Key takeaways:

-

Short-term Bitcoin holders sold 20,000 BTC at a loss since Sunday.

-

Technicals suggest pushing Bitcoin’s price below $100,000 could be a tough task for the bears.

Bitcoin (BTC) price has pulled back below $116,000, as uncertainty ahead of Jerome Powell’s Jackson Hole speech led investors and traders to reevaluate risks and stay cautious.

Bitcoin “weak hands” back to realizing losses

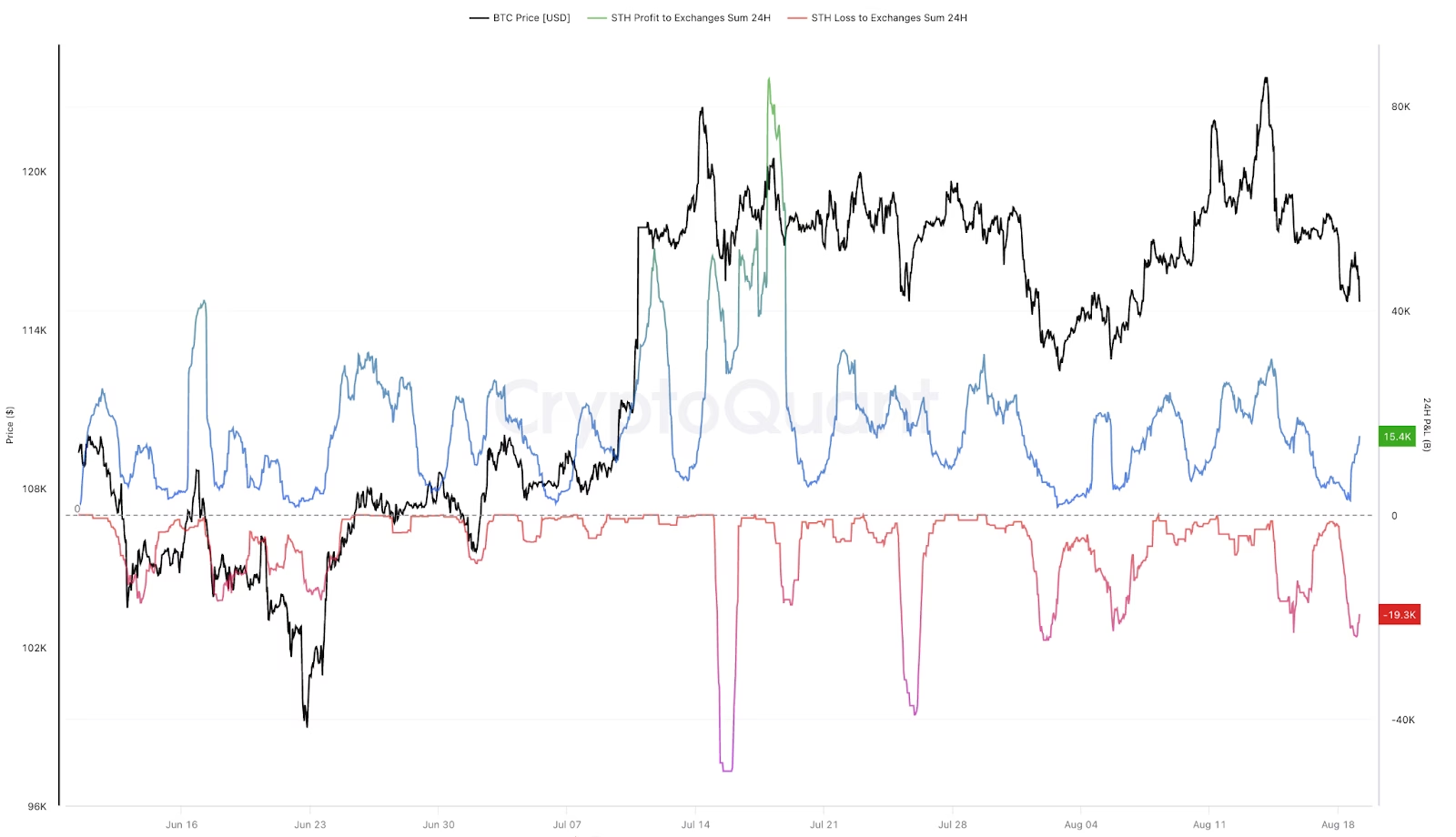

Bitcoin has retraced 7.6% from its new all-time high of $24,500 set last week. Following this price action, onchain data from CryptoQuant show that over 20,000 BTC held by short-term holders (STHs) — investors who have held the asset for less than 155 days — moved to exchanges at a loss over the last three days.

