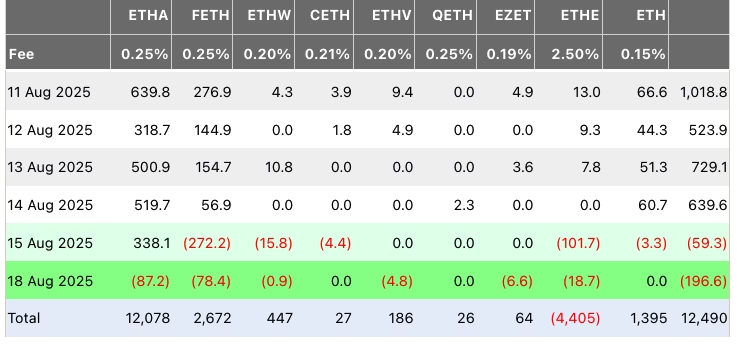

Spot Ether funds started a new week with a major sell-off, posting nearly $200 million in outflows on Monday and extending a trend that started last week.

Spot Ether (ETH) exchange-traded funds (ETFs) saw $196.7 million of outflows on Monday, marking their second-largest daily outflows since launching. Monday’s outflows were only topped by $465 million in outflows on Aug. 4, according to SoSoValue.

The latest outflows followed Friday’s $59 million in losses, bringing the two-day total to $256 million.

The outflows remain modest compared to the record $3.7 billion inflow streak over the previous eight trading days, when some single-day inflows topped $1 billion.

BlackRock’s ETHA sees $87 million in outflows

According to Farside data, BlackRock and Fidelity saw the largest ETH ETF outflows among issuers on Monday, totaling $87 million and $79 million, respectively.

Last Friday, Fidelity’s Ethereum Fund (FETH) alone posted $272 million in outflows, significantly contributing to the total $59 million in daily outflows.

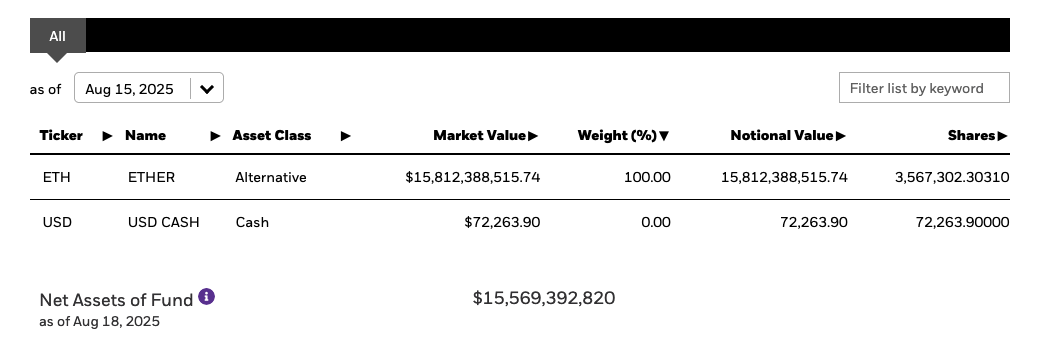

BlackRock has become one of the largest institutional holders of Ether. According to official data for the iShares Ethereum Trust ETF (ETHA), the fund held approximately 3.6 million ETH — valued at $15.8 billion — as of last Friday.

Since then, the dollar value of ETHA’s holdings has declined by 1.5% to $15.6 billion reported on Monday.

In this period, the ETH price has tumbled around 6.5%, according to CoinGecko.

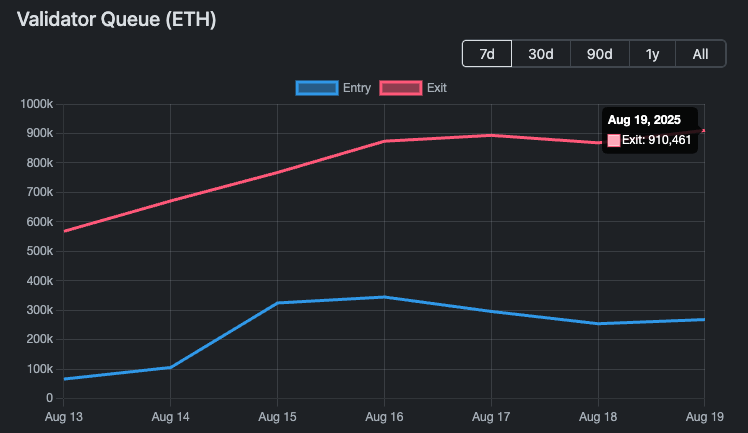

Ether unstaking queue repeatedly hits new highs

The record Ether ETF outflows and turbulent ETH prices come amid the ongoing surge in Ether unstaking queue, or the amount of Ether being awaited to be withdrawn from staking pools by Ethereum validators.

According to ValidatorQueue, a third-party website tracking the validator queues on the Ethereum proof-of-stake (PoS) network, the validator’s exit line broke an all-time high of 910,000 ETH worth approximately $3.9 billion on Tuesday.

The data also suggests that validators now have to wait at least 15 days and 14 hours to unstake their ETH.

Some crypto market observers have highlighted the potentially negative outcomes of the ongoing ETH unstaking queue growth, warning of a looming “unstakening.”

“The flippening will never happen but the…

Click Here to Read the Full Original Article at Cointelegraph.com News…