US investment adviser Two Prime has partnered with staking infrastructure provider Figment to offer institutional clients access to cryptocurrency yield opportunities — highlighting the growing institutional shift toward blockchain-based yield strategies.

Through the partnership, Two Prime’s institutional clients will gain access to yield strategies for Bitcoin (BTC) and more than 40 other digital asset protocols, including Ethereum, Solana, Avalanche and Hyperliquid, the companies announced Tuesday.

Two Prime, a crypto-native investment adviser registered with the US Securities and Exchange Commission, manages roughly $1.75 billion in assets and operates one of the industry’s larger Bitcoin lending businesses.

In July, Bitcoin miner MARA Holdings acquired a minority stake in Two Prime, substantially increasing the amount of BTC the firm manages on its behalf.

Several blockchain firms are turning to Bitcoin yield, seeking to tap the underutilized potential of the $2.3 trillion asset. Solv Protocol has introduced a structured vault system designed to generate BTC yield through a mix of decentralized and traditional finance strategies.

Bitcoin-focused DeFi startup BOB has raised $21 million to further expand Bitcoin yield opportunities using hybrid models.

Coinbase has also entered the space with its new Bitcoin Yield Fund, targeting non-US investors with returns of up to 8%. The exchange said the fund was launched “to address the growing institutional demand for bitcoin yield.”

Related: Bitcoin yield demand booming as institutions seek liquidity — Solv CEO

Institutional adoption fuels rising demand for Bitcoin yield

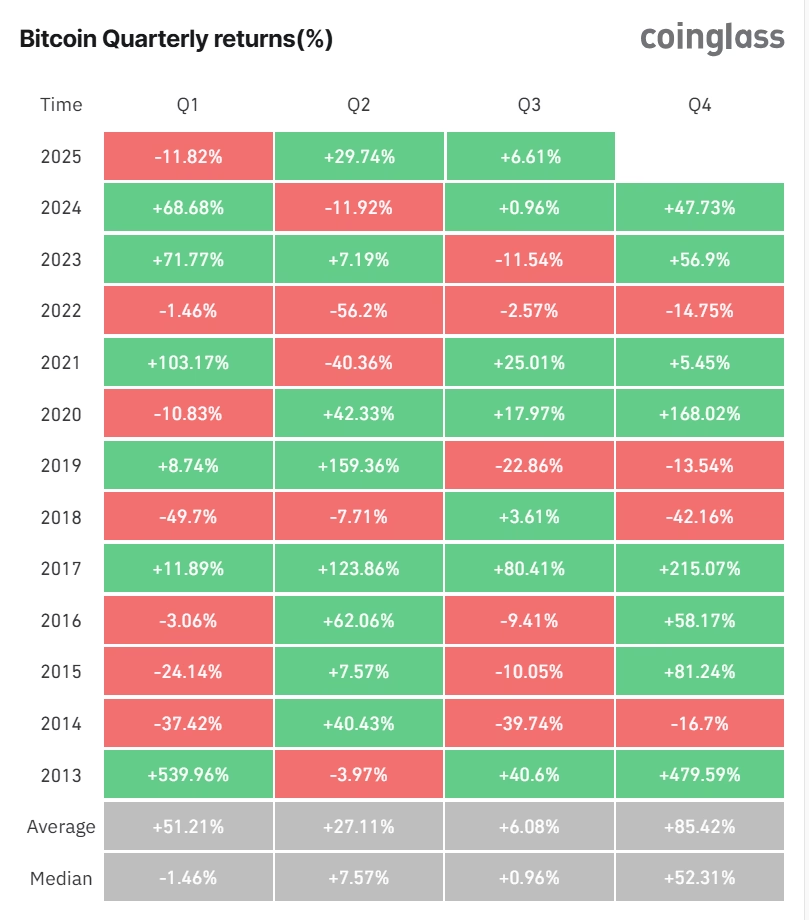

Bitcoin’s outsized historical returns are pushing more investors toward yield strategies that generate income on otherwise idle holdings.

As hedge funds, family offices and asset managers move into BTC, they increasingly seek exposure that also delivers predictable returns. Unlike crypto-native “diamond hands,” institutions view Bitcoin as part of a diversified portfolio — where yield is a desired or expected component.

Javier Rodríguez-Alarcon, chief investment officer of digital asset manager XBTO, said in June that Bitcoin’s maturation as an asset class “requires sophisticated solutions that go beyond simple exposure.”

Rodriguez-Alarcon’s firm partnered with Arab Bank Switzerland to offer wealth management…

Click Here to Read the Full Original Article at Cointelegraph.com News…