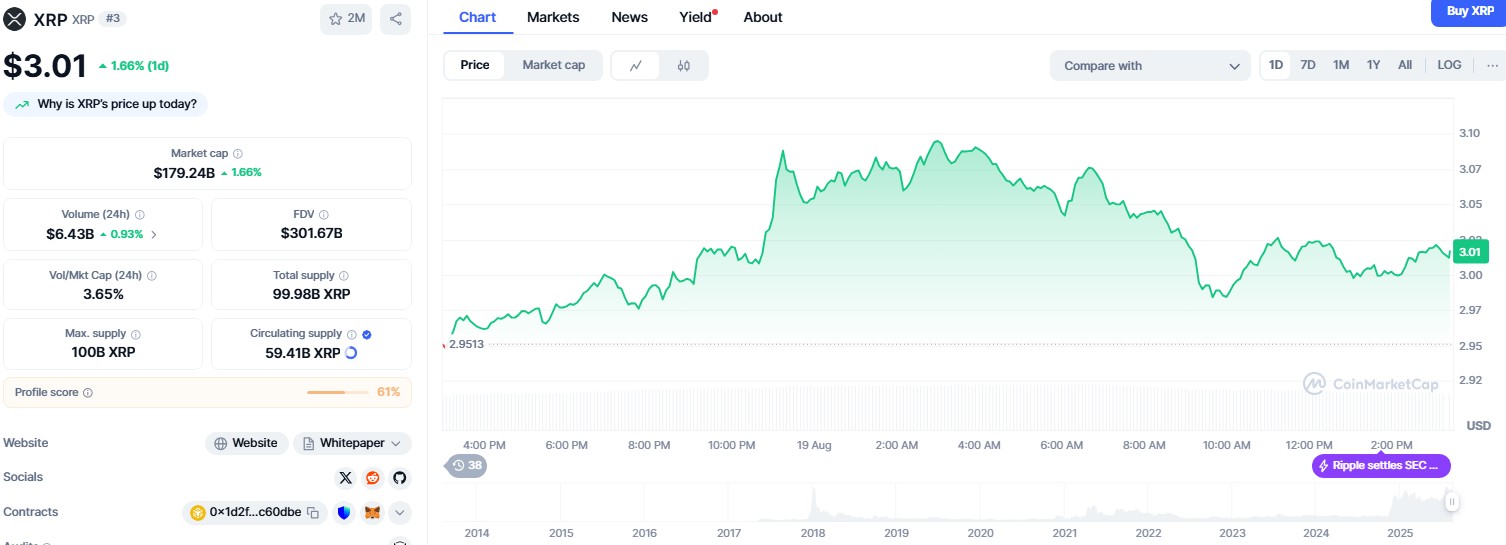

- XRP could potentially rise from around $3 to $28, representing a 777% increase.

- Financial institutions are increasingly adopting XRP for cross-border payments.

- The projected surge depends on favorable market conditions and continued adoption.

XRP is once again at the centre of market discussions after crypto strategist @egragcrypto shared a prediction suggesting the token could rally by as much as 777%, potentially reaching $28.

The digital asset, currently trading at around $3.01, has attracted renewed attention from both investors and analysts across global markets.

This projection comes against a backdrop of historical price cycles, ongoing legal clarity from Ripple’s battle with the US Securities and Exchange Commission (SEC), and increasing institutional adoption of blockchain-based settlement solutions.

The combination of technical chart patterns and real-world developments is driving speculation on whether XRP can repeat its past performance and set new all-time highs.

XRP cycles show patterns behind $28 forecast

According to the analysis, XRP’s price history reveals three distinct cycles. The first, during the 2017–2018 boom, saw the token move from just a few cents to over $3.00 before the wider crypto market collapsed.

The second occurred between 2020 and 2021, when XRP staged a strong rebound despite Ripple being caught in an SEC lawsuit.

Egrag’s cycle analysis now points to a potential third phase. XRP has been consolidating near multi-year highs, with the 777% target at $28.16 projected if the historical pattern plays out once again.

The forecast has spread widely across social media, with the tweet by @egragcrypto fuelling further debate among market watchers and crypto traders worldwide.

Ripple’s legal win and institutional partnerships

Momentum around XRP has also been supported by developments outside of charts. A key turning point came in 2023, when Ripple secured a partial court victory against the SEC.

The ruling determined that XRP was not considered a security when traded on exchanges, removing a major source of regulatory uncertainty. This outcome provided banks and institutions with the confidence to engage with the token, reviving its role as a settlement asset.