Key takeaways:

-

Bitcoin’s $124,500 high is unlikely to be the cycle top, with all 30 peak indicators still neutral.

-

Recent losses show new investors capitulating as seasoned holders are unfazed.

-

Holding above the 20-week EMA keeps Bitcoin’s path open toward $150,000.

Bitcoin’s (BTC) retreat from its record highs is fueling concerns over whether the market has already peaked for 2025. But the so-called “$124K top” is nothing but “noise,” according to analyst Merlijn The Trader.

30/30 indicators hint Bitcoin has more room to rise

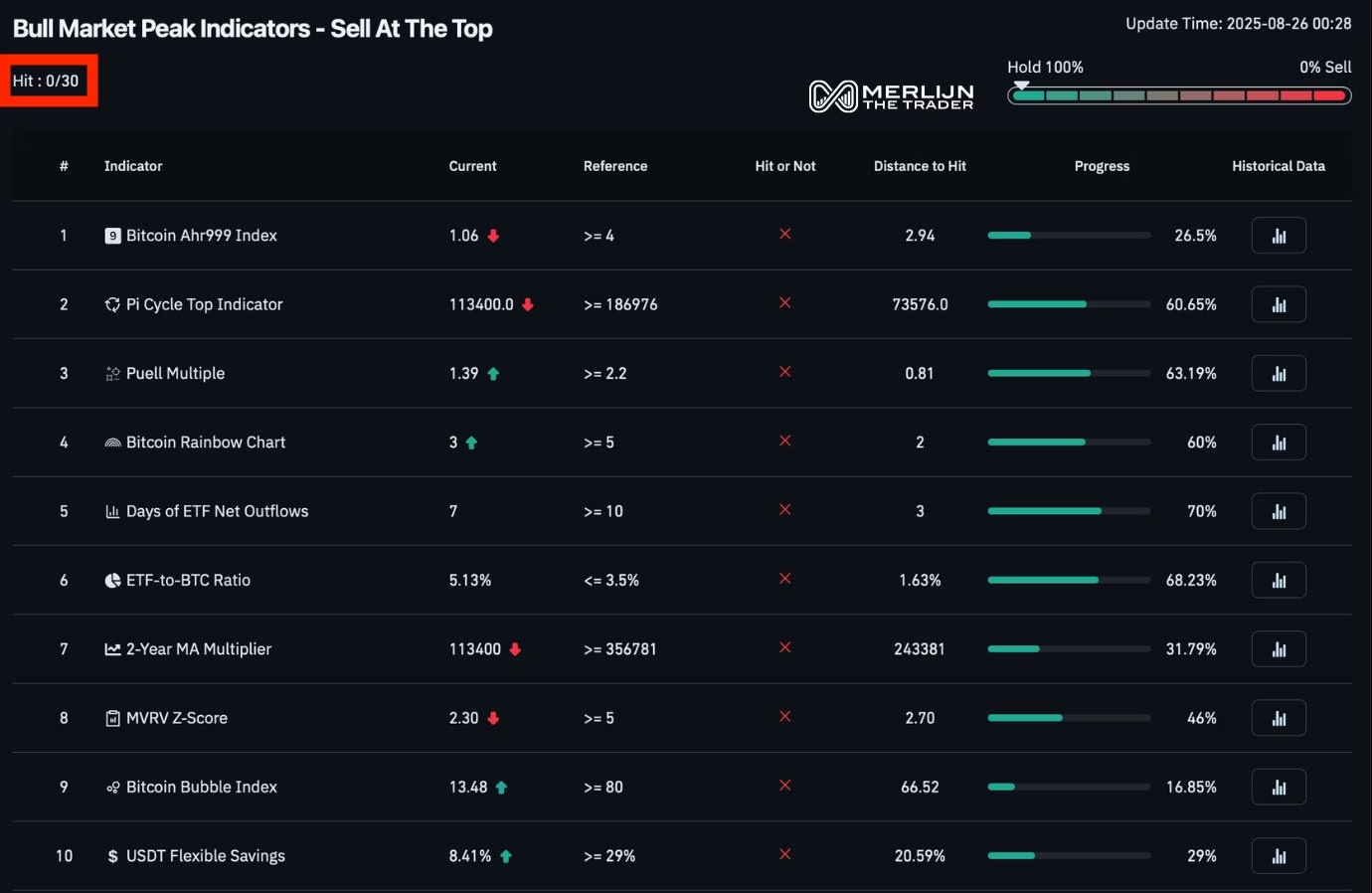

In a Tuesday post, Merijn stressed that none of Bitcoin’s 30 widely followed peak indicators have flashed red so far.

