly concerning given that SOL’s price has already gained 39% over the past two months.

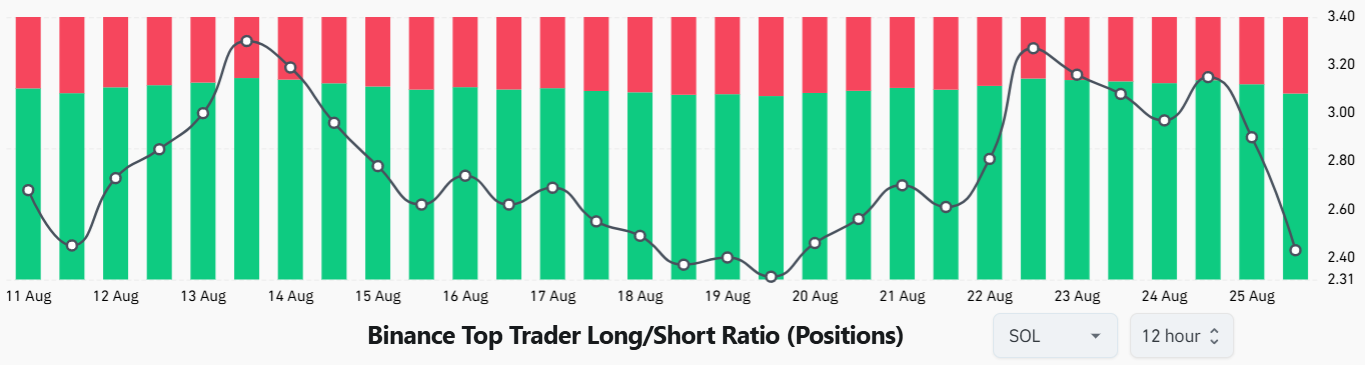

Binance’s top-trader long-to-short ratio has shifted sharply toward bearish positioning. This indicator provides a broader measure of sentiment since it incorporates futures, margin, and spot markets.

Demand for bullish SOL exposure on Binance reached a monthly high last Saturday but has since dropped significantly….

Click Here to Read the Full Original Article at Cointelegraph.com News…