Key takeaways:

-

Bitcoin’s long-term CAGR of 42.5% outpaces the Nasdaq and gold, but is projected to drop to 30% by 2030.

-

The power-law and quantile models keep BTC’s Q4 2025 target between $150,000–$200,000, with $1.2million to $1.5 million possible by 2035.

The long-term growth of Bitcoin (BTC) remains exceptional, according to a recent Bitcoin Intelligence Report, noting that even in the context of other major assets, its trajectory stands out.

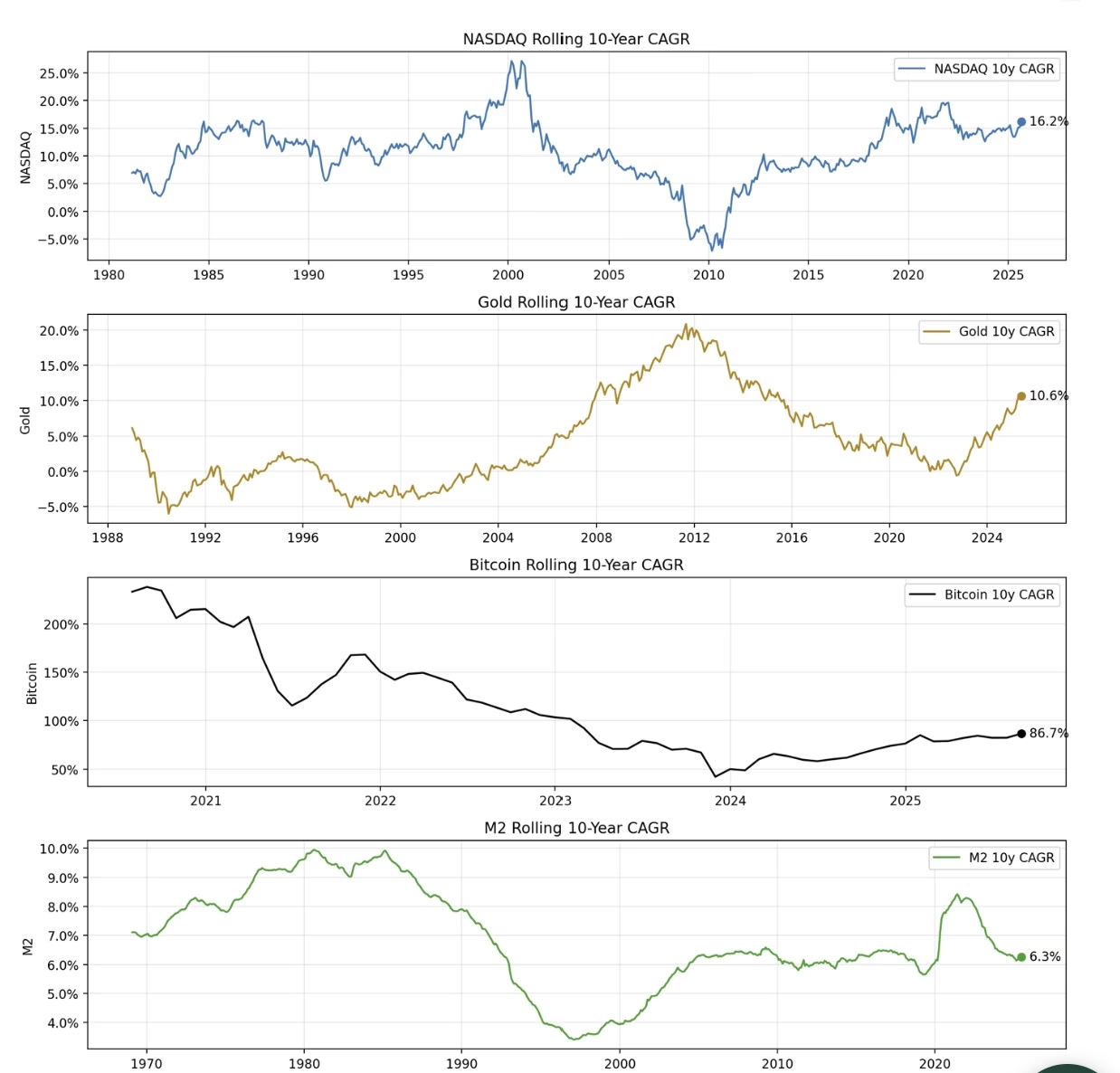

The report compared the Nasdaq’s 10-year rolling compound annual growth rate (CAGR), which typically sits in the mid-single to low-teens, with the latest decade delivering 16%. Gold has averaged 10.65% over the past decade, rising to 12.88% when adjusted for its 2% annual supply growth.

