Investor sentiment toward cryptocurrencies surged this week, with growing retail interest in altcoins suggesting Bitcoin’s recent euphoria phase may be nearing an end, according to analysts.

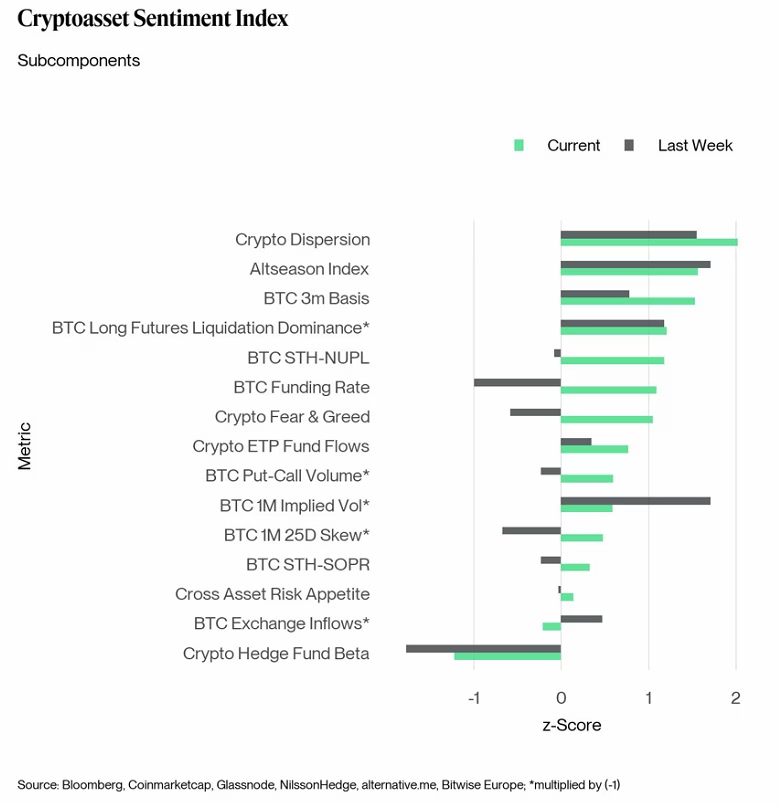

The crypto asset sentiment index rose from 0.23 to 0.91 within a week, according to Max Shannon, senior research associate at crypto index fund manager Bitwise.

Google searches for altcoins and Ethereum also rose to a multiyear high, reminiscent of prior bear markets, which may signal a growing investor mindshare for altcoins and Ether (ETH), following Bitcoin’s latest all-time high above $124,000.

These developments mark a “classic froth-infused behaviour that can precede buyer exhaustion,” said Shannon in a Thursday X post.

Buyer exhaustion occurs when diminishing buy orders are overwhelmed by selling pressure, potentially leading to a Bitcoin (BTC) pullback as capital rotates into other cryptocurrencies.