More than 1,670 BTC were transferred to exchanges at a loss on Sunday, which surged to 23,520 BTC by Tuesday, coinciding with a 3.5% drop in BTC’s price to $114,400 from $118,600, per Glassnode data.

Related: Bitcoin ‘liquidity zones swept’ but uptick in open interest hints at BTC recovery

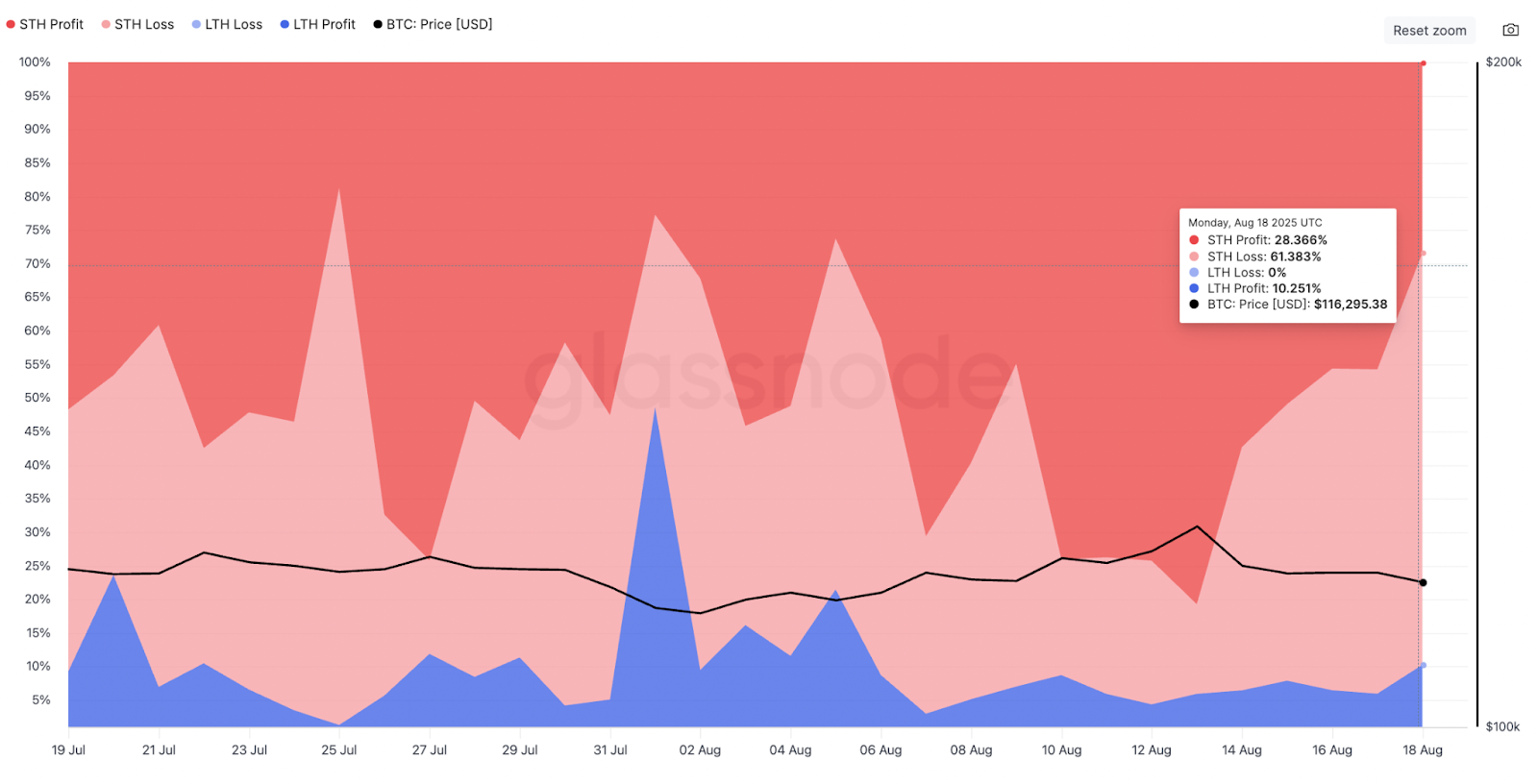

The chart below shows that most Bitcoin sent to exchanges at a loss are from STHs, while LTHs—both in profit and loss—comprise just 10% of the total volume to exchanges.