Meanwhile, the US M2 money supply has expanded at roughly 6% annually over the same period. Against this backdrop, Bitcoin’s modeled CAGR of 42.5% underscores its outsized performance.

The company’s power-law model, which has tracked Bitcoin with “unprecedented consistency” for 16 years, projects a gradual, adoption-driven deceleration toward 30% by 2030, still triple gold’s supply-adjusted growth rate.

“Bitcoin remains the cleanest barometer of global liquidity,” the report states, citing its smaller market size and role as a “liquidity sponge” in a structurally expansive monetary regime.

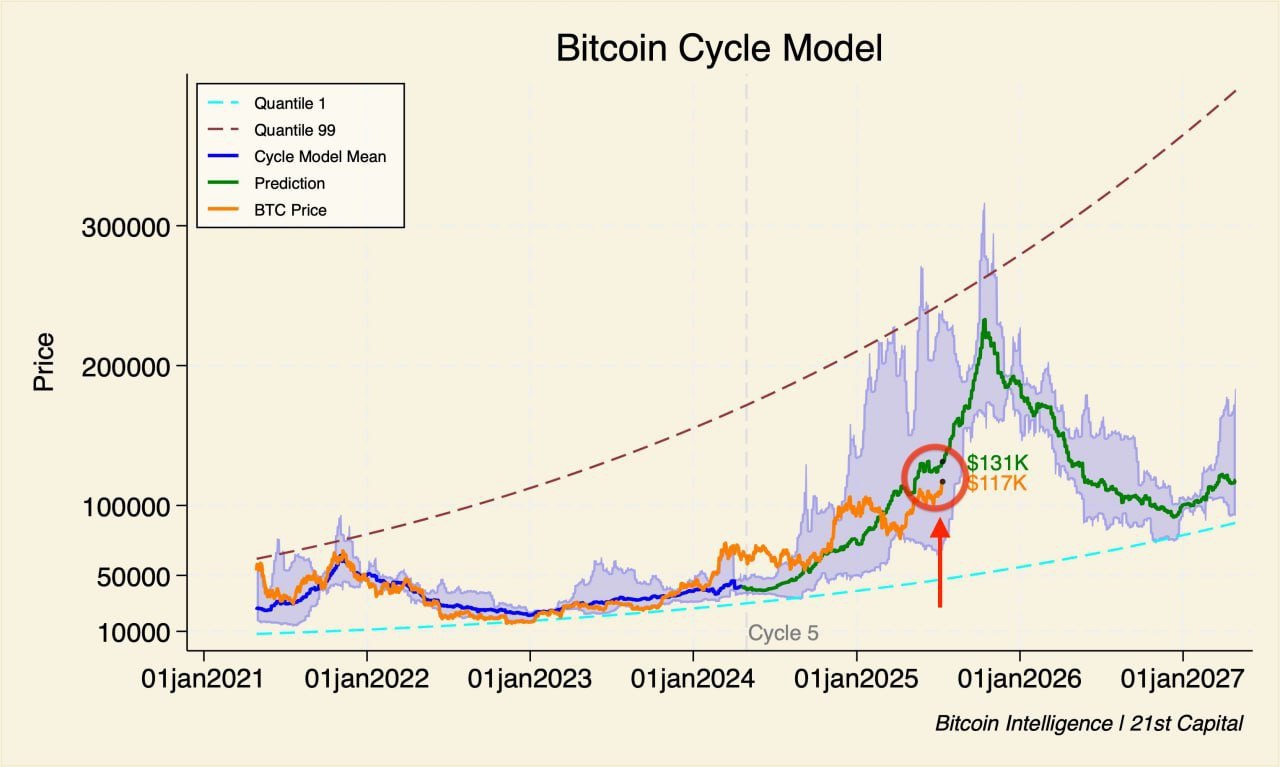

The report shows that the $114,000–$117,000 accumulation zone proved resilient, triggering a spot-led rebound to $122,000.

Related: Bitcoin institutional volume hits 75% on Coinbase in new BTC price signal

Bitcoin $200,000 target by Q4 remains on track

While the immediate resistance lies just above $130,000, the year-end target for Bitcoin remains close to $200,000. Its price projection combines the power-law approach with quantile analysis to track Bitcoin’s historical growth.

According to the model, the base trend for Bitcoin by the end of 2025 sits around $120,000. Factoring in the cyclical bull phase, the price could realistically climb to between $150,000 and $200,000. Looking further out, by 2035, the model anticipates Bitcoin could reach $1.2 million to $1.5 million, a forecast based on exponential, network-like growth rather than speculative hype.

The chart shows that every 50% increase in Bitcoin’s age has historically driven about a 10x jump in price, a pattern the model…

Click Here to Read the Full Original Article at Cointelegraph.com News…