Key takeaways:

-

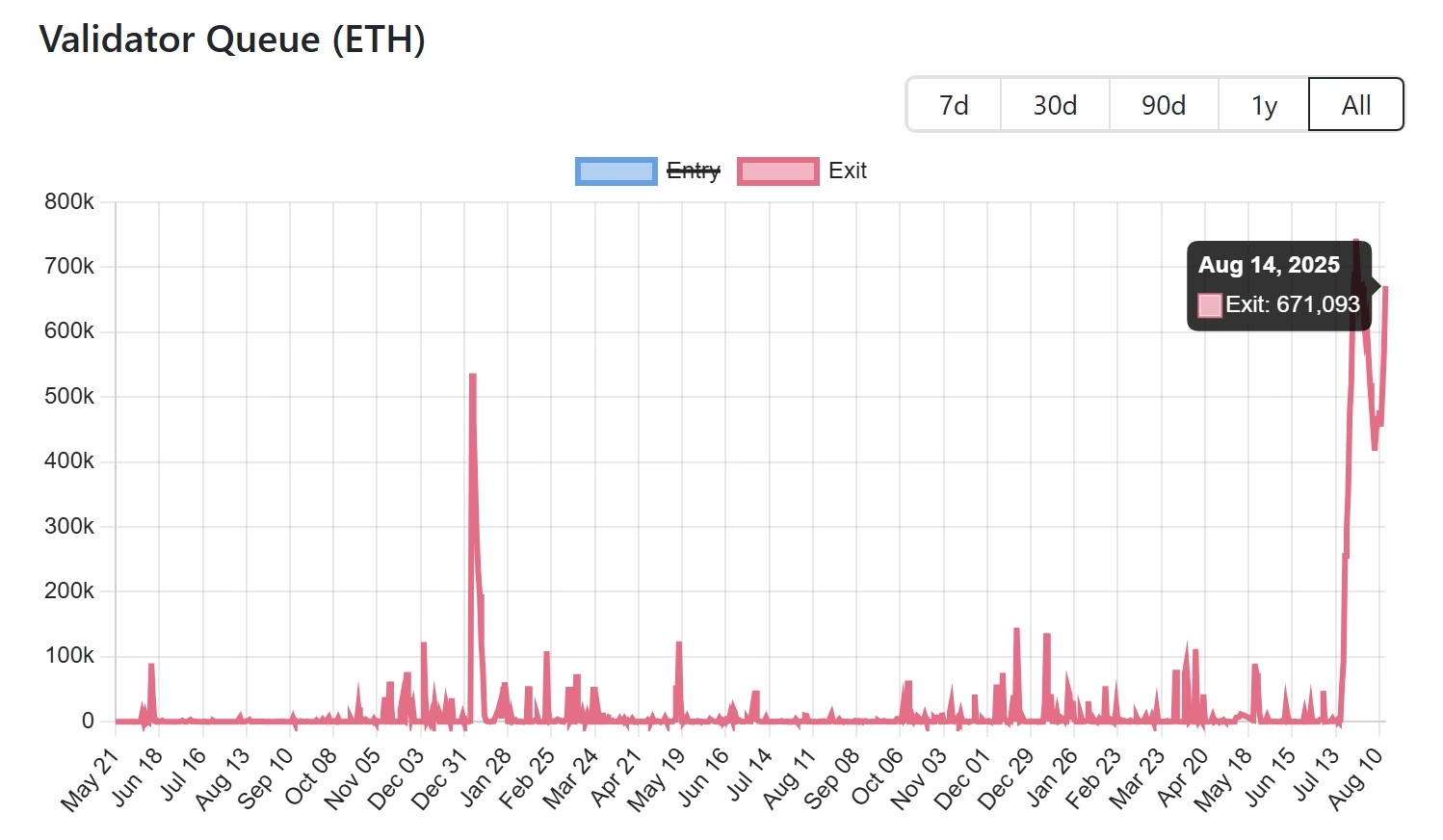

Ether queued for unstaking hits a record $3.8 billion, led by Lido, EthFi, and Coinbase.

