Key points:

-

Bitcoin’s pullback is finding support near $117,000, indicating buying on dips.

-

Ether has given up some ground but is likely to find support near $4,094.

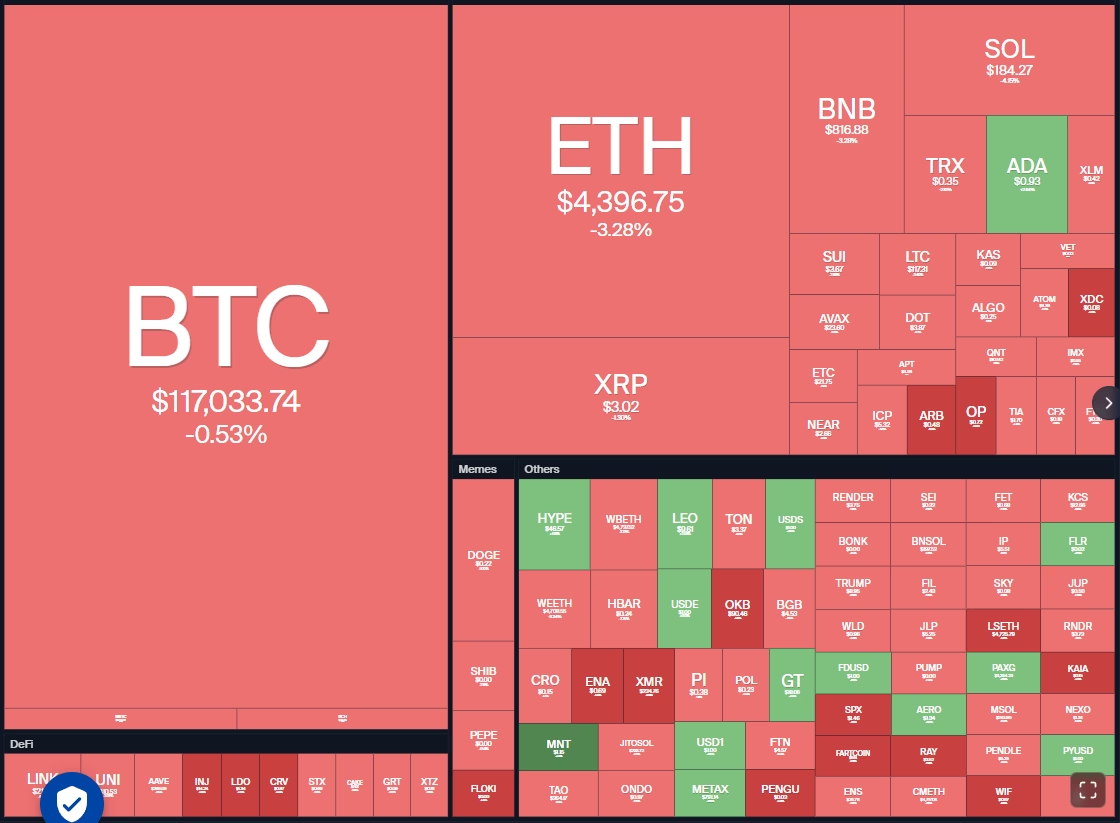

Bitcoin (BTC) turned down sharply from $124,474 on Thursday, but a positive sign is that the bulls are trying to arrest the decline near $117,000. According to a recent Bitcoin Intelligence Report, BTC has immediate resistance just above $130,000, but its year-end target is near $200,000.

Along with BTC, traders are keeping a close watch on Ether (ETH), which has been in a strong uptrend since July. According to SoSoValue data, spot ETH exchange-traded funds have recorded more than $2.9 billion in net inflows this week. That suggests institutional investors expect ETH’s up move to continue for some more time.

ETH’s strength is giving confidence to traders that an altcoin season could be around the corner. In a monthly outlook report on Thursday, Coinbase Institutional global head of research David Duong said that market conditions “suggest a potential shift toward a full-scale altcoin season” in September.

What are the important support levels to watch out for in BTC and the major altcoins? Let’s analyze the charts of the top 10 cryptocurrencies to find out.

Bitcoin price prediction

BTC has pulled back to the 20-day exponential moving average (EMA) ($117,485), which is a critical near-term support to watch out for.

If the price bounces off the 20-day EMA, it signals solid buying on every minor dip. The bulls will then make another attempt to resume the uptrend by pushing the BTC/USDT pair above $124,500. If they can pull it off, the Bitcoin price could skyrocket to $135,000.

Conversely, a close below the 20-day EMA signals profit booking by the bulls. The pair may then dip to the 50-day simple moving average (SMA) ($115,137) and later to the solid support at $110,530. A break below $110,530 could intensify selling, signaling a potential short-term top.

Ether price prediction

ETH is facing selling near $4,788, opening the doors for a retest of the breakout level of $4,094.

If the price rebounds off $4,094, it suggests that the bulls are trying to flip the level into support. If they do that, the ETH/USDT pair could rally toward the overhead resistance zone between $4,788 and $4,868. A close above $4,868 clears the path for a rally to the…

Click Here to Read the Full Original Article at Cointelegraph.com News…