The race to build crypto treasuries is accelerating. Alongside high-profile ventures raising billions, blockchain native protocols themselves are exploring new ways to lock value into their ecosystems, and in some cases, even reimagine what a treasury can do.

On Aug. 7, the Chainlink network announced its own reserve, designed to accumulate the protocol’s native token Chainlink (LINK) collected from both onchain service fees and offchain enterprise revenue, creating a direct link between Chainlink’s business activity and long-term token demand.

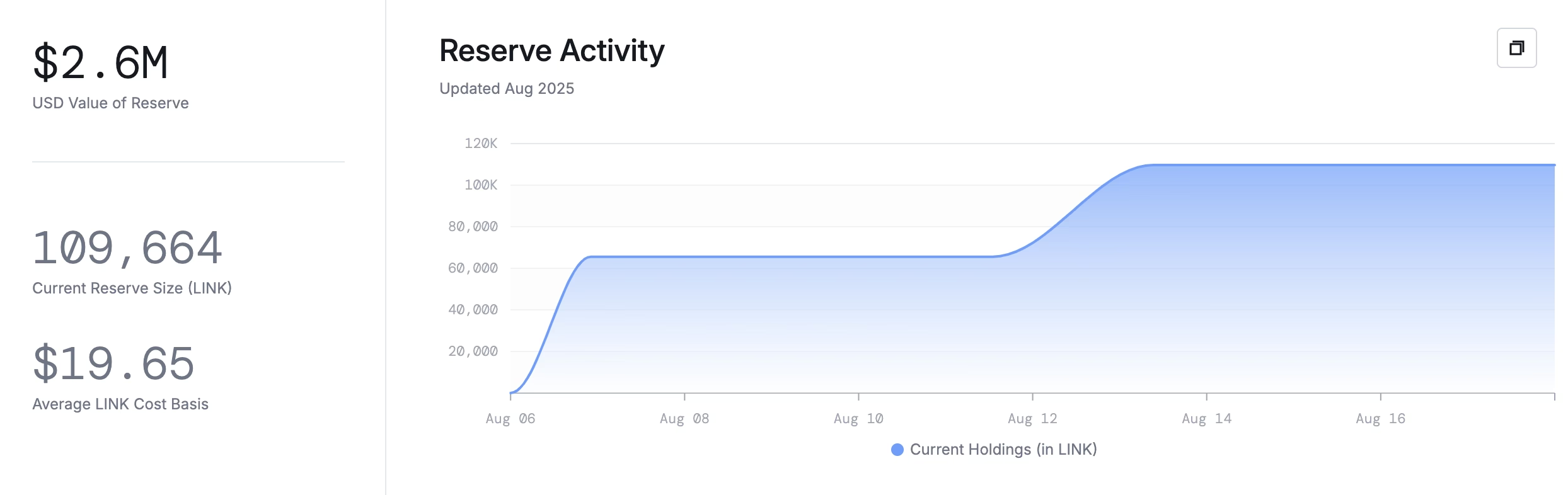

Since then, the protocol has made two deposits to its newly launched onchain treasury. Onchain data from Etherscan shows total holdings at 109,661.68 LINK at this writing, valued at about $2.6 million.

While Chainlink hasn’t disclosed how much or how often it will add to the reserve, the initiative is part of a broader shift in crypto toward using treasuries as active drivers of token demand rather than passive reserves.

Related: What is Chainlink, and how does it work?

Turning treasuries into perpetual demand engines

Chainlink’s reserve is funded with revenue from enterprise clients in banking and capital markets. Those payments — whether in stablecoins, gas tokens, or fiat — are collected and automatically converted into LINK through Chainlink’s Payment Abstraction system before being deposited into the reserve.

Chainlink Labs says the network has already generated hundreds of millions of dollars from these enterprise deals. It also noted that no withdrawals will be made from the reserve for several years.

Also exploring crypto treasury alternatives is Cardano. In a June 15 livestream, Cardano’s founder Charles Hoskinson suggested converting 5%–10% of Cardano’s $1.2 billion ADA (ADA) treasury into Bitcoin and stablecoins, then using the yield to buy back its native token from the open market. By his estimates, reallocating around $100 million of ADA could generate $5 million–$10 million in annual buybacks, creating a perpetual demand loop.

Unlike Chainlink, which channels external revenue into LINK without selling its reserves, Cardano’s plan would reallocate existing assets, creating short-term sell pressure but offering the potential for larger long-term gains if the strategy works.

Danny Ryan, a research analyst at Bitwise, told Cointelegraph that sustained purchases in the tens of millions would…

Click Here to Read the Full Original Article at Cointelegraph.com News…