Key takeaways:

-

ETH surged 13% on Friday after Federal Reserve Chair Jerome Powell’s dovish Jackson Hole speech hinted at an interest rate cut in September.

-

Onchain and technical indicators signal Ether’s potential to hit $6,000 in the short term.

Ether’s (ETH) price displayed strength at the Wall Street open on Friday, rising 13% to $4,788 following Federal Reserve Chair Jerome Powell’s Jackson Hole speech.

ETH price rallied from $4,200 within minutes, reclaiming $4,600, a level that has suppressed the price over the last seven days, per data from Cointelegraph Markets Pro and TradingView.

This performance follows Powell’s Jackson Hole speech, where he hinted at a potential interest rate cut in September, signaling a dovish stance that boosted market optimism.

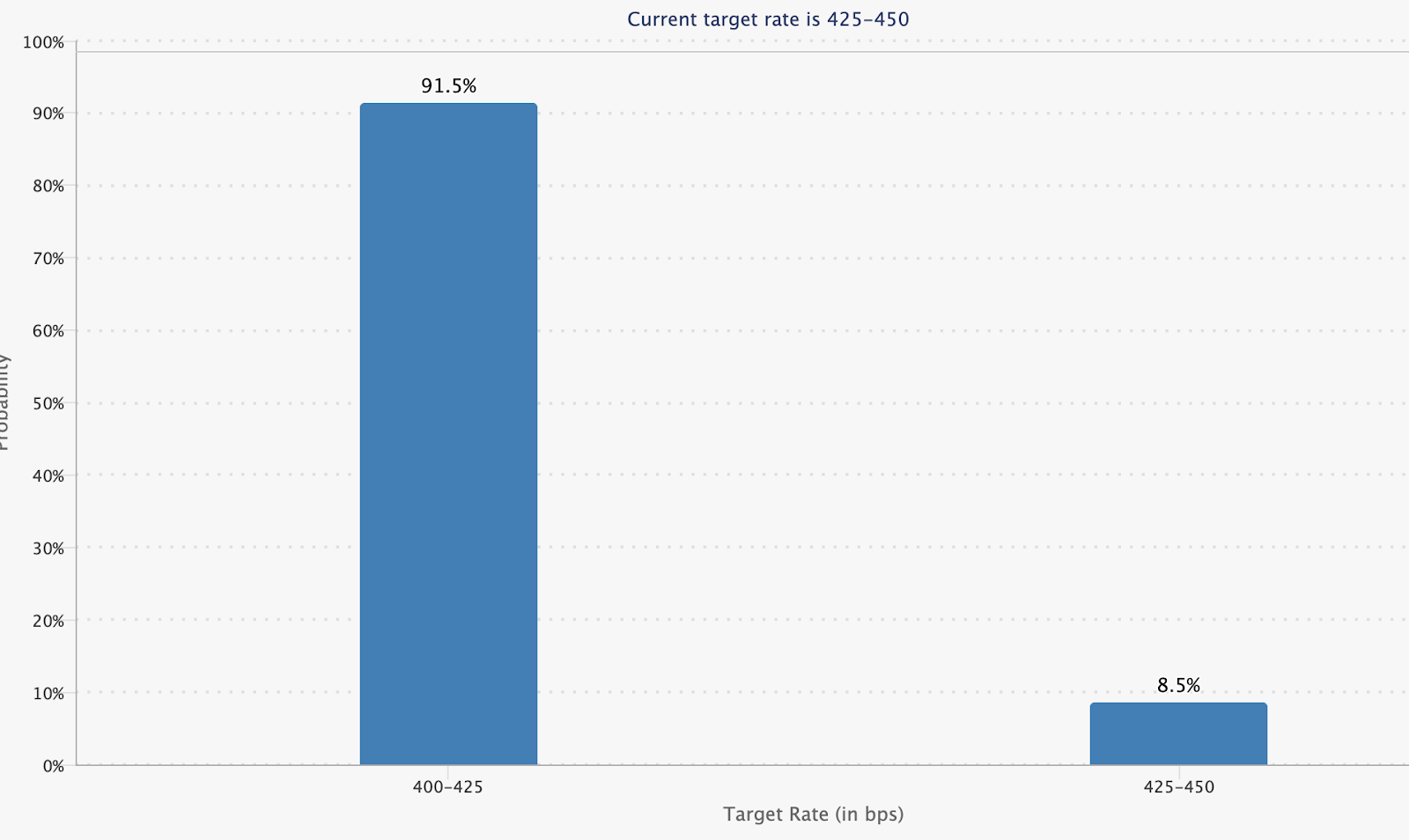

Interest rate cut odds for the Sept. 17 FOMC meeting have now jumped to 91.5% from 75% a day prior, according to the CME Group Fedwatch tool.

