Key takeaways:

-

Ethereum has rebounded by over 250% from its April lows.

-

Fed Chair Jerome Powell’s dovish stance is fueling the ETH price rally.

-

Bitcoin’s crypto market share has dropped below 60% for the first time since March.

Ethereum’s native token, Ether (ETH), reached a new record high on Friday, crossing above $4,867 on Coinbase for the first time since November 2021.

Ether price is up 250% since April

ETH jumped by around 14% on Friday, just as Federal Reserve Chair Jerome Powell raised the odds of a 25 basis point interest rate cut in September. That brought ETH’s gains to over 250% when compared to its April low at $1,385.

“The stability of the unemployment rate and other labor market measures allows us to proceed carefully as we consider changes to our policy stance,” Powell said during his speech at the Jackson Hole symposium on Friday, adding:

“Nonetheless, with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.”

Powell’s dovish tilt signals looser liquidity ahead, a backdrop that typically bolsters demand for risk assets such as Ethereum.

ETH DATs keep stacking, and Powell turns dovish

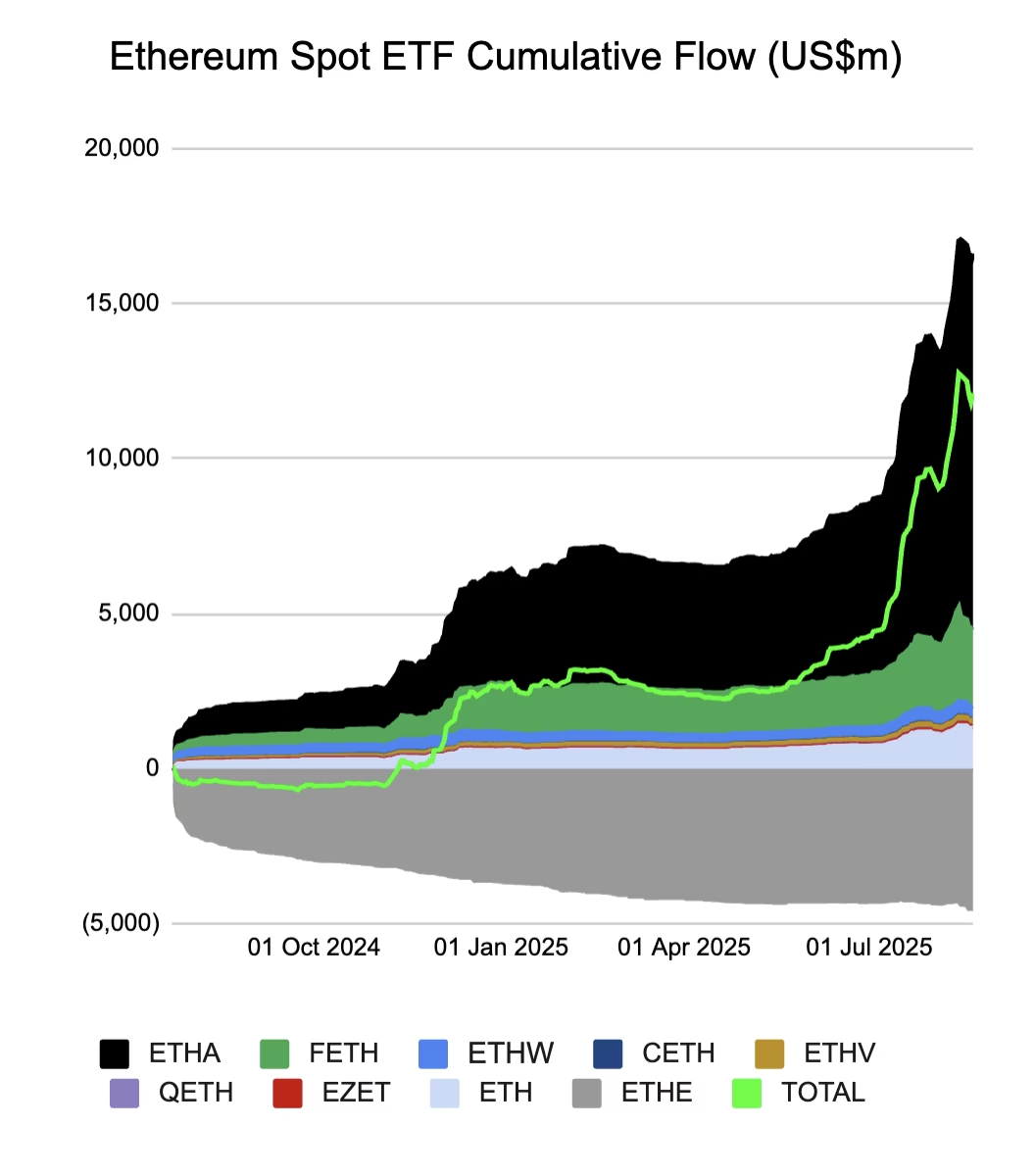

Ether markets are further benefiting from renewed inflows into its US-based ETFs. On Aug. 21, these funds attracted $287.60 million worth of capital, after witnessing four days of outflows.

As of Friday, Ether ETFs were collectively managing over $12.12 billion worth of assets.

Ethereum has also gained significant momentum through growing ETH treasury adoption by corporations.

Over the past month, corporate Ethereum treasury firms have acquired roughly $1.6 billion worth of ETH, with BitMine, SharpLink, Bit Digital, BTCS, and GameSquare among the most active buyers.

As of Friday, these holdings had ballooned to over $29.75 billion, according to data resource StrategicETHReserve.xyz.

Ether is increasingly being viewed less as a speculative token and more as a utility-rich reserve asset, says Ray Youssef, CEO of finance app NoOnes.

Standard Chartered has upped its year-end ETH price target to $7,500 from $4,000 and $25,000 by 2028. Some analysts say that the ETH price can reach $13,000 in the coming months.

According to analysts at Hyblock, market demand for ETH is likely to continue outpacing available supply. They said,

“Usually, when you get to these all-time high levels (psychological levels), you see OGs from 2012-2015…

Click Here to Read the Full Original Article at Cointelegraph.com News…