Key takeaways:

-

XRP’s rally to $3 has pushed 94% of supply into profit, a level that historically marked macro tops.

-

XRP is in the “belief–denial” zone, onchain metrics show, echoing peaks in 2017 and 2021.

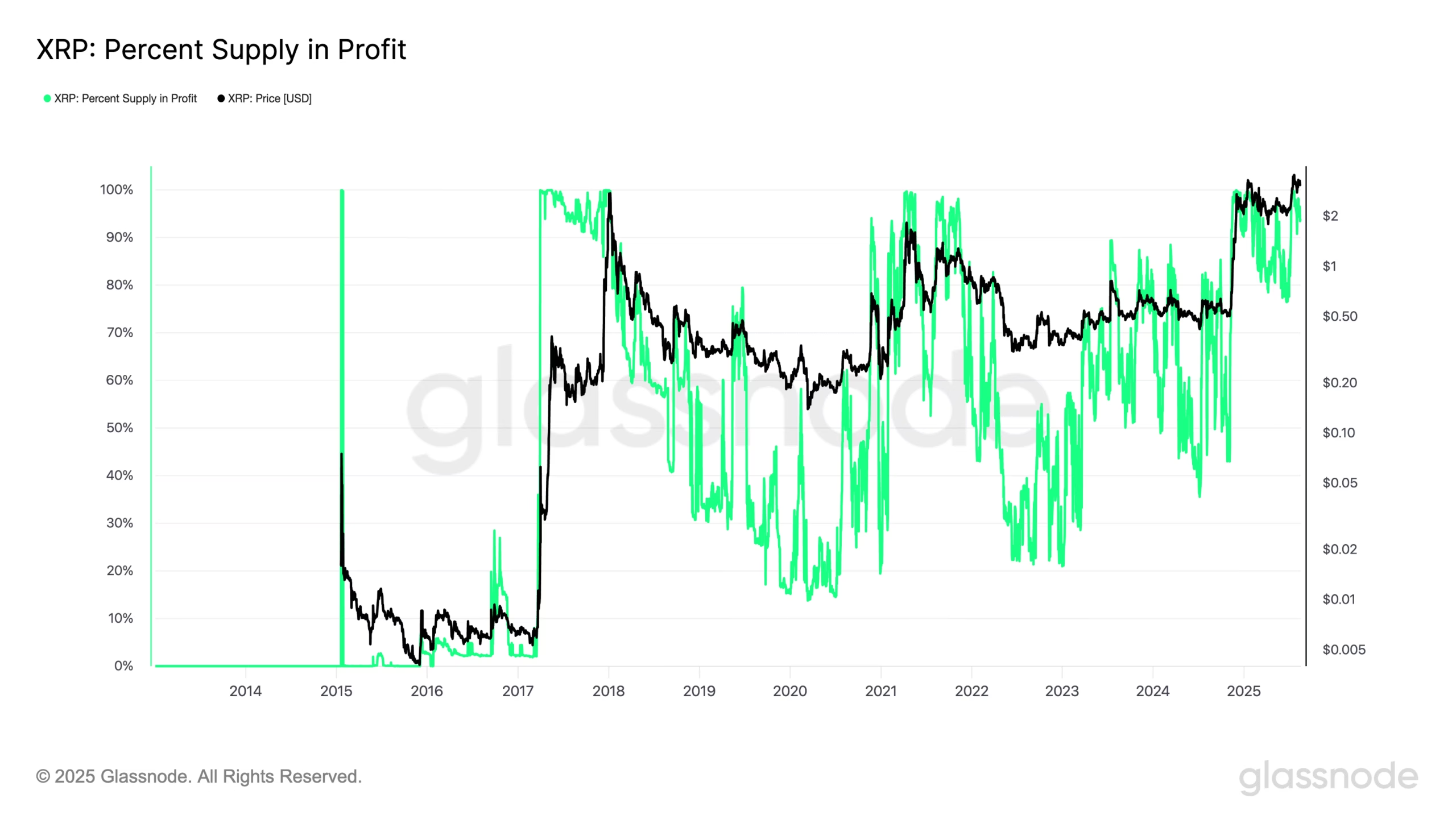

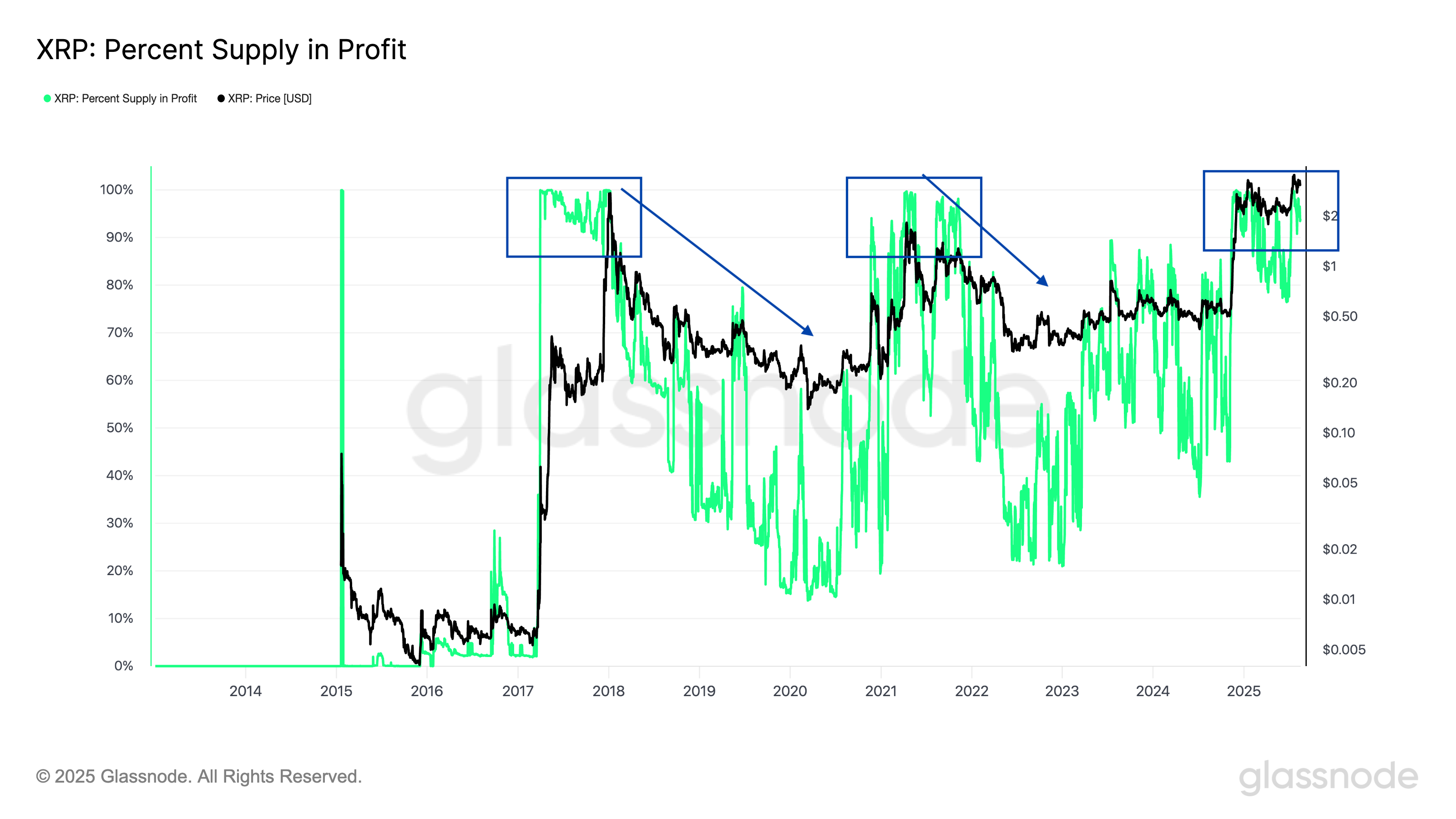

XRP’s (XRP) rally to over $3 has pushed nearly 94% of its circulating supply into profit, Glassnode data shows.

As of Sunday, XRP’s percent supply in profit was 93.92%, underscoring strong investor gains as the cryptocurrency rallied by more than 500% in the past nine months to $3.11 from under $0.40.

90%> supply in profit is usually an XRP macro top

Such high profitability has historically signaled overheated conditions.

In early 2018, over 90% of holders were in profit just as XRP peaked near $3.30 before a 95% price reversal. A similar setup appeared in April 2021, when profitability levels above 90% preceded an 85% crash from the top near $1.95.

The broad profitability underscores strong investor gains, which typically heightens the risk of distribution as traders may seek to realize profits. A similar scenario could be unfolding now.

