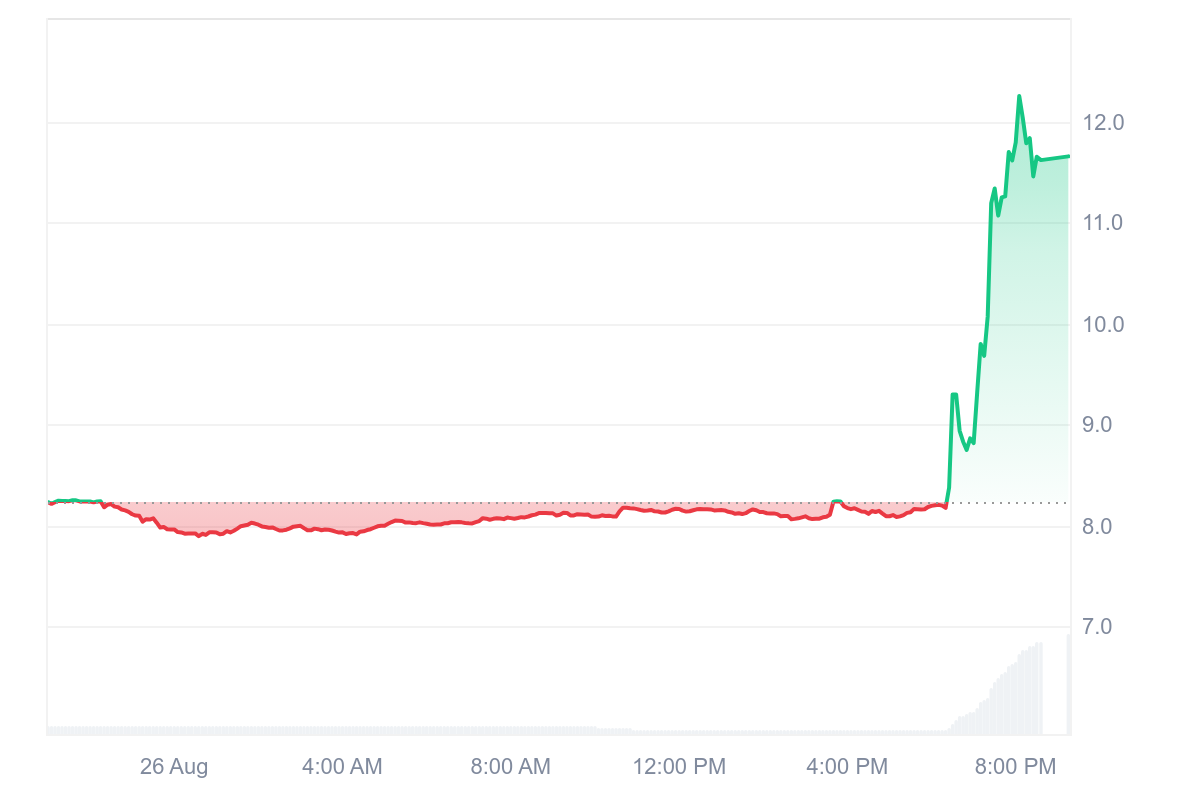

- Numeraire price is up 40% to near $12.40 after JPMorgan secured $500 million capacity in Numerai.

- The NMR token jumped to highs last seen in February.

- JPMorgan’s move sees Numerai more than double its size.

Numeraire (NMR), the native token of the San Francisco-based crypto hedge fund Numerai, has surged more than 40% in the past 24 hours after JPMorgan announced investment in the hedge fund.

On Aug. 26, the Numerai team announced that JPMorgan has secured $500 million in capacity in Numerai, triggering the sharp price surge. Gains outpaced Cronos (CRO), which spiked after Trump Media announced a partnership with Crypto.com.

As NMR price broke to near $12.40, Numeraire’s daily volume jumped more than 800% to over $115 million. The token’s price reached its highest price since February.

JPMorgan secures $500 million capacity in Numerai hedge fund

As the intersection between artificial intelligence and decentralised finance grows, the crypto sector has become a magnet for top collaborations.

Numerai, the San Francisco-based hedge fund built by data scientists, is one of those in the ascendancy.

On Tuesday, the platform revealed that it had secured a $500 million commitment from JPMorgan Asset Management, with this coming after Numerai saw its assets grow from $60 million to $450 million.

The $500 million allocation follows Numerai’s exceptional performance in 2024, delivering a 25.45% net return with a Sharpe ratio of 2.75.

As highlighted in Numerai’s blog, investment from JPMorgan, one of the largest allocators to quantitative strategies globally, signals Wall Street’s growing confidence in AI-powered financial models.

The Paul Tudor Jones-backed hedge fund is set to see its assets under management more than double after this move.

A rebound that caught Wall Street’s attention

Numerai’s path has not been without setbacks. The firm lost 17% in 2023, echoing the struggles of other experimental quant platforms such as Quantopian, which shut down in 2020 after failing to deliver sustainable returns.

However, Numerai rebounded with a 25% gain in 2024 and has strung together 15 consecutive months of positive performance.

That turnaround drew the attention of institutional…