Historically, Bitcoin cycle tops have coincided with multiple “overheating” signals across well-known onchain tools.

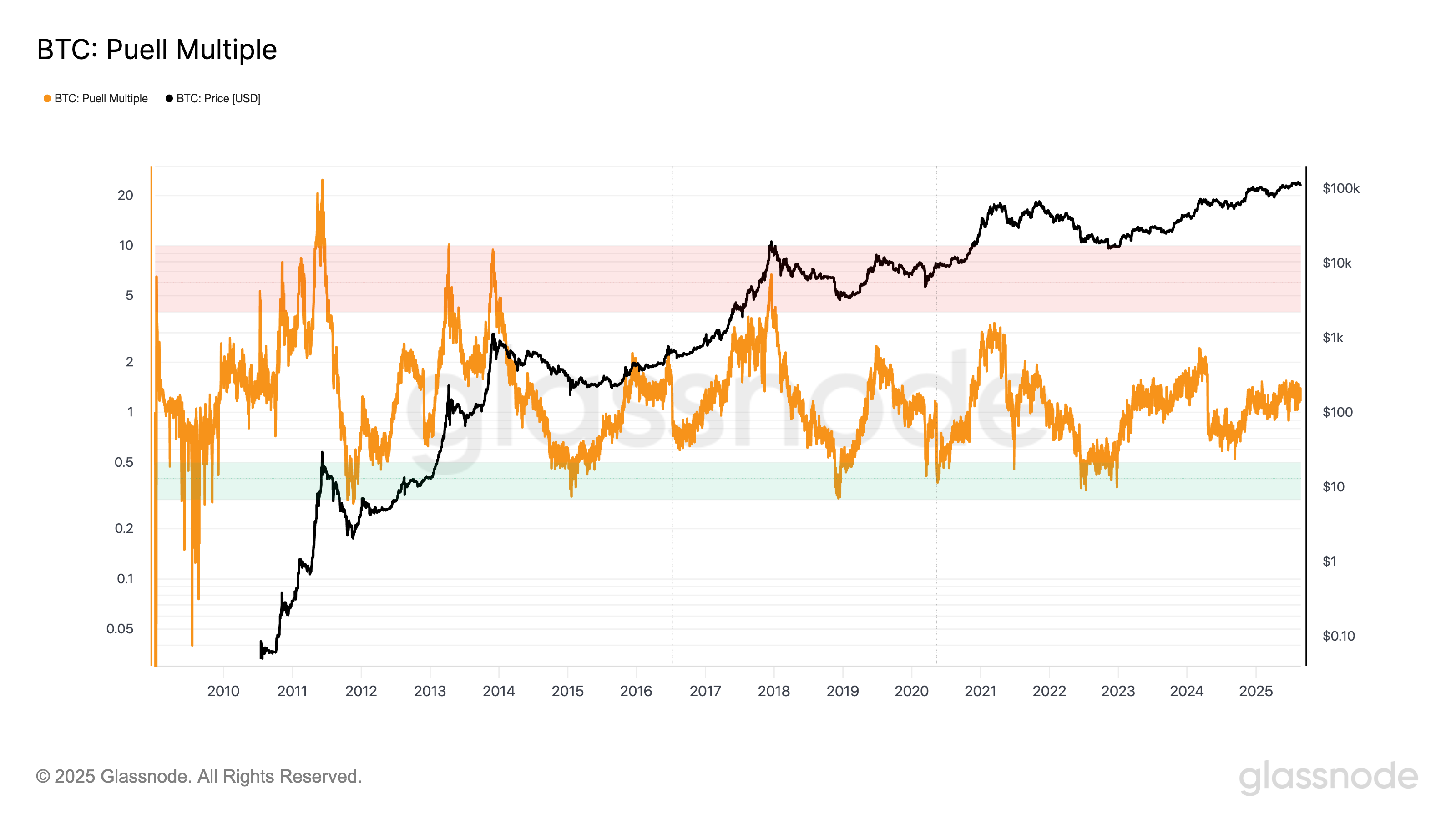

For instance, the Puell Multiple, which spikes when miners earn unsustainably high revenues, is sitting at just 1.39, well below the 2.2 danger zone seen before past price peaks.