This activity underscores a familiar behavioral pattern where short-term speculators panic-sell during market dips, frequently realizing losses.

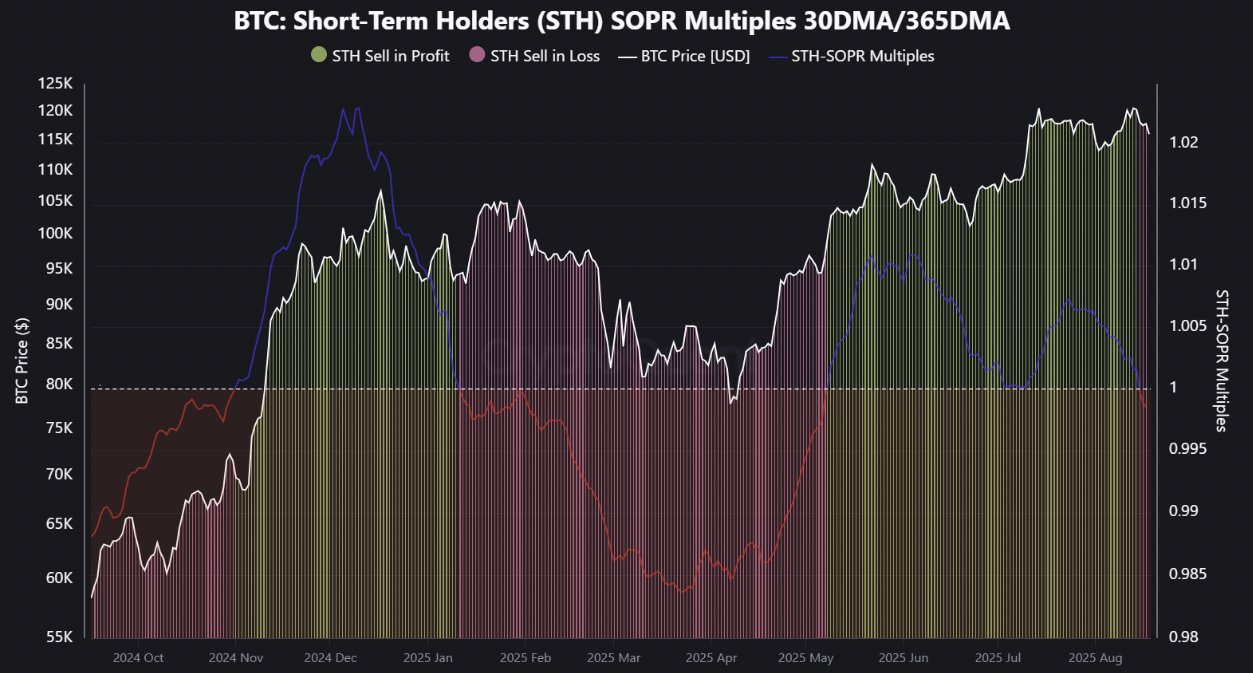

The last time Bitcoin STHs moved into sustained loss realization was in January, “a period that marked the deepest correction of this cycle,” according to CryptoQuant analyst Kripto Mevsimi.

“For the first time since that January drawdown, STH-SOPR multiples have slipped back below 1, indicating that short-term investors are once again realizing losses,” the analyst said in an Aug. 18 Quicktake note.

Historically, this has carried two implications: A weakening momentum where extended loss realization often precedes deeper corrective phases, or a healthy reset where “brief dips below 1 can flush out weak hands, clearing the path for more sustainable rallies,” Kripto Mevsimi explained, adding:

“This loss-selling event becomes a critical barometer of market health. If absorbed quickly, it could mirror past resets that fueled strong rebounds. If not, it risks signaling a momentum breakdown.”

Bitcoin’s drop below $100,000…

Click Here to Read the Full Original Article at Cointelegraph.com News…