Key takeaways:

-

Ether rallied 5% after a “Monday trap,” but leverage risk is rising with Binance’s ELR at record highs.

-

$1.65 billion in stablecoin inflows and 208,000 ETH withdrawals show strong accumulation.

-

ETH holding $4,700 keeps the door open to $5,000, while losing it risks a sharper correction.

Ether (ETH) is showing resilience against Bitcoin (BTC) after shaking off the latest “Monday Trap,” a recurring pattern where leveraged longs face steep liquidations at the start of the week. While ETH rallied as much as 5% on Tuesday, BTC’s return has been limited to only 1%.

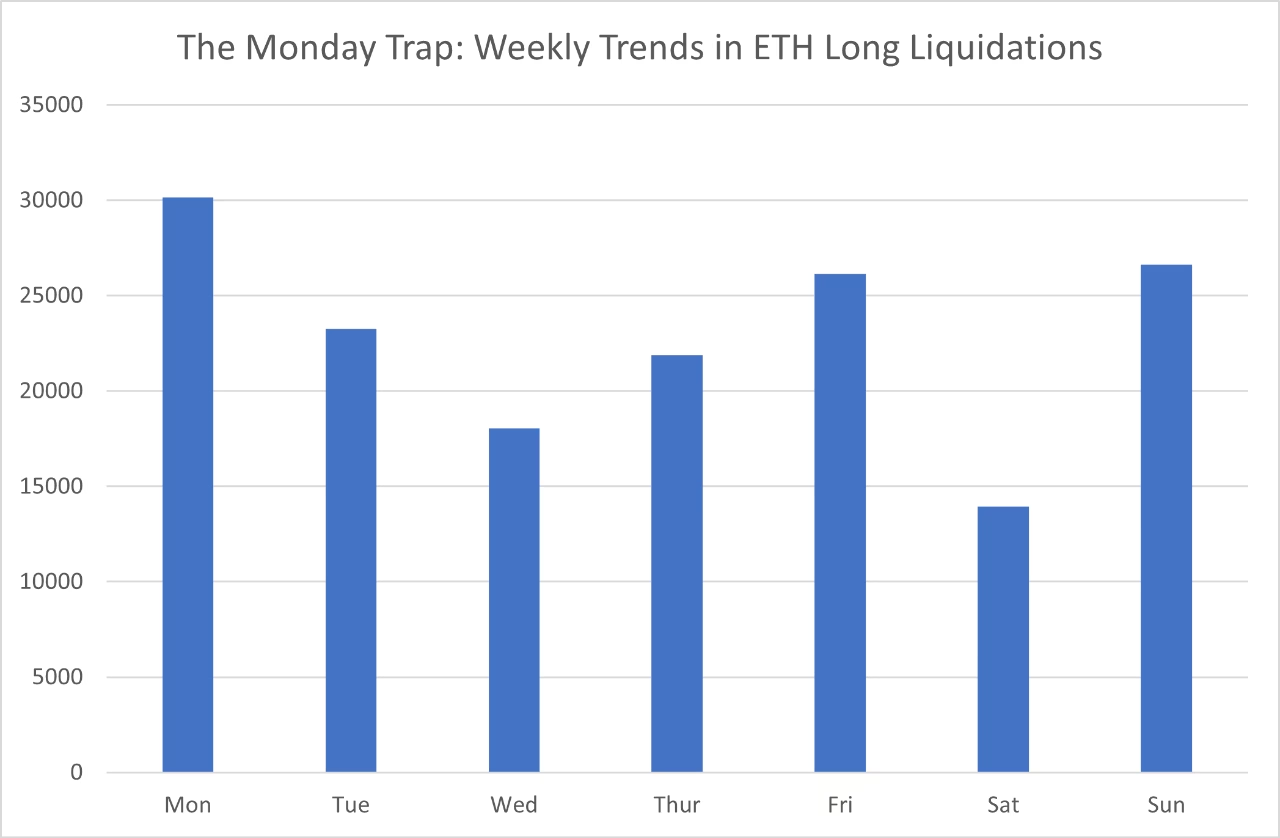

Data reveals that Monday has consistently recorded the highest long liquidations, with spikes topping 300,000 ETH during April and June’s drawdowns. The pattern underscores how weekend optimism flips into losses once liquidity returns early in the week.

