How do whales influence Bitcoin?

If anyone comes close to “moving the market,” it’s the whales. These are the investors holding thousands of BTC, often institutions, funds or OG holders from the early days. And in 2025, they’re more active than ever.

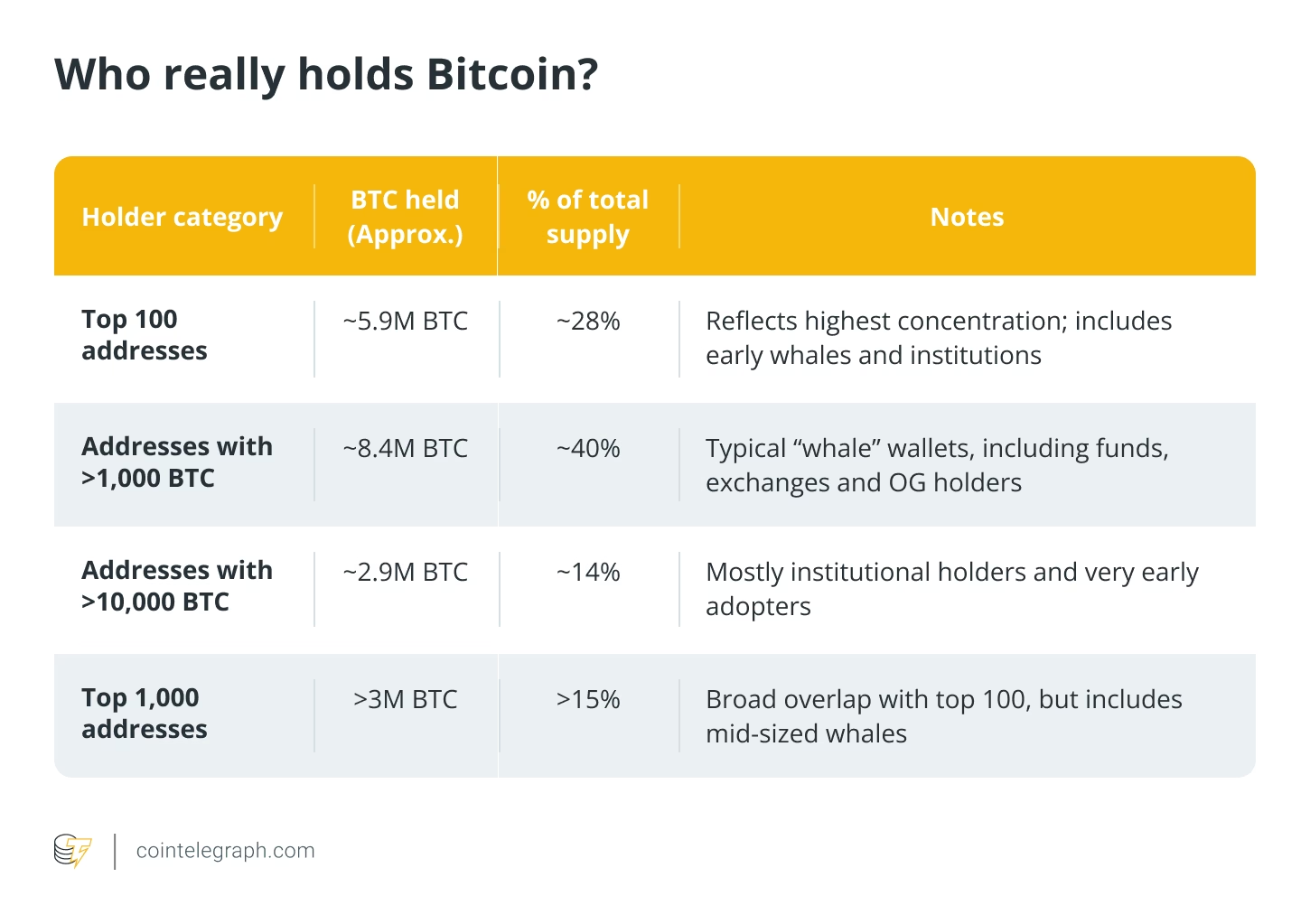

The number of wallets holding over 1,000 Bitcoin (BTC) has climbed to 1,455 as of May 2025, marking a renewed wave of accumulation. Some of this growth is driven by institutional players: Strategy alone now holds over 580,000 BTC (around 2.76% of total supply), while BlackRock has added Bitcoin allocations to its iShares Bitcoin Trust ETF and related portfolios.

Together, the two firms control an estimated 6% of the total Bitcoin supply, a staggering figure in an ecosystem with fixed issuance and increasingly thin exchange liquidity.

Whales aren’t necessarily hodlers either. They buy at scale, take profits on strength, and often offload right when retail piles in. Since the start of 2025, several major corrections have followed large inflows to exchanges from whale wallets — a pattern onchain analysts flagged as early as February.

On the flip side, stretches of dormancy in whale wallets have coincided with upward price momentum, including Bitcoin’s climb past $110,000 in April.

That said, not all whales are short-term traders. Data from CryptoQuant shows that long-standing whale addresses have realized just $679 million in profits since April, while newer large holders — likely hedge funds or high-net-worth individuals — have taken over $3.2 billion off the table in the same period.

This suggests a bifurcation: Early whales appear to be consolidating for the long haul, while new entrants are quicker to cash out.

Whale behavior may be nuanced, but the impact remains blunt. Whether they’re accumulating or distributing, these entities continue to play an outsized role in setting the tone and direction of Bitcoin’s price action (BTC).

Did you know? The top 2% of Bitcoin addresses control over 90% of its supply, but most of them are cold wallets and exchanges. This means the actual number of individuals with whale-like influence is far lower than raw address data suggests.

Can developers influence the Bitcoin price?

Developer-led upgrades don’t happen often in Bitcoin, and when they do, they tend to make waves. New functionality, better scalability or…

Click Here to Read the Full Original Article at Cointelegraph.com News…