Key points:

-

Bitcoin risks falling to $110,530, where the buyers are expected to step in.

-

Bitcoin is approaching a solid support, and a strong rebound off it could see buyers return to ETH, BNB, LINK, and MNT.

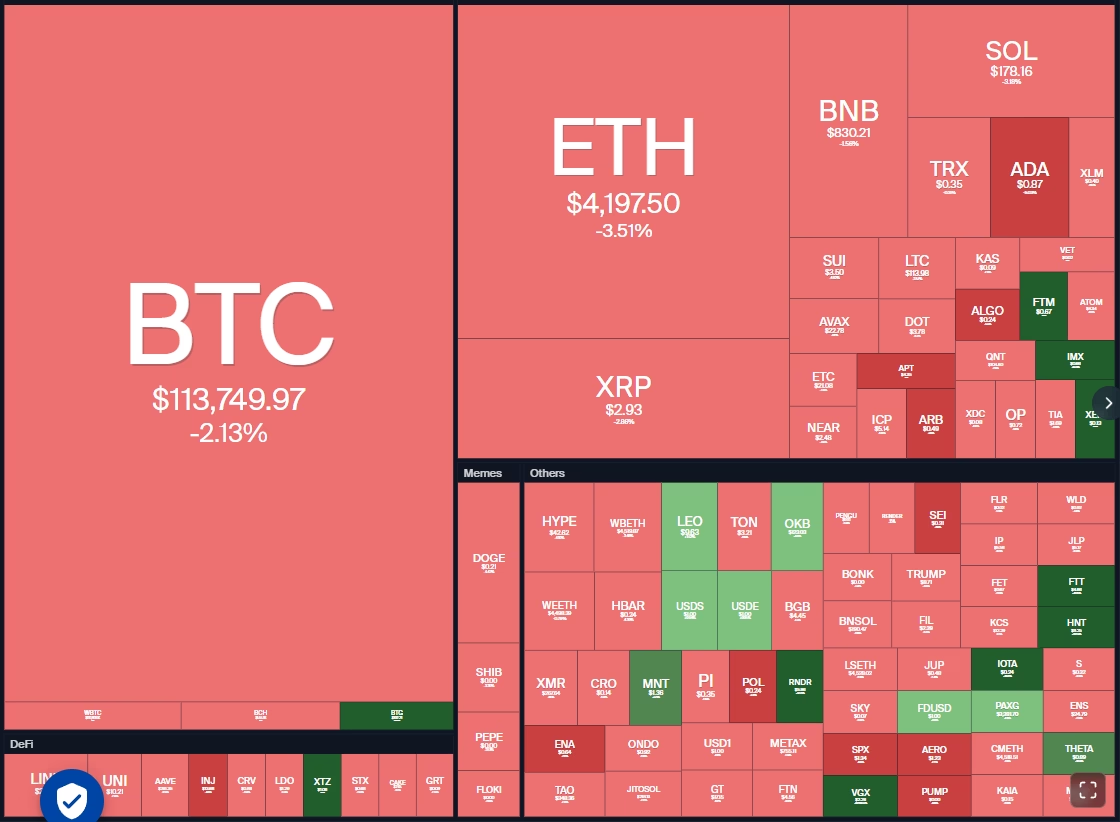

Bitcoin (BTC) is gradually pulling lower, indicating profit booking by short-term traders. Bitfinex analysts said in a report on Monday that BTC could remain range-bound until stronger macro catalysts emerge as investors remain in a wait-and-watch mode.

While some analysts expect BTC to drop toward $100,000, X analyst BitQuant thinks otherwise. He said BTC remains on target to soar to $145,000 and would not even come close to $100,000.

BTC’s near-term uncertainty has put the brakes on the rallies of several altcoins, including Ether (ETH). Spot ETH exchange-traded funds recorded $196.7 million in outflows, the second-largest daily outflow since launch, according to SoSoValue data.

Unfazed by the dip, trader Merlijn said in a post on X that ETH could surge above $8,000, terming it “a new chapter” in ETH’s history.

If BTC rebounds off the support, select altcoins could surprise to the upside. Let’s analyze the charts of the top 5 cryptocurrencies that look strong on the charts in the near term.

Bitcoin price prediction

BTC bounced off the neckline of the inverse head-and-shoulders pattern on Monday, but the bulls could not clear the overhead hurdle at the 20-day exponential moving average ($117,032).

The bears resumed selling on Tuesday and are trying to maintain the price below the neckline. If they manage to do that, the BTC/USDT pair could plummet to solid support at $110,530. Buyers are expected to fiercely defend the $110,530 level because a break below it could accelerate selling. The Bitcoin price may then skid toward $100,000.

The first sign of strength will be a break and close above the 20-day EMA. That suggests the selling pressure is reducing. The pair may then climb to $120,000 and eventually to the all-time high of $124,474.

The 20-EMA is sloping down, and the relative strength index (RSI) is in the negative territory on the 4-hour chart. That suggests the bears have the upper hand in the near term. The Bitcoin price could skid to $112,000, which is likely to act as strong support. If the price rebounds off $112,000 and breaks above the moving averages, the pair could form a…

Click Here to Read the Full Original Article at Cointelegraph.com News…