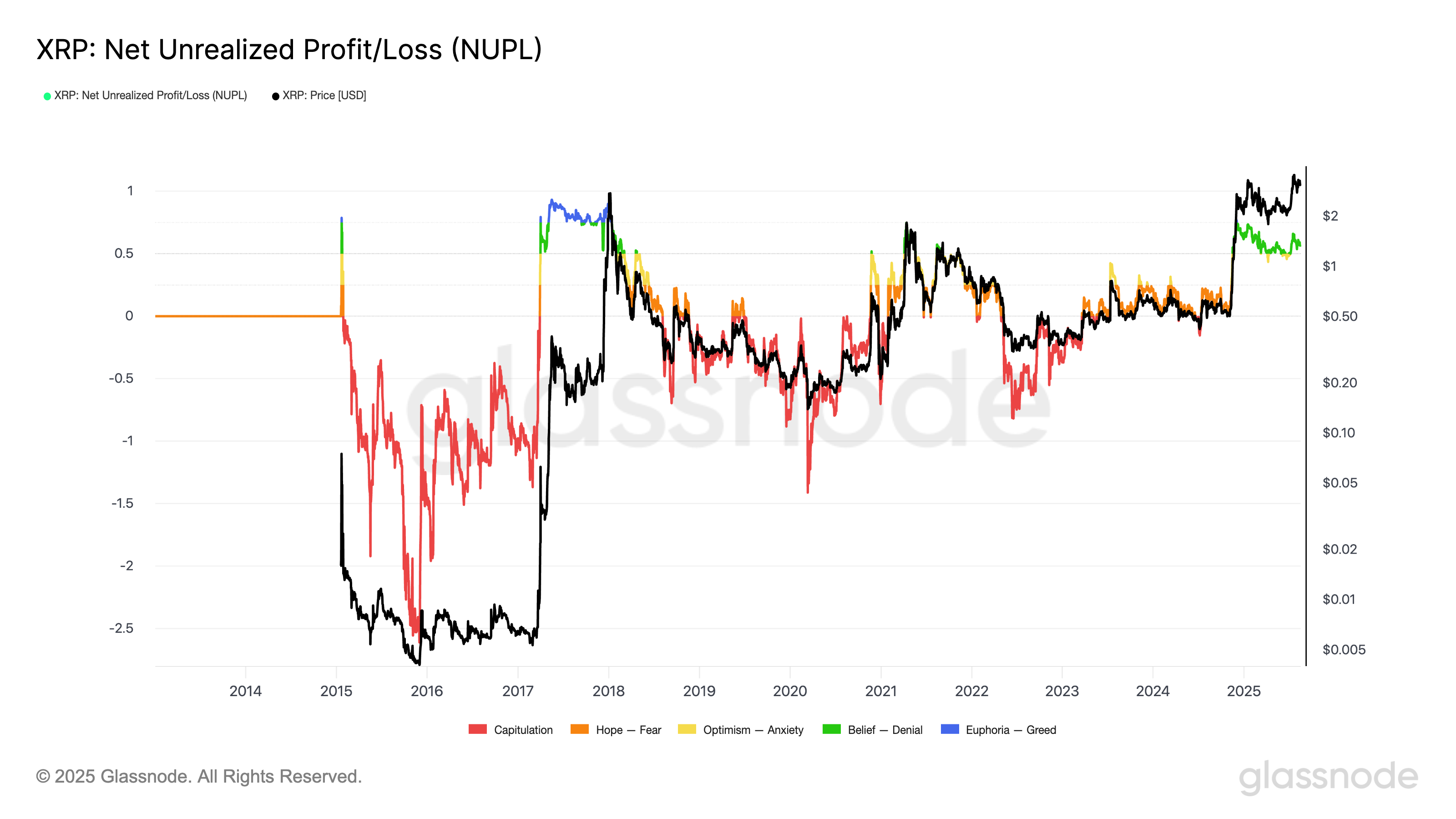

XRP’s NUPL mirros 2017 and 2021 price peaks

XRP’s Net Unrealized Profit/Loss (NUPL) is further signaling top risks.

The indicator, which tracks the difference between unrealized gains and losses across the network, has entered the “belief–denial” zone, a phase historically observed before or during market tops.

For example, in late 2017, XRP’s NUPL spiked to similar levels just as XRP price peaked above $3.30. A comparable pattern unfolded in April 2021, when NUPL readings above 0.5 coincided with XRP’s top near $1.95 before another sharp downturn.

The current trajectory suggests investors are heavily in profit but not yet in full “euphoria.” But the risk of profit-taking and distribution will intensify if NUPL rises toward greed levels for the first time since 2018.

XRP might absorb potential selling pressure and avoid a deeper correction below $3 if it can attract fresh inflows, driven by institutional demand and broader altcoin momentum.

XRP’s classic bearish setup risks 20% drop

XRP price is consolidating inside a descending triangle after rising above $3.

The pattern, typically bearish, is defined by lower highs against horizontal support near $3.05. Earlier this month, XRP briefly broke below the support in a fakeout, only to rebound back…

Click Here to Read the Full Original Article at Cointelegraph.com News…