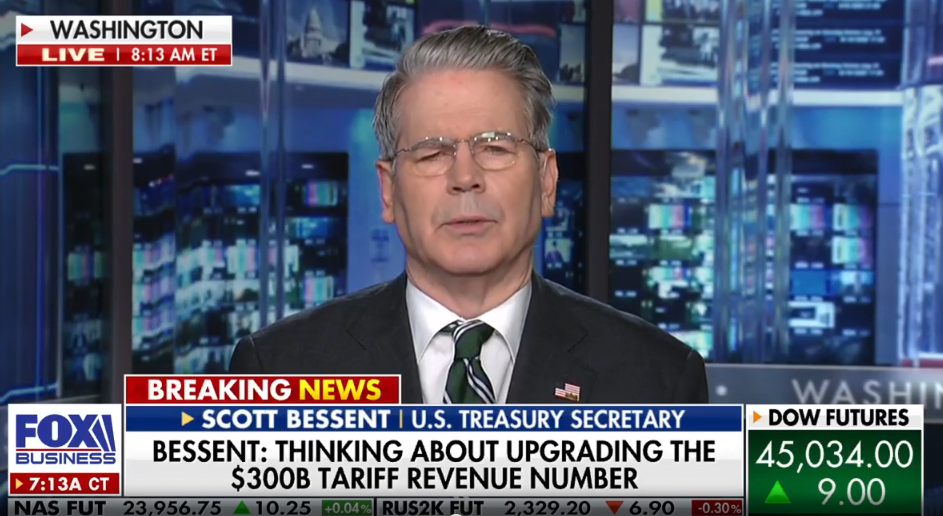

Bitcoin dipped below $118,000 on Thursday as investors digested comments from US Treasury Secretary Scott Bessent, who said the government had no plans to make additional purchases for its Strategic Bitcoin Reserve and separate digital asset stockpile.

Bessent backpedalled on his statement hours later, clarifying that his department was still exploring budget-neutral ways to acquire BTC for the Strategic Bitcoin Reserve.

“Treasury is committed to exploring budget-neutral pathways to acquire more Bitcoin to expand the reserve, and to execute on the President’s promise to make the United States the ‘Bitcoin superpower of the world,’” Bessent wrote in an X post on Thursday.

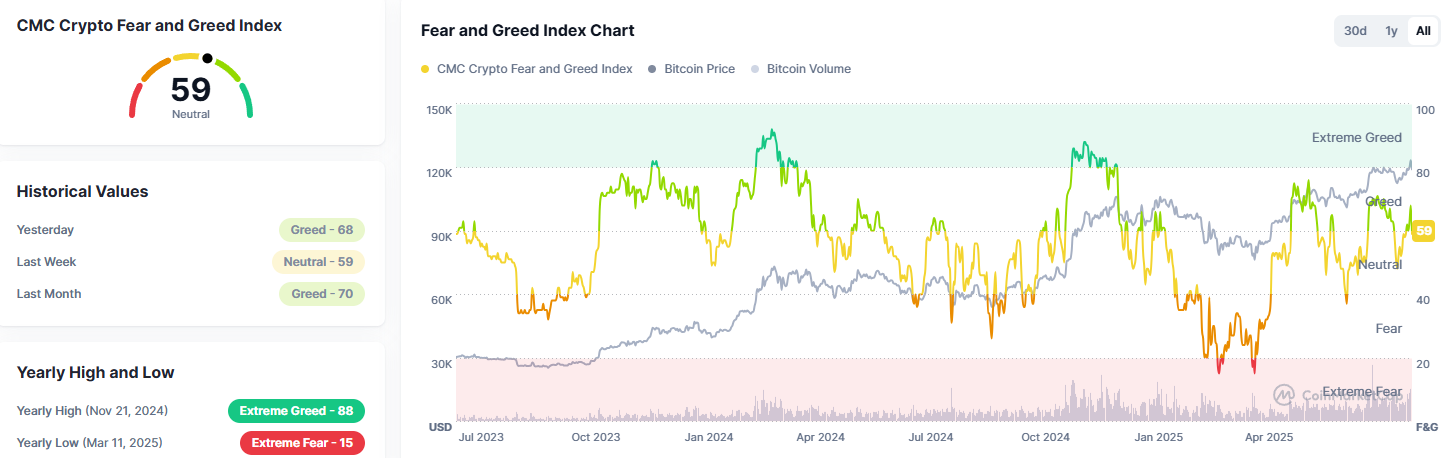

The Crypto Fear & Greed Index shifted from “greed” to “neutral” territory, falling to 59 at the time of writing, down from 68 on Thursday, CoinMarketCap data showed.

Despite the drop into neutral territory, investor sentiment remained “elevated but shy of euphoria, leaving room for trend continuation if macro doesn’t deteriorate,” according to Stella Zlatareva, dispatch editor at digital asset investment platform Nexo.

Favorable policy developments, such as the Securities and Exchange Commission’s incoming Solana exchange-traded fund (ETF) decision deadline in October, signal that the “uptrend’s broader narrative remains intact,” she told Cointelegraph.

Related: Bitcoin briefly flips Google market cap as investors eye…

Click Here to Read the Full Original Article at Cointelegraph.com News…