Key takeaways:

-

President Donald Trump’s push for aggressive interest rate cuts could trigger a surge in inflation, weaken the dollar, and destabilize long-term bond markets.

-

Even without rate cuts, trade policy and fiscal expansion are likely to push prices higher.

-

Bitcoin stands to benefit either way—whether as an inflation hedge in a rapid-cut environment, or as a slow-burn store of value as US macro credibility quietly erodes.

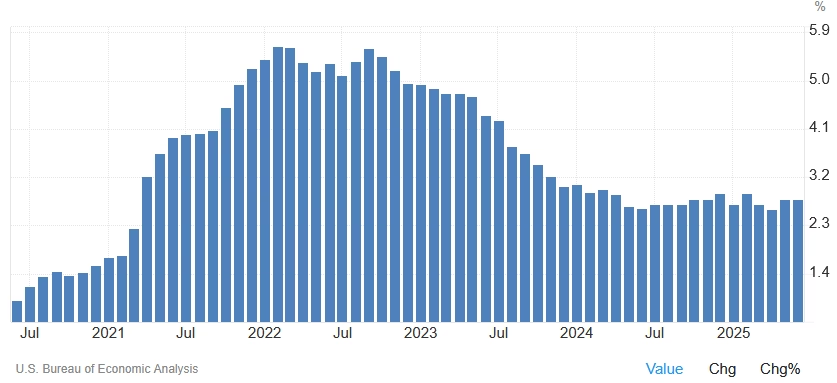

The US economy may be growing on paper, but the underlying stress is increasingly difficult to ignore — a tension now in sharp focus at the Federal Reserve’s Jackson Hole symposium. The US dollar is down over 10% since January, core PCE inflation is stuck at 2.8% and the July PPI surged 0.9%, tripling expectations.

Against this backdrop, 10-year Treasury yields holding at 4.33% look increasingly uneasy against a $37 trillion debt load. The question of interest rates has moved to the center of national economic debate.

President Donald Trump is now openly pressuring Federal Reserve Chair Jerome Powell to cut interest rates by as much as 300 basis points, pushing them down to 1.25-1.5%. If the Fed complies, the economy will be flooded with cheap money, risk assets will surge, and inflation will accelerate. If the Fed resists, the effects of rising tariffs and the fiscal shock from Trump’s newly passed Big Beautiful Bill could still push inflation higher.

In either case, the US appears locked into an inflationary path. The only difference is the speed and violence of the adjustment, and what it would mean for Bitcoin price.

What if Trump forces the Fed to cut?

Should the Fed bow to political pressure starting as early as September or October, the consequences would likely unfold rapidly.

Core PCE inflation could climb from the current 2.8% to above 4% in 2026 (for context, post-COVID rate cuts and stimulus pushed core PCE to a peak of 5.3% in February 2022). A renewed inflation surge would likely drag the dollar down even further, possibly sending the DXY below 90.

Monetary easing would briefly lower Treasury yields to around 4%, but as inflation expectations rise and foreign buyers retreat, yields could surge beyond 5.5%. According to the Financial Times, many strategists warn that such a spike could break the bull market altogether.

Higher yields would have immediate fiscal consequences. Interest payments on US debt could rise from around $1.4 trillion to as much as $2…

Click Here to Read the Full Original Article at Cointelegraph.com News…