Key takeaways

-

Quants: $180,000-$325,000+, tied to PnL swings.

-

Legal/CCO: Up to $500,000 TC with equity.

-

Influencers: Six/seven figures from sponsors; high risk.

-

Auditors: $150,000 base; bounties can hit millions.

-

Brokers: 1%-3% commissions; six-figure monthly commissions possible.

In Web3, many of the best-paying blockchain jobs are concentrated in areas where specialized skills or direct revenue impact are most evident, such as protocol/security, quantitative trading, media outlets with premium sponsorships and high-value brokerage for Bitcoin mining sites and hosting capacity.

Total compensation (TC) often combines a base salary and bonus with tokens or equity, commissions or bug-bounty payouts. Actual earnings can vary significantly depending on token prices, market conditions and deal flow.

These top-earning crypto jobs typically involve safeguarding high total value locked (TVL), executing profitable basis trades, brokering multimillion-dollar contracts or monetizing large media audiences.

Many are global in scope, frequently offered as remote positions and show strong demand across Web3 jobs in the UK and US.

Did you know? According to the Web3 Industry Report 2025, the global Web3 sector employs over 460,000 professionals, having added about 100,000 new employees in the past year alone.

The five highest-paying Web3 roles

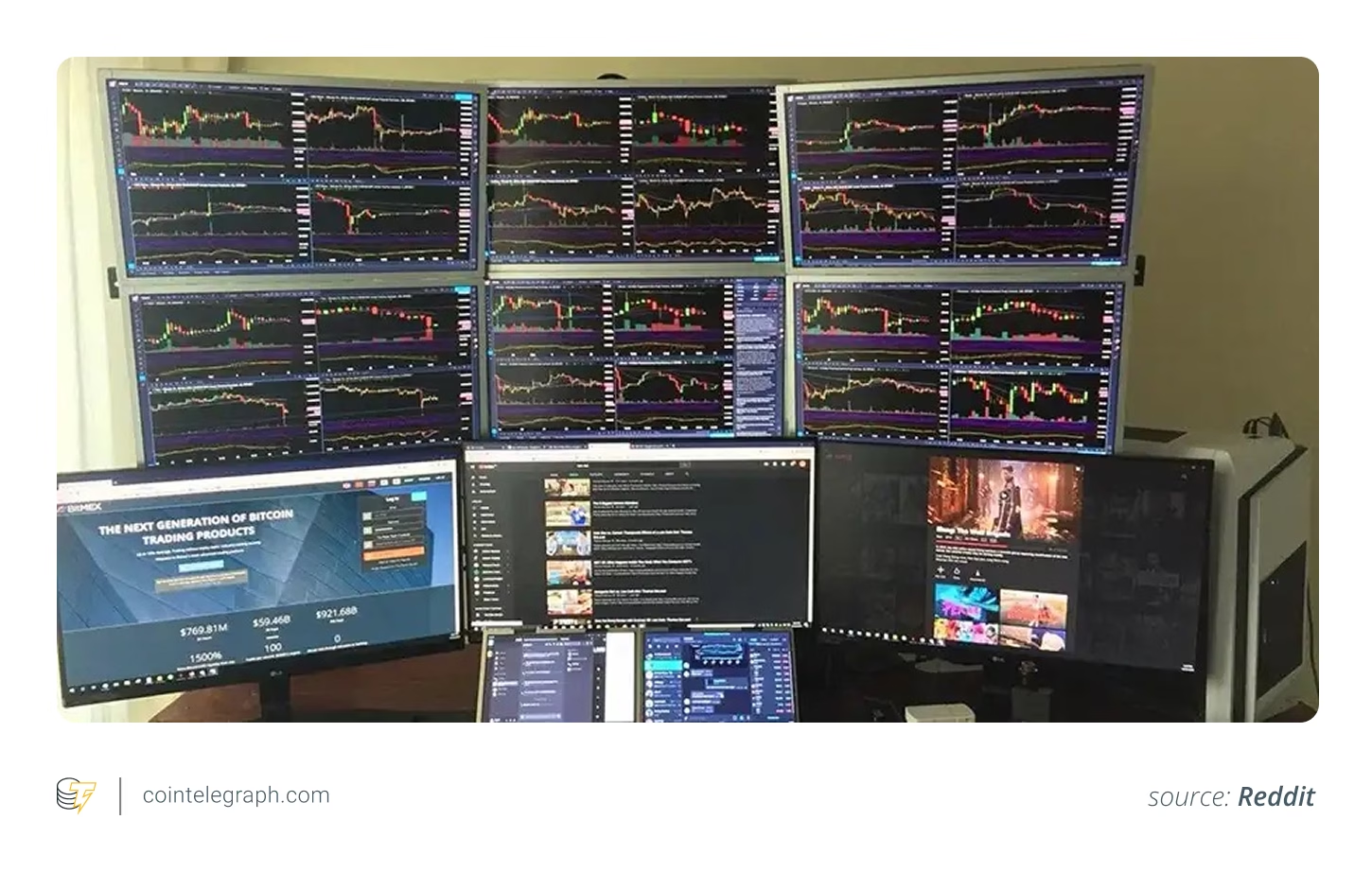

5) DeFi quant researcher/trader (market makers and crypto funds)

At top market makers and quant funds, a reasonable mid-career TC sits around $180,000-$325,000+, scaling with profit and loss (PnL) share.

Public postings for crypto researchers often show $150,000-$200,000 bases. Crowd-sourced bands at tier-one TradFi/crypto shops suggest $270,000-$425,000 is common once bonus and/or equity is included.

Here’s how to get in: You’ll need to be an expert in Python, C++ or Rust, market microstructure, exchange APIs, onchain data and robust, slippage-aware backtesting.

Also, publish serious notebooks (signal discovery, walk-forwards), contribute to open-source market-data stacks and target market-maker roles that emphasize research autonomy. Weekend risk coverage is prized (crypto is 24/7).

Keep in mind: Your upside tracks volatility and the firm’s inventory/risk policy more than job title. When spreads compress, bonuses do, too. In hot years, researchers with live signals can see outsized variable comp; in slow ones, the base carries you. For Web3 careers in 2025, this is squarely in the “highest paying crypto jobs (2025)” bucket,…

Click Here to Read the Full Original Article at Cointelegraph.com News…