-

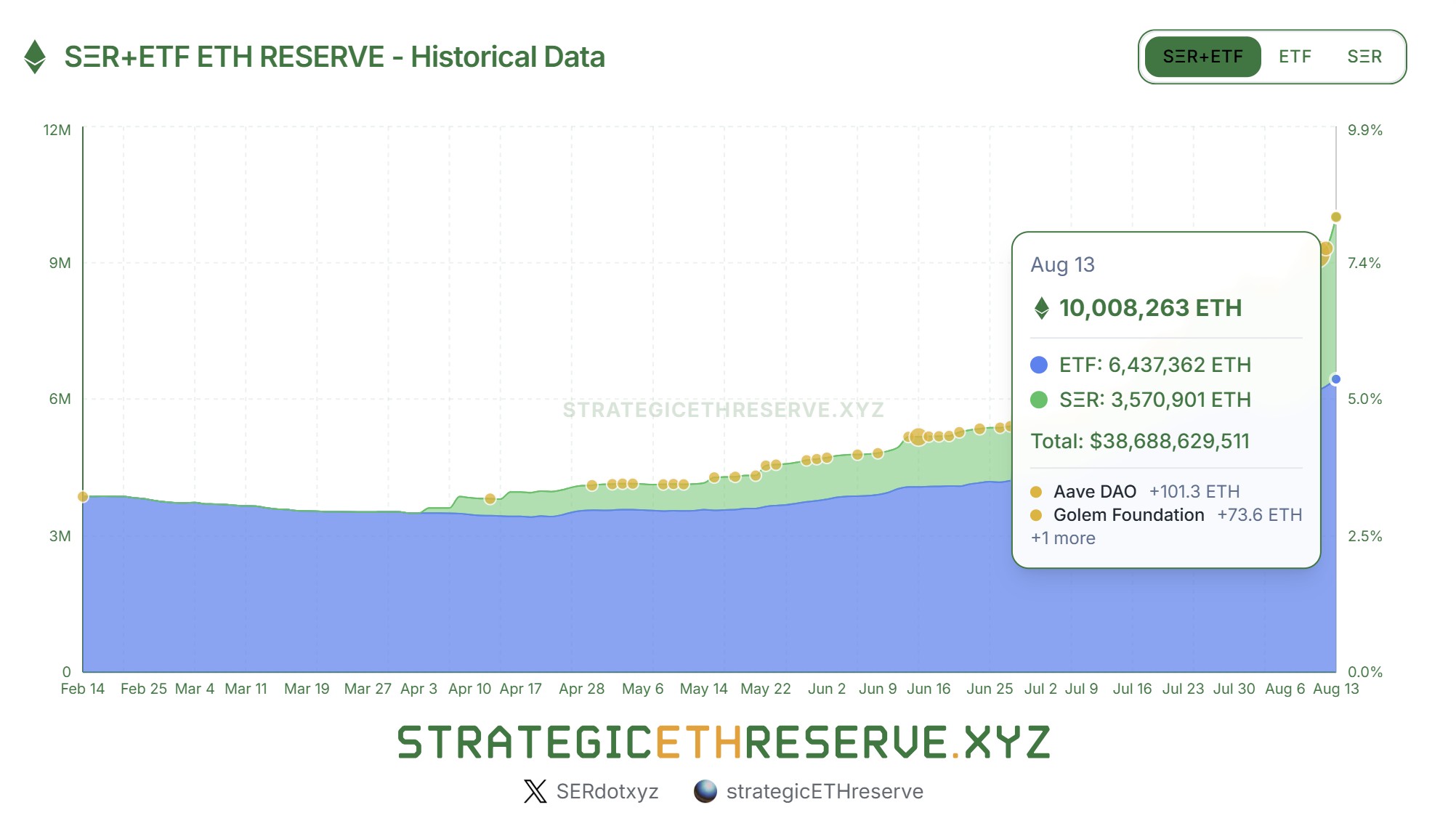

Strategic reserves and ETF holdings have jumped by 140% since May 1.

-

ETH’s $4,200 support is critical, with $1.2 billion in longs at risk if the price tags the level.

The staking ecosystem of Ethereum has reached new highs, with 877,106 Ether (ETH) worth $3.88 billion currently queued for a withdrawal, with a 15-day wait time on Friday. Data from ValidatorQueue notes that the current number of active validators is above 1.08 million, with 29.5% of the total ETH supply staked, i.e., around 35.3 million ETH.

Decentralized finance (DeFi) analyst Ignas said that the surge in unstaked ETH is being driven largely by the top three liquid staking platforms. Lido leads with 285,000 ETH queued for withdrawal, followed by EthFi with 134,000 ETH and Coinbase with 113,000 ETH.

While this rise in queued unstaked ETH could mean massive profit-taking could be underway, the analyst believes that the recent accumulation and buying strength from Ether treasury companies and spot ETH exchange-traded funds (ETFs) is absorbing much of the selling pressure.

Data from strategicethreserve.xyz highlights that collective holdings of strategic reserves and ETFs have surged 140% since May 1, climbing to 10,008,263 ETH from 4,140,953 ETH. The sharp increase underscores a swift consolidation of Ether supply into the hands of major institutional and corporate players.

Ignas highlights another bullish narrative tied to the potential launch of ETH staking ETFs. The analyst suggests that some investors may be freeing up liquidity now to re-enter through these products later, effectively reshuffling their exposure without exiting the ETH market altogether.

While the SEC’s final deadline for approval is set for April 2026, Bloomberg ETF analyst Seyffart notes that the green light could come much sooner, possibly as early as October 2025.

Related: Ether price prediction markets bet ETH will hit $5K by end of August

How does “the wait” impact Ether price?

The high number of queued ETH is a double-edged sword for Ether’s price action. If institutional flows keep pace, ETH could hold its ground and even set up for another leg higher. However, if those inflows slow down, the backlog of unstaked ETH could weigh on the market.

Ether price has faced a sharp…

Click Here to Read the Full Original Article at Cointelegraph.com News…