As US President Donald Trump’s tariffs create an unpredictable trade environment, some members of his administration have been investing in sectors influenced by his policies, including Bitcoin (BTC).

On Tuesday, the Trump administration announced it would extend the tariff delay on China. At the same time, the United States Commerce Department will introduce aluminum tariffs on over 400 different products, including wind turbines, mobile cranes, railcars, motorcycles and construction equipment.

The unpredictability of Trump’s trade tariffs has raised concerns among national trade groups like the National Foreign Trade Council (NFTC), which said they are “delaying growth, disrupting operations, and raising legal concerns among companies.”

Amid this uncertainty, officials connected with the Trump administration have deepened their ties with crypto and businesses affected by his trade policies.

Lutnick’s firm buys Bitcoin amid tariffs

Recent filings with the Securities and Exchange Commission, as reported by Sludge, show that US Secretary of Commerce Howard Lutnick, via his family-controlled firm, Cantor Fitzgerald, has been actively investing or divesting in sectors affected by Trump’s economic policies.

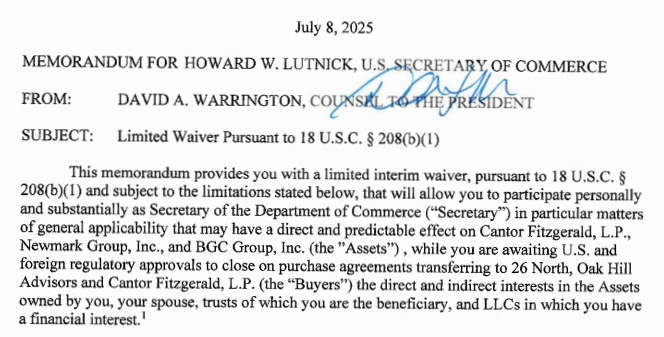

While US law does include certain provisions to protect against conflicts of interest, Lutnick received a waiver on July 8, which allows him to participate “in particular matters … that may have a direct and predictable effect on Cantor Fitzgerald.”

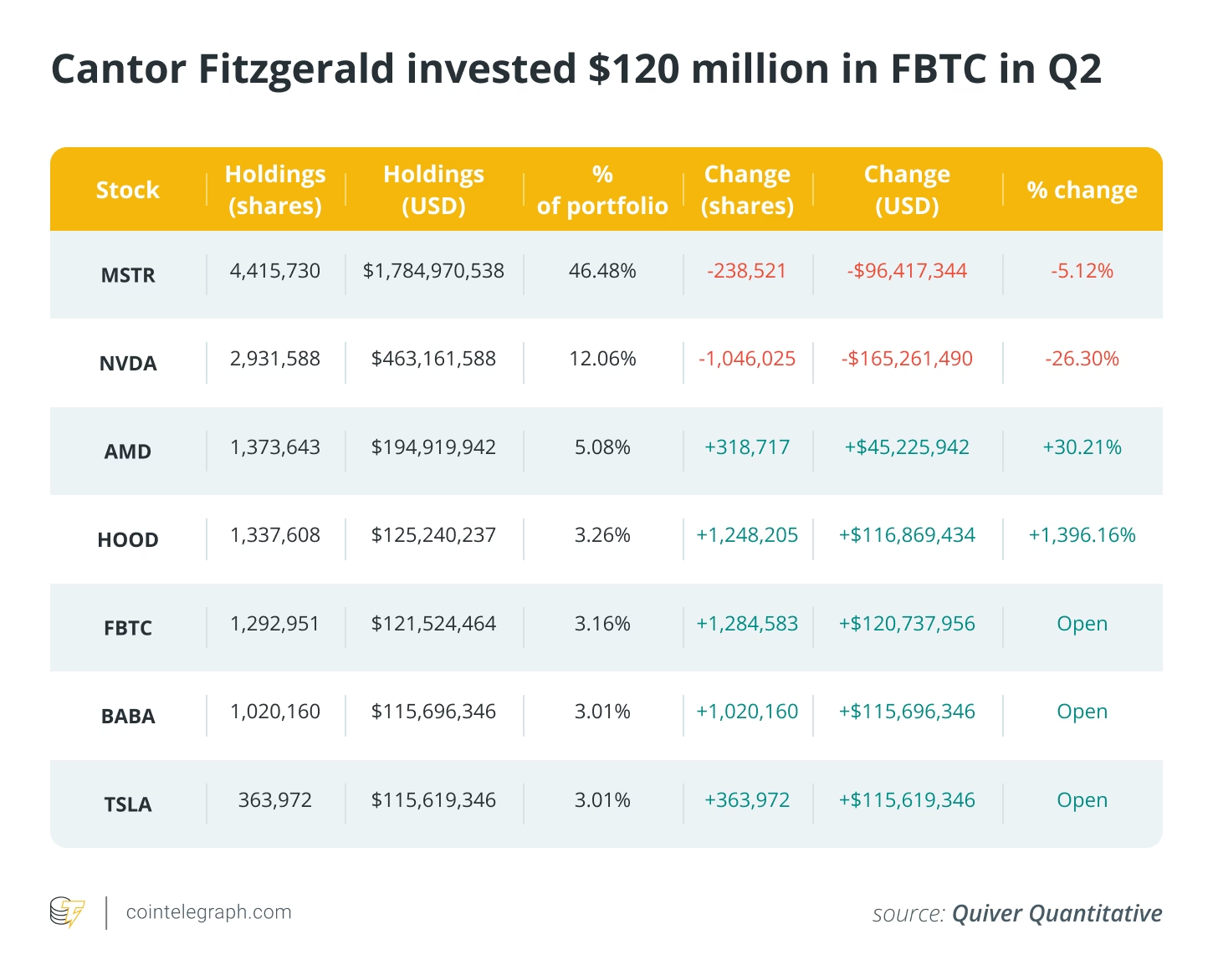

According to an Aug. 14 filing with the SEC and subsequent analysis from Quiver Quantitative, Cantor Fitzgerald invested in a Fidelity Wise Origin Bitcoin Fund (FTBC) as well as stock in companies like chip producer AMD, Tesla, Alibaba and Robinhood.

Cantor’s investments in FTBC and trading platform Robinhood numbered $120.7 million and $116.8 million, respectively. This came after Bo Hines, executive director of the Presidential Council of Advisers on Digital Assets, suggested after a White House interview in April that the government could use tariffs to fund purchases for the newly created Strategic Bitcoin Reserve.

Related: US should fund Bitcoin strategic reserve with tariff surplus: Author

Meanwhile, Cantor’s other investments have been deemed by analysts as either resistant to tariff policies, in the case of Chinese e-commerce site Alibaba or directly benefitting from tariffs,…

Click Here to Read the Full Original Article at Cointelegraph.com News…