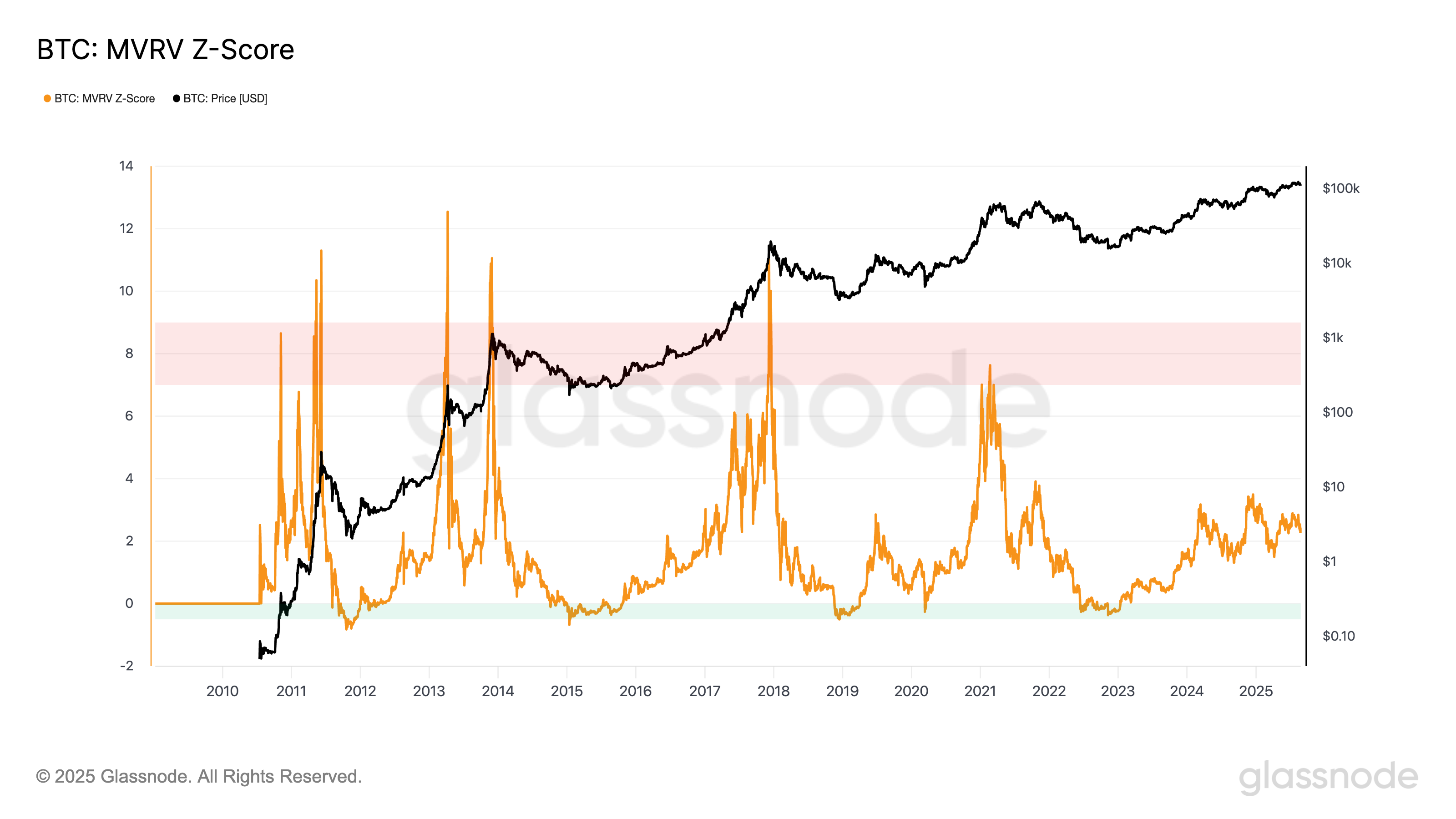

Similarly, the MVRV Z-Score, which compares Bitcoin’s price to its actual capital inflows, remains in neutral territory rather than at the overheated extremes that marked prior tops.

