Lawmakers in the US state of Wisconsin introduced a bill in the state’s Senate to accompany an earlier bill filed in the lower house that aims to curb fraud occurring through crypto ATMs.

Senator Kelda Roys, along with six other Democrats, introduced Senate Bill 386 on Monday as companion legislation to Assembly Bill 384, which Democratic Representative Ryan Spaude introduced on July 31.

Under the identical proposed bills, crypto ATM or kiosk operators will need a money transmitting license to conduct operations in the state and must collect information about their users, including name, date of birth, number, address and email.

Filing identical bills in both chambers is a tactic to increase the likelihood of a bill becoming law and speeds up the legislative process as both chambers can consider it simultaneously.

Wisconsin looks to warn crypto ATM users

Under the bills, crypto ATM operators will have to collect a government-issued document from their customers, like a passport or a driver’s license, and will need to take a photo of the customer.

Operators will have to verify their customers’ identity for every transaction, and users will be capped at $1,000 worth of transactions per day.

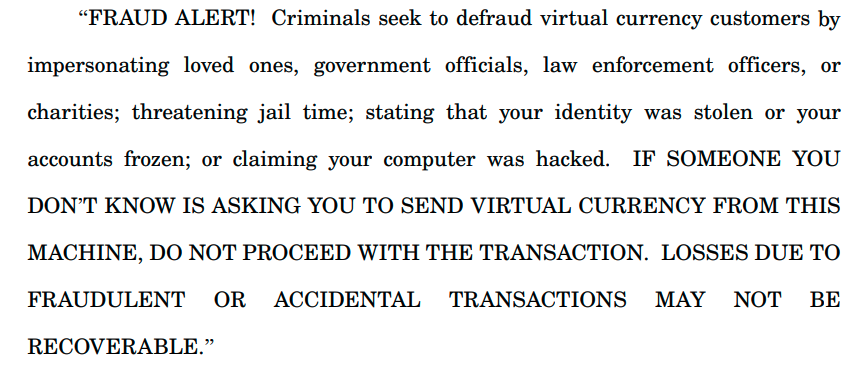

The bills mandate that labels warning of the potential for fraud must be placed “within the customer’s field of vision” on the front of the machine.

Crypto ATMs typically charge much higher fees compared to online crypto exchanges, and the bills propose capping the fees operators can charge customers to a flat $5 fee or 3% of the transaction value, whichever is higher.

Operators will also have to fully reimburse customers if an ATM is used to process a fraudulent transaction, such as to a scammer, or if the operator is contacted by law enforcement agencies confirming that the transaction was fraudulent within 30 days.

FinCEN warns on crypto ATM scams

On Aug. 4, the US Treasury’s Financial Crimes Enforcement Network (FinCEN) issued a notice to financial institutions asking them to report suspicious transactions conducted via crypto ATMs.

“Criminals are relentless in their efforts to steal money from victims, and they’ve learned to exploit innovative technologies like CVC [convertible virtual currency] kiosks,” FinCEN Director Andrea Gacki said.

FinCEN said…

Click Here to Read the Full Original Article at Cointelegraph.com News…