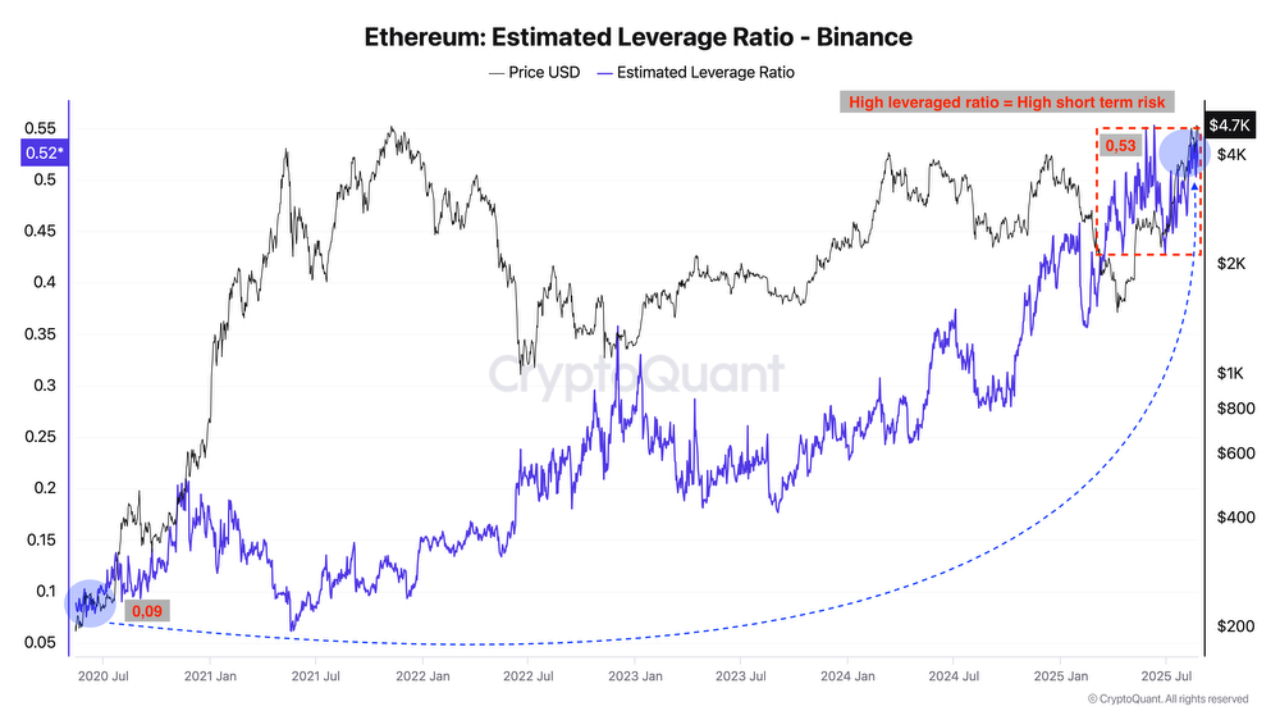

Despite the recovery, ETH’s derivatives landscape signals overheating. Binance’s Estimated Leverage Ratio (ELR) on ETH has surged to a record 0.53, up dramatically from just 0.09 in mid-2020.

ELR tracks the ratio of open interest to exchange reserves, offering a gauge of how heavily traders are using leverage. Higher values suggest excessive optimism and a greater risk of forced liquidations.

With ETH open interest hitting a new all-time high of $70 billion on Aug. 22, such extremes signal short-term risk, as excessive positions often precede sharp deleveraging events that flush out traders before the next leg higher.

Yet, the spot flows paint a contrasting picture of strength. Crypto analyst Amr Taha points out that Binance exhibited over $1.65 billion in stablecoin deposits this month, marking the second such surge above $1.5 billion in August.

These inflows signal fresh liquidity preparing to enter the market. Meanwhile, Ether withdrawals from Binance totaled nearly 208,000 ETH, i.e., $1 billion, across Aug. 24–25, suggesting investors are moving assets into cold storage, reducing sell-side pressure and reinforcing long-term bullish positioning.

The combination of rising leverage and institutional accumulation leaves ETH at a crossroads. While liquidity inflows and exchange outflows tilt bullish, extreme leverage heightens the risk of near-term volatility.

Related: SharpLink added $252M ETH last week, $200M war chest left

Ether bulls must reclaim $4,700 to regain control

Ether rallied strongly on Tuesday, climbing to…

Click Here to Read the Full Original Article at Cointelegraph.com News…