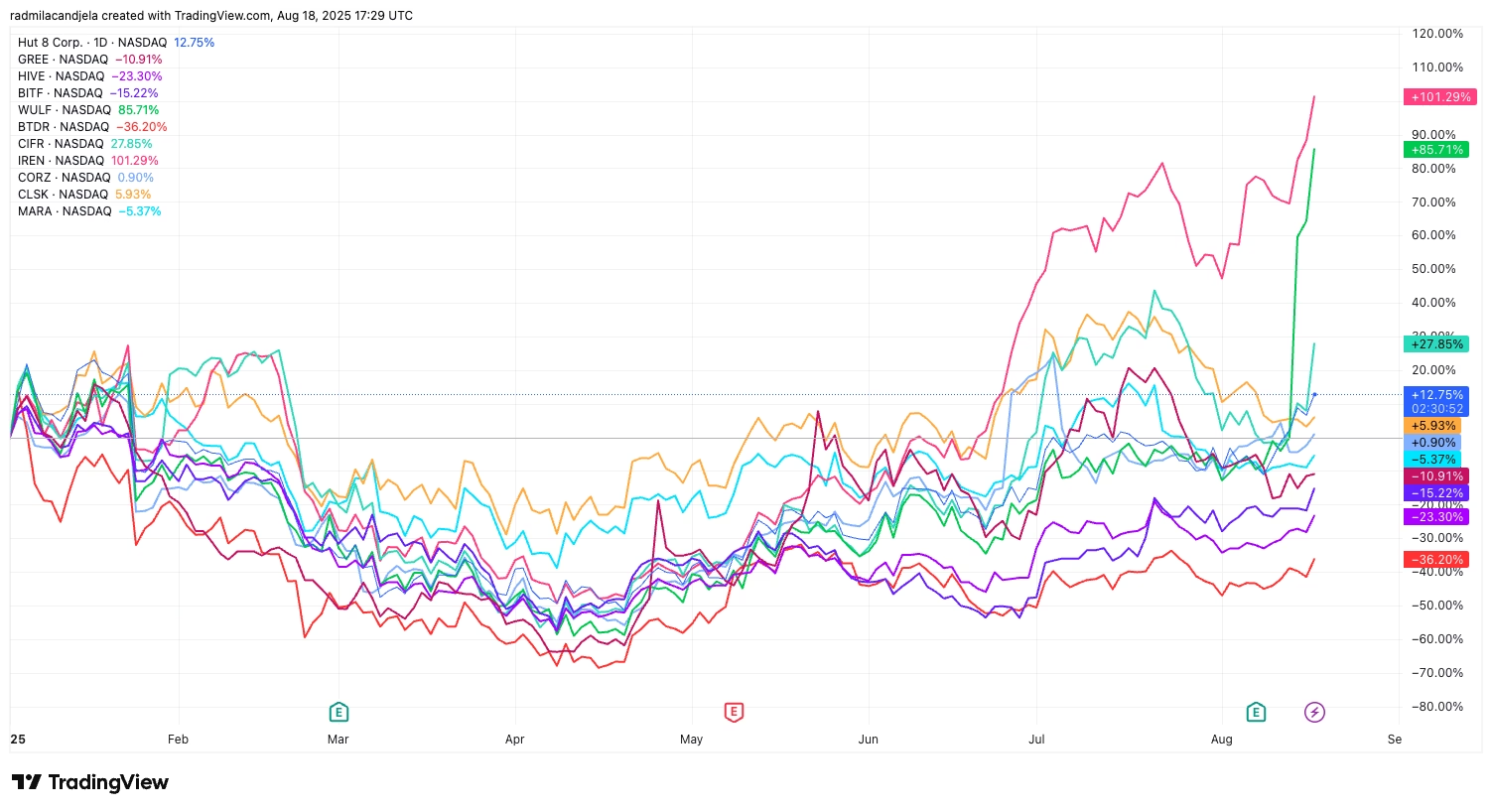

Despite its weekend downturn, Bitcoin is up over 22% year-to-date, but public mining companies listed on NASDAQ have struggled to keep pace. The equal-weighted basket of mining stocks has gained just over 12% between Jan. 1 and Aug. 18.

However, that underperformance masks a reversal in the past two months, when miners surged more than 46% against Bitcoin’s 11% rise, flipping the performance spread into positive territory on shorter time frames.

The divergence shows the structural risks in listed mining equities and the concentrated bursts of upside that appear when conditions align. Understanding where miners trail and where they overshoot is important for assessing their role as a proxy for Bitcoin exposure.

Throughout the year, dispersion inside the group has been extreme. IREN and WULF have led the pack with year-to-date gains of 101% and 81.5%, respectively. At the same time, BTDR has shed 36%, HIVE 23.8%, and BITF nearly 16%. MARA, traditionally one of the most liquid names, is down almost 7%. Such a vast difference in performance shows how much miner returns depend on balance sheet management, funding events, and operational specifics, rather than just Bitcoin’s performance.

Shorter-term windows show a very different picture. Over the 10 days ending August 18, the miners’ basket gained 17.3% while Bitcoin slipped 0.5%. The rally was broad, with WULF soaring 97%, HUT 22.8%, CIFR 29.2%, and BITF 9.3%.

During this stretch, BTC’s flat price action illustrates how miners can outperform in bursts even when the underlying asset stalls. The 30-day data confirm the effect: miners rose 4.8% while BTC fell 1.6%, again creating a positive spread of more than six percentage points.

These bursts are not uniform in size. WULF and IREN dominate recent gains, while MARA and CLSK lag, down 17.9% and 22.4% over the past 30 days. That imbalance shows the rally is as much about stock-level catalysts and positioning as it is about Bitcoin beta.

Risk metrics further illustrate how uneven this performance is. Over the past 60 days, several miners display textbook high-beta behavior: GREE with a beta of 1.57, BTDR at 1.44, and MARA at 1.39. Yet correlations tell a different tale. Despite doubling in price, WULF shows a negative correlation to Bitcoin over the same horizon. IREN, up more than 100% year-to-date, also shows near-zero correlation.

Drawdowns reinforce the structural gap…

Click Here to Read the Full Original Article at Cryptocurrency Mining News | CryptoSlate…