Key points:

-

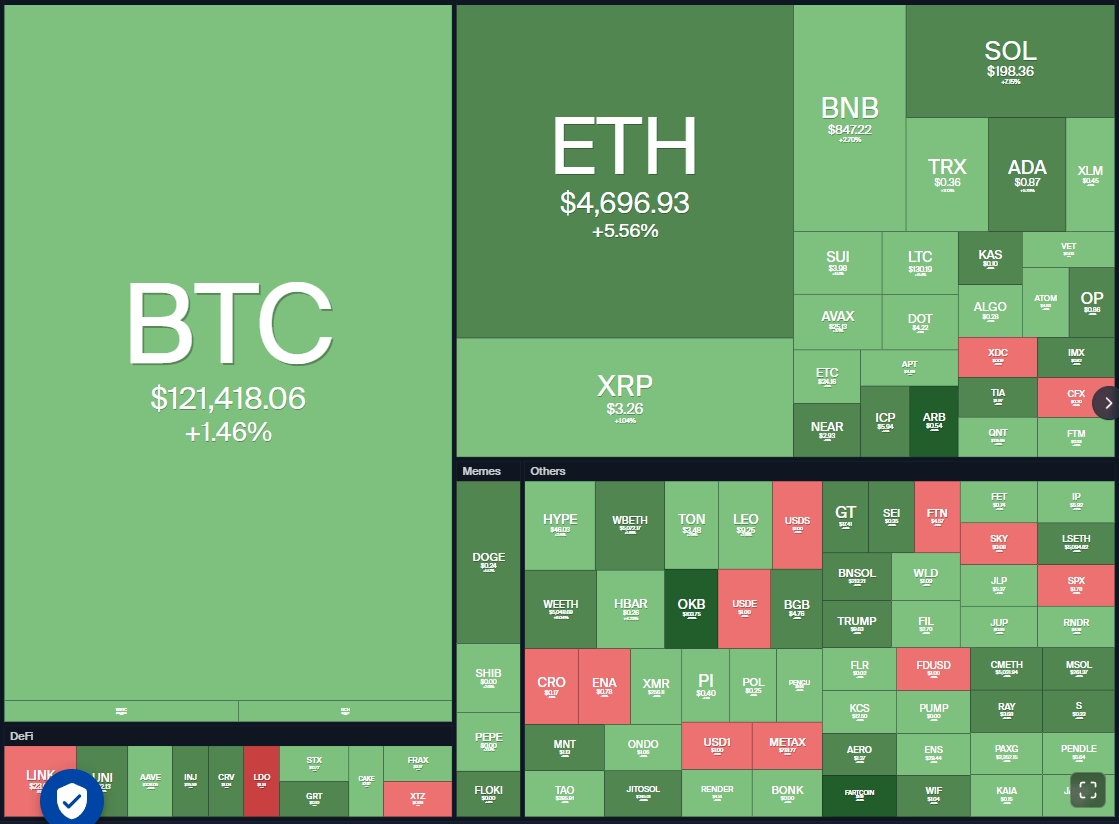

Bitcoin bulls are chasing after BTC’s $123,218 all-time high as buying pressure surges.

-

Ether has played catch-up to Bitcoin and is close to making a new all-time high.

Bitcoin (BTC) rose above $122,000 on Wednesday, indicating that the bulls have kept up the pressure. The repeated retest of a resistance level tends to weaken it, increasing the likelihood of a breakout above the all-time high of $123,218.

BTC is not alone. Ether (ETH) has also charged toward its all-time high of $4,868. Crypto sentiment-tracking platform Santiment said in a post on X that ETH could break out to a new all-time high as retail traders are in disbelief of the current rally. History shows the price moves in “the opposite direction of retail traders’ expectations.”

In a report shared with Cointelegraph, Standard Chartered said aggressive buying by ETH treasury companies and exchange-traded funds, along with the pace of stablecoin adoption, improves the outlook for ETH. This led the bank to boost their ETH price target to $7,500 in 2025 from $4,000 previously.

Could BTC break above the all-time high, pulling altcoins higher? Let’s analyze the charts of the top 10 cryptocurrencies to find out.

Bitcoin price prediction

Buyers have again pushed BTC toward the all-time high of $123,218, indicating solid buying on every minor dip.

The flattish 20-day simple moving average (SMA) ($116,957) signals a balance between supply and demand, but the relative strength index (RSI) above 65 indicates positive momentum. That increases the likelihood of a break above $123,218. The BTC/USDT pair could then surge toward $135,000.

Time is running out for the bears. They will have to swiftly yank the price below the 50-day SMA ($114,682) to weaken the bullish momentum. If they do that, the Bitcoin price could tumble to $110,530.

Ether price prediction

ETH extended its rally above $4,700 on Wednesday, indicating sustained demand from the bulls.

Sellers will try to defend the $4,868 level, which could trigger a short-term correction or consolidation. The overbought level on the RSI also suggests the rally may cool off in the near term. If that happens, the ETH/USDT pair could descend to $4,350 and then to the breakout level of $4,094.

Instead, if buyers pierce the $4,868 level, the Ether price could skyrocket to the psychological level…

Click Here to Read the Full Original Article at Cointelegraph.com News…