- UAE investment news and Reuters coverage sparked a rapid Morphware (XMW) rally.

- Low liquidity and profit-taking fueled a sharp price reversal.

- Contract risks and cautious sentiment have kept volatility high.

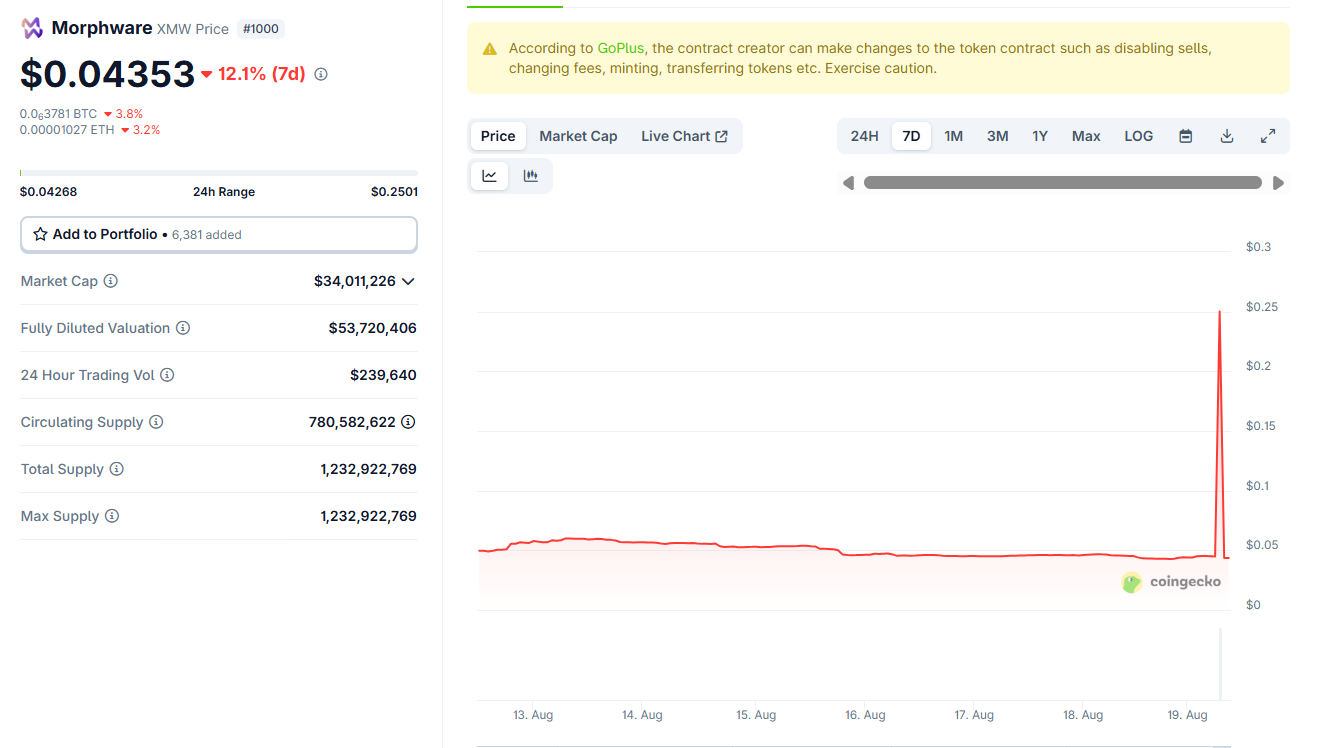

The price of the Morphware (XMW) token jumped 450% earlier today, reaching a high of $0.2501 according to Coingecko, before erasing all the gains to trade at $0.04353 at the time of writing.

The sudden pump-and-dump unfolded within hours, leaving traders scrambling for answers.

Here’s a closer look at what triggered the move, why it collapsed, and what comes next for XMW holders.

What caused the surge?

The rally was sparked by Morphware’s announcements earlier this week.

On August 12, the team revealed that a leading UAE investment firm had committed funds to its AI infrastructure and mining operations.

The following day, the news was picked up by Reuters as a press release, bringing mainstream visibility to the project’s expansion into the UAE.

This combination of social media hype and media coverage fueled a rush of speculative buying.

The headlines not only attracted existing crypto traders but also drew in new investors who had never tracked Morphware before.

Why the rally collapsed

Despite the explosive move, the rally was unsustainable. The first reason was liquidity.

Morphware’s 24-hour trading volume stood at just $241,276, far too low to support a rapid surge in valuation.

As a result, even modest buying pressure was enough to send the price skyrocketing, and a relatively small wave of sell orders triggered the collapse.

Second, speculative momentum quickly gave way to profit-taking.

Traders who entered early rushed to lock in gains, while others, alarmed by the pace of the spike, chose to exit before the inevitable correction.

Finally, lingering concerns around the project’s contract added to the selloff.

Risk trackers have warned that the contract creator retains significant privileges, including the ability to change fees, mint tokens, or even disable sales.

Fundamentals versus volatility

Morphware has promoted itself as more than just a token play.

The company emphasises its enterprise AI services powered by NVIDIA B200 and H200 GPUs, hydroelectric-powered data centres at Itaipu, and an…