Key takeaways:

-

ETH price has a short liquidation cluster “magnet” at $4,300–$4,360.

-

Ether price technicals support the case for a rally toward $4,750–$8,000.

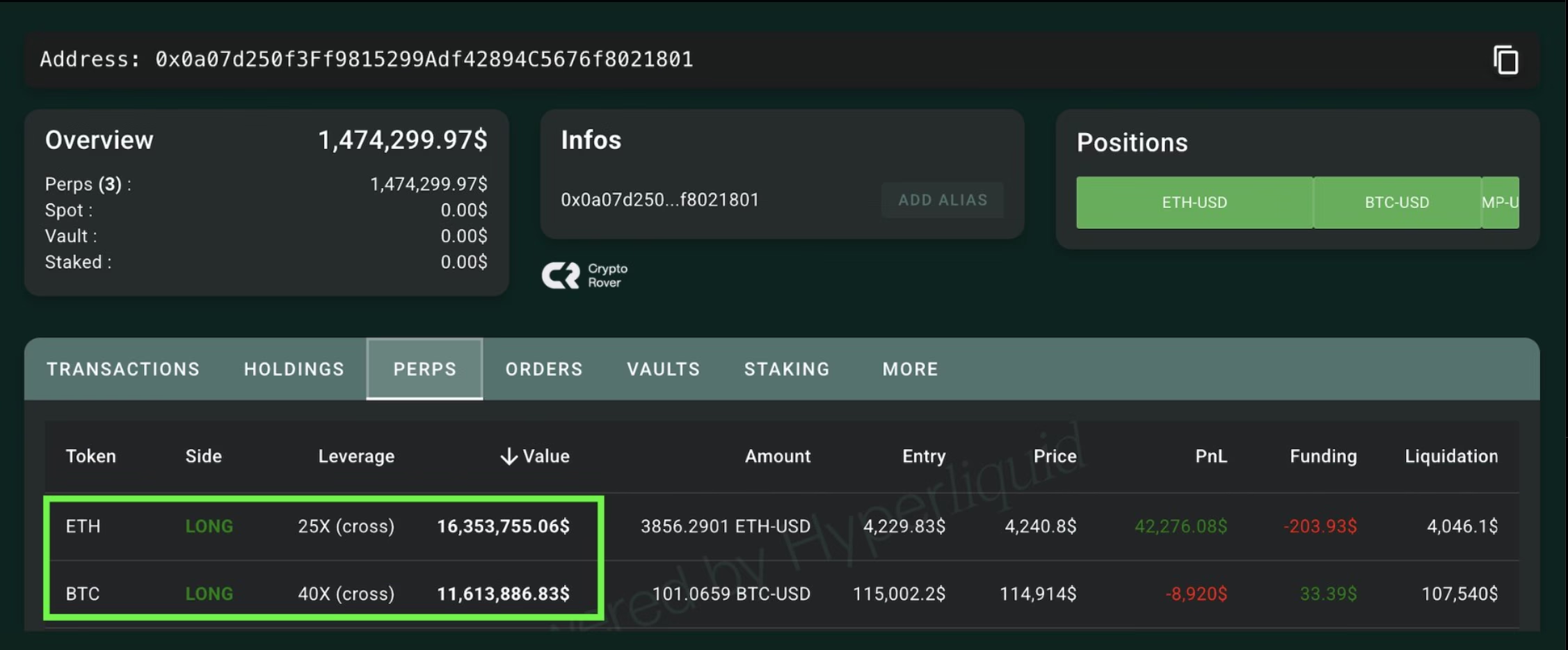

An Ethereum whale has opened a massive $16.35 million long position on Ether (ETH), using 25x leverage, in what looks like a bold wager that the latest dip is over.

1% price ETH gain equals $163,000 in profit

The position, entered at $4,229.83 per ETH, is already slightly in profit with ETH trading just above $4,240. At this scale, a mere 1% rise from the entry would add over $163,000 in profit.