This adds to the encouraging bullish sentiment that could potentially drive ETH to new highs.

ETH crosses $4,600 with a “god candle,” said analyst Elisa in response to Ether’s reaction, adding:

Several bullish signs suggest that ETH is well-positioned to break out toward fresh all-time highs in the following days or weeks.

Continued spot ETF inflows back ETH price upside

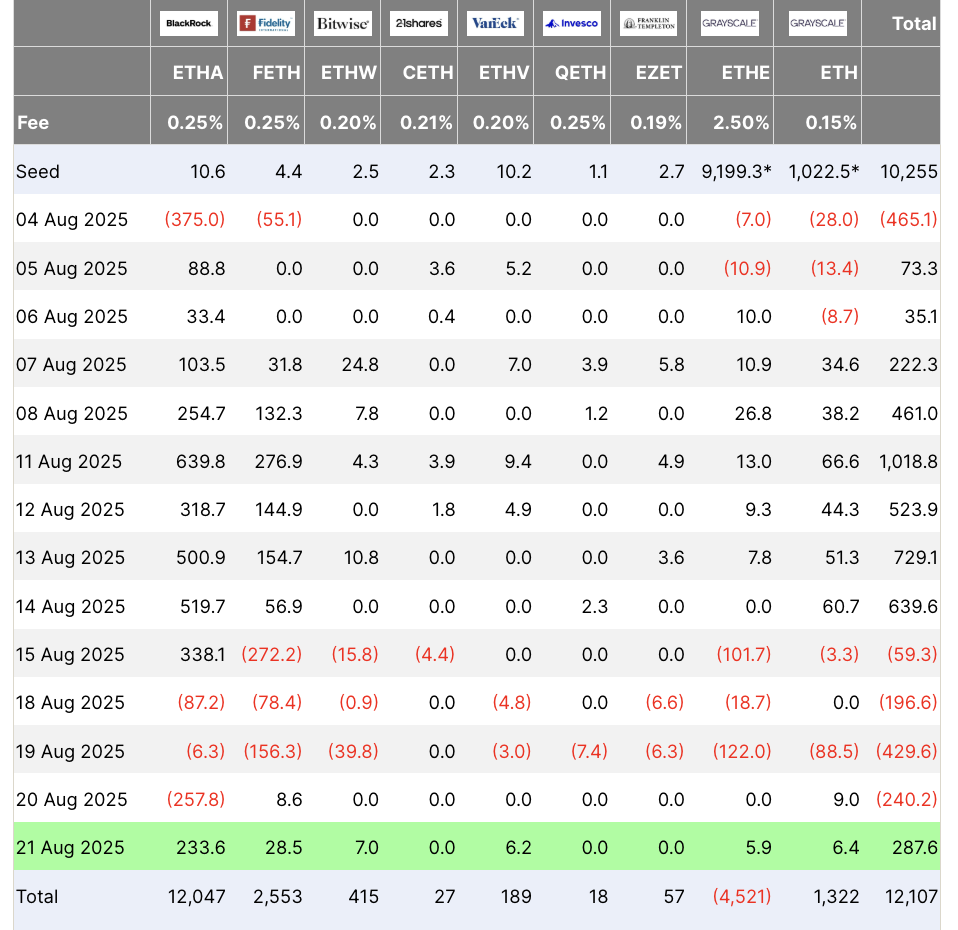

One factor supporting Ether’s bull argument is persistent institutional demand, reflected by significant inflows into spot Ethereum exchange-traded funds (ETFs).

Spot Ether ETFs saw $287.6 million in inflows on Aug. 21, breaking a four-day outflow streak. These investment products have seen net inflows totaling $2.55 billion month-to-date as per data from Farside Investors.

As Cointelegraph reported, Ether continued dominating global exchange-traded products (ETPs) last week, with inflows totaling $2.9 billion, marking growing investor appetite for the altcoin ETPs.

Related: EU exploring Ethereum, Solana for digital euro launch: FT

Exchange supply plummets

ETH balances on exchanges have dropped to nine-year lows, falling to 14.9 million ETH for the first time since July 2016, Glassnode data shows.

The total balance between inflows and outflows in and out of all known exchange wallets shows a steep decline since October 2023, when withdrawals from the trading platforms…

Click Here to Read the Full Original Article at Cointelegraph.com News…