Ether treasury company ETHZilla, which recently pivoted from its biotechnology roots to cryptocurrency, has approved a $250 million share repurchase program — signaling that some firms may increasingly tap digital-asset gains as a source of liquidity.

ETHZilla’s board of directors authorized the buyback of up to $250 million worth of its outstanding common shares, the company disclosed Monday. The company currently has 165.4 million shares outstanding.

The move comes less than a month after the firm rebranded from 180 Life Sciences and made Ether (ETH) its core strategy — a pivot that helped revive its beaten-down stock.

ETHZilla has since acquired 102,237 ETH at an average price of $3,948.72, spending just over $403 million. At current market levels, those holdings are worth about $489 million. The company said its most recent ETH purchases will be staked with Electric Capital.

Management’s language around the repurchase echoed classic triggers, citing “market conditions,” “management discretion,” and “alternative uses of capital.”

ETHZilla’s new strategy comes against a backdrop of weak fundamentals. As a public company, it has struggled with limited revenues, persistent losses and shareholder dilution. Last year alone, it reported an accumulated deficit of over $141.5 million.

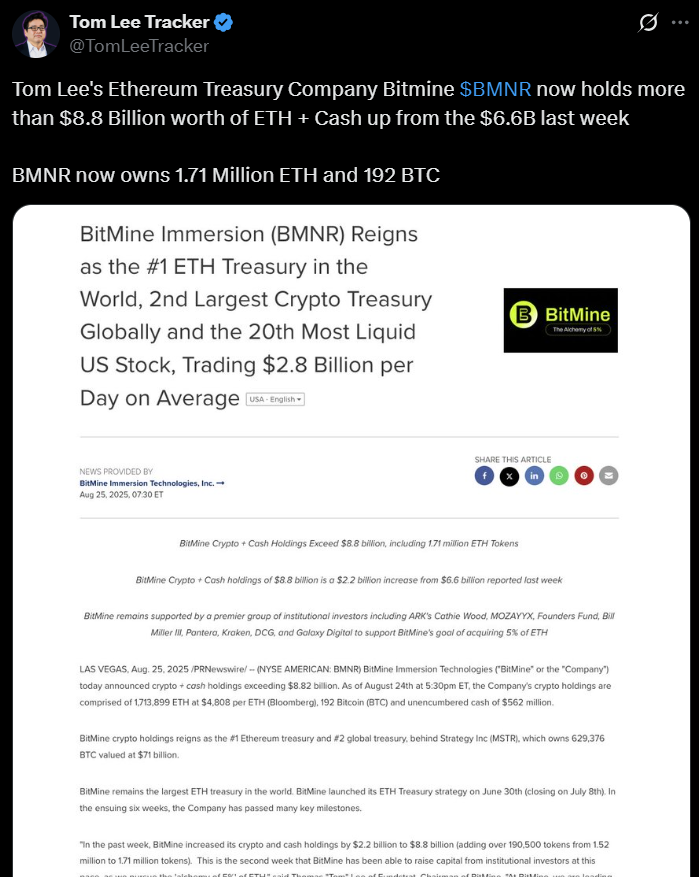

ETHZilla is not alone in embracing crypto as a balance-sheet asset. Companies both inside and outside the digital-asset sector — including BitMine Immersion Technologies, The Ether Machine, SharpLink Gaming, Bit Digital and Ether Capital Corp. — have all made strategic Ether acquisitions.

Related: Ether treasuries climb to $13B as price breaks $4,300

Leverage and concentration risks

Analysts see parallels between today’s “crypto treasury” plays and earlier waves of corporate gold adoption, but warn that leverage-fueled balance sheet builds remain a major risk. Companies that borrow heavily to accumulate crypto could face worsening financials if — or when — another bear market hits.

Mike Foy, chief financial officer at Amina Bank, told Cointelegraph that it’s still too early to tell whether crypto-treasury strategies are sustainable in the long run. In the meantime, he said it’s important to determine whether companies are pursuing the approach for speculative gains, signaling purposes or as part of a broader…

Click Here to Read the Full Original Article at Cointelegraph.com News…