Seasoned BTC holders are unfazed

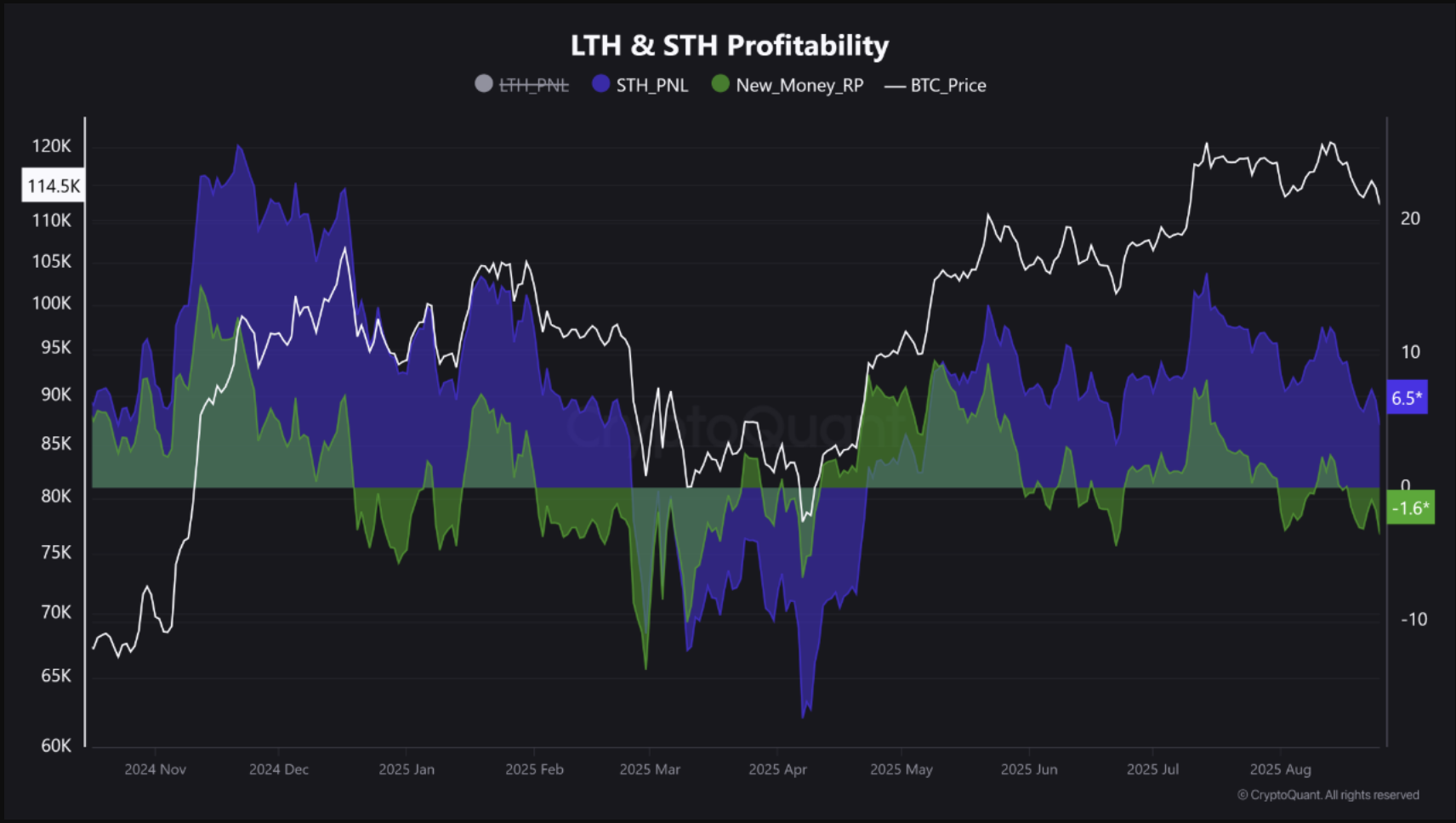

On-chain data supports the bullish view, showing a classic capitulation phase underway.

The newest Bitcoin investors—those holding BTC for less than a month—are sitting on average unrealized losses of around -3.50% and are now selling, according to data shared by analyst CrazzyBlockk.

Conversely, the broader Short-Term Holder (STH) cohort, which has held for one to six months, remains profitable with an aggregate unrealized gain of +4.50%.

“This is a bullish structural development,” writes CrazzyBlockk, adding:

“The market is purging its weakest hands, transferring their BTC to holders with a lower cost basis and higher conviction […] This shakeout, while painful for recent top-buyers, is precisely the kind of event that builds a strong support base for the next significant move higher.”

$70 million in BTC longs liquidated

Onchain analyst Amr Taha further argues in favor of a recovery next, citing the recent $70 million flush of leveraged longs following BTC’s price dip below $111,000 on Binance.

Open interest (OI) dropped significantly after the…

Click Here to Read the Full Original Article at Cointelegraph.com News…