Key takeaways:

-

Bitcoin futures demand continues rising despite the recent price weakness, indicating sustained trader engagement.

-

The put options maintained a premium over calls, reflecting persistent bearish sentiment among investors.

Bitcoin (BTC) traded down to $109,400 on Monday, its lowest level in more than six weeks. The correction followed an $11 billion sale by a 5-year dormant whale that had been dormant for 5 years, with proceeds rotating into Ether (ETH) spot and futures on decentralized exchange Hyperliquid.

Despite the price decline, demand for Bitcoin futures surged to an all-time high, prompting traders to ask whether $120,000 is the next logical step.

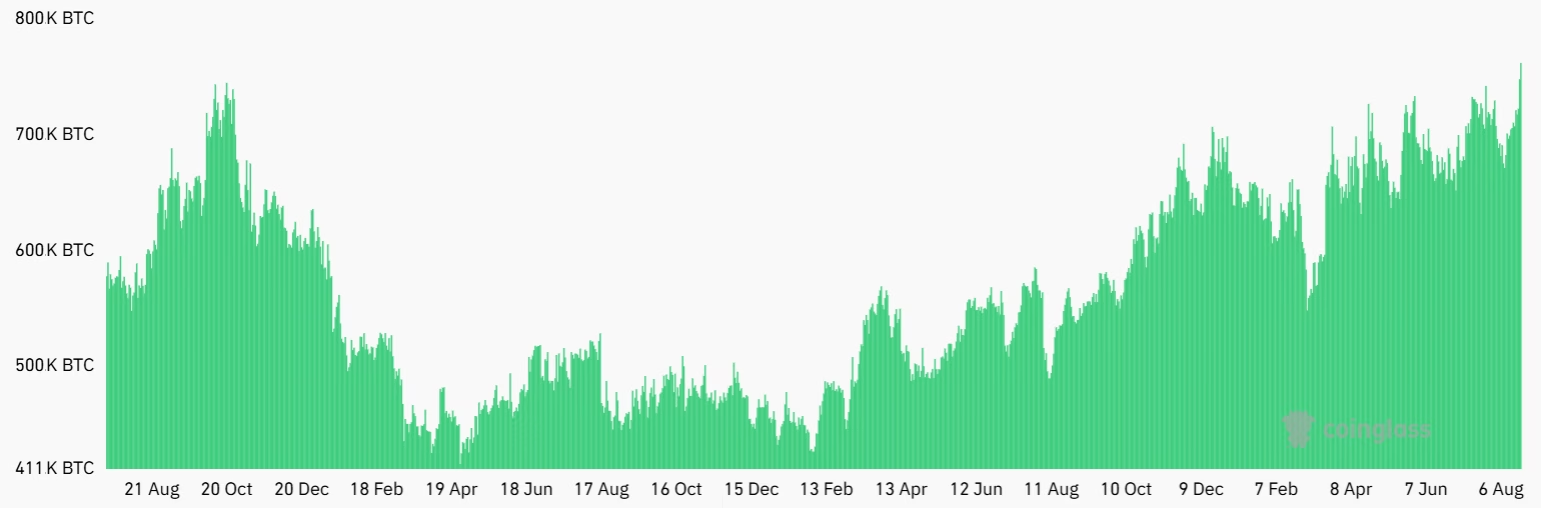

Bitcoin futures open interest climbed to an all-time high of BTC 762,700 on Monday, up 13% from two weeks earlier. The stronger demand for leveraged positions shows traders are not abandoning the market despite a 10% price drop since Bitcoin’s all-time high on Aug. 14.

While this is a positive indicator, the $85 billion in futures open interest does not necessarily reflect optimism, since longs (buyers) and shorts (sellers) are always matched. If bulls lean too heavily on leverage, a dip below $110,000 could trigger cascading liquidations.

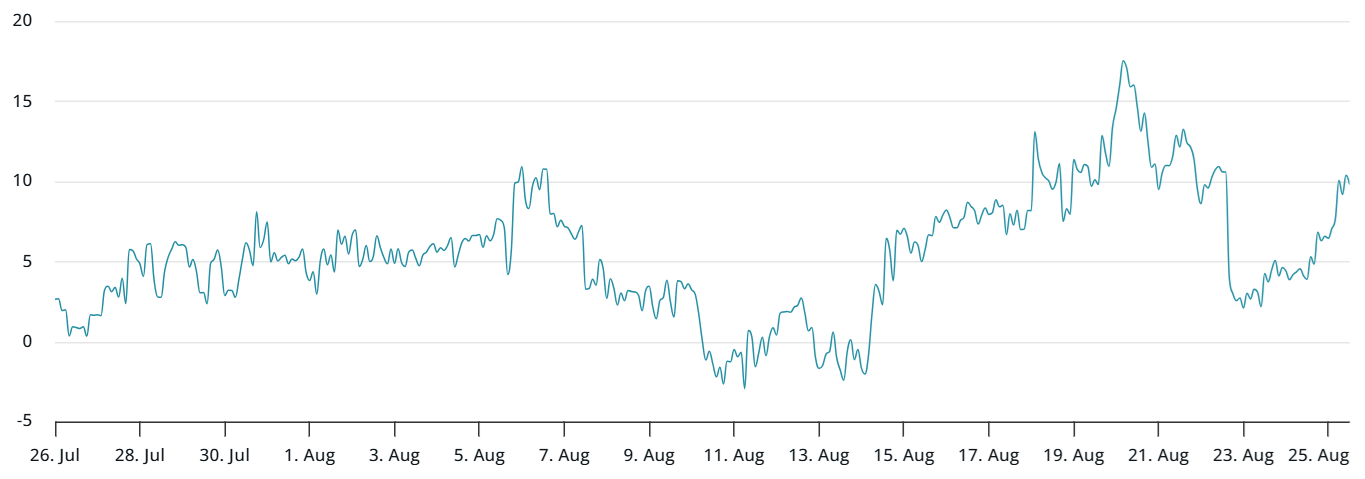

The Bitcoin futures premium is currently at a neutral 8%, up from 6% the previous week. Notably, the metric has not remained above the 10% neutral threshold for more than six months, meaning even the $124,176 all-time high failed to instill broad bullishness.

Leverage shakeout highlights liquidity but sparks suspicion

The recent decline blindsided overleveraged traders, leading to $284 million in liquidations of long positions, according to CoinGlass data. The event showed that Bitcoin maintains deep liquidity even on weekends, but the speed of execution raised suspicions, given that the seller had held the position for years.

The Bitcoin perpetual futures funding rate dropped back to 11% after a short-lived uptick. In neutral markets, the rate usually ranges between 8% and 12%. Some of the muted sentiment can be explained by $1.2 billion in net outflows from US-listed spot Bitcoin ETFs between Aug. 15 and Aug. 22.

To assess whether this level of caution is worrying, traders should examine the BTC options market.

Click Here to Read the Full Original Article at Cointelegraph.com News…