What is hodling crypto?

Hodling crypto means holding onto cryptocurrency long-term instead of selling, regardless of market volatility.

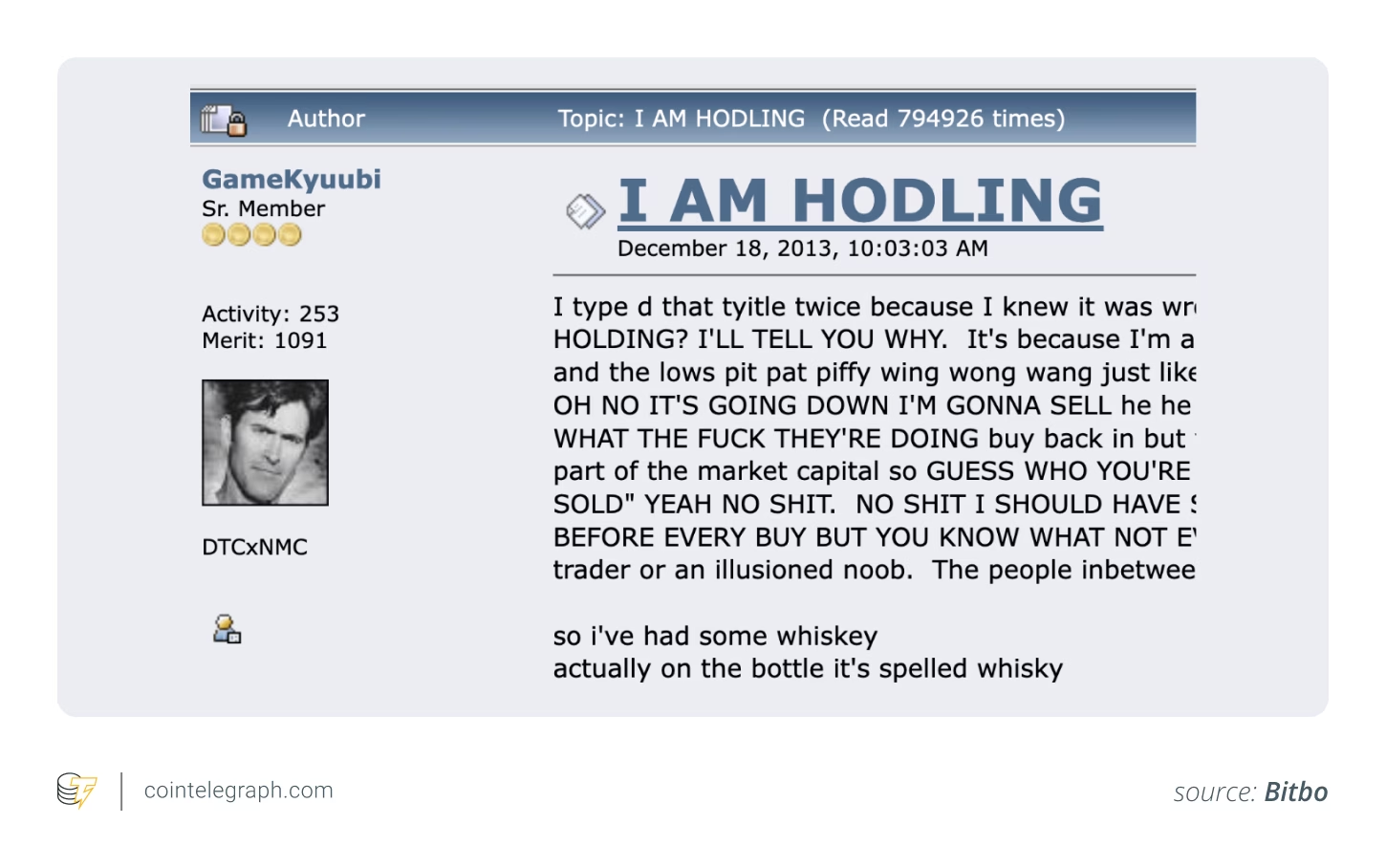

In 2013, a late-night forum post on Bitcointalk was titled “I AM HODLING.”

The user, clearly frustrated with market swings and maybe a few drinks in, meant to say “holding.”

Nevertheless, the typo stuck. In the years that followed, “HODL” went from meme to mindset.

In a space that thrives on hype cycles, FOMO trades and 100x gambles, hodling offered a radically simple idea: Buy Bitcoin and don’t touch it. No day trading. No panic selling. Just conviction.

Now, in 2025, the world looks very different, but hodling is still here. It’s the strategy behind many of Bitcoin’s biggest success stories, especially as more long-term investors step into the market.

Central banks are still fighting inflation, institutions are stacking sats, and Bitcoin (BTC) has matured into a macro asset. In that kind of environment, sitting tight has paid off.

So, what is hodling in crypto today? It’s a long-term Bitcoin strategy that’s still relevant, still working and arguably more validated than ever.

Did you know? The original “HODL” post was written in response to a 39% Bitcoin price crash in one day (Dec. 18, 2013). The user, GameKyuubi, admitted he was drinking whiskey and “bad at trading” but decided to hold anyway. That raw honesty helped the post go viral.

Ideas behind hodling Bitcoin in 2025

Hodling can be thought about as a psychological defense mechanism against one of the most volatile markets in history.

At the core of this mindset is loss aversion, a well-documented principle in behavioral finance.

According to research by Nobel laureate Daniel Kahneman, people feel the pain of losses about twice as strongly as the pleasure of equivalent gains.

In crypto, where 20% daily swings aren’t unusual, this emotional bias can drive irrational decisions: panic selling at the bottom or FOMO buying near the top.

Hodlers reject that impulse. They subscribe to what the crypto community calls “diamond hands,” a commitment to long-term conviction, even when the market turns red. It’s not about timing tops and bottoms; it’s about not flinching when others do.

This mentality aligns closely with how Bitcoin is increasingly positioned in 2025: as a store of value. Fidelity,

Click Here to Read the Full Original Article at Cointelegraph.com News…