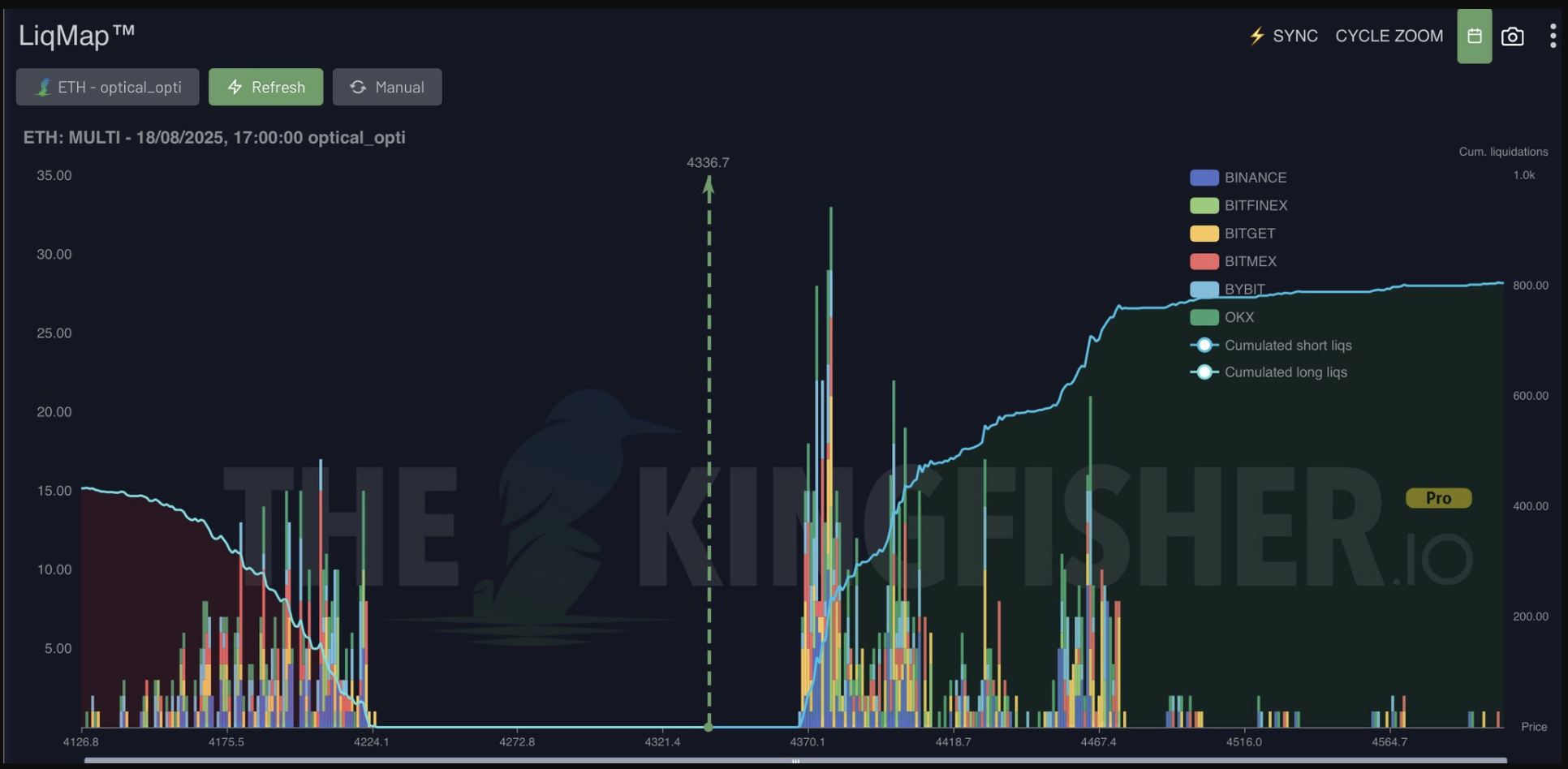

Fresh liquidation heatmaps support the timing of the whale’s entry.

Data from Kingfisher shows a dense cluster of short liquidations above $4,300–$4,360, with a particularly large pocket near $4,336. Markets are often drawn toward such liquidity “magnets” as market makers hunt stops.

Strategically, this means ETH doesn’t need a full-blown breakout to validate the whale’s trade. A simple push into the $4,336 liquidity pool could generate multimillion-dollar paper gains.

The whale’s position could be up by nearly $450,000 in unrealized profit if ETH hits that level.

Related: SharpLink purchases $667M in Ether at near record prices

On the flip side, a 4.34% drop to around $4,046 would completely liquidate the trade, erasing the margin behind the position.

Did Ether find a local bottom?

Ethereum is also holding firm above its 20-day exponential moving average (20-day EMA; the green wave), a support that has guided the uptrend since July, barring a brief breakdown last month.

The level now aligns with the lower boundary of a developing falling wedge pattern on the daily chart, a classic bullish reversal setup. This confluence of support strengthens the case for the whale’s $16.35 million long bet.

ETH could eye an upside target around $4,750, nearly 13% higher from current levels, if the wedge and 20-day EMA fractal play out. A close below $4,140, however, risks invalidating the setup.

Zooming out to the weekly chart, ETH is staging what some analysts call one of the “obvious weekly retests” in years.

DIY Investing notes that Ethereum has flipped its “biggest resistance” around the $3,900-4,000 area into support, adding:

“$ETH to $8k once this retest holds.”

This article does not…

Click Here to Read the Full Original Article at Cointelegraph.com News…