Corporate Bitcoin treasuries have surged past $100 billion, raising concerns among analysts that the United States could one day nationalize these holdings in a move reminiscent of the gold standard era.

Corporate crypto treasuries have surpassed $100 billion of digital asset holdings, with Bitcoin (BTC) treasury firms amassing 791,662 BTC worth about $93 billion, representing 3.98% of the circulating supply, Cointelegraph reported on July 31.

The growing corporate holdings may present a new centralized point of vulnerability for Bitcoin, which may see the world’s first cryptocurrency follow the same “nationalization path” as gold in 1971, according to crypto analyst Willy Woo.

“If the US dollar is structurally getting weak and China is coming in, it’s a fair point that the US might do an offer to all the treasury companies and centralize where it could be then put into a digital form, not create a new gold standard,” Woo said during a panel discussion at Baltic Honeybadger 2025, adding:

“You could then rug it like happened in 1971. And it’s all centralized around the digital Bitcoin. The whole history repeats again back to the beginning.”

In 1971, President Richard Nixon ended the Bretton Woods system, suspending the dollar’s convertibility into gold and abandoning the fixed $35-per-ounce rate, effectively ending the gold standard.

Related: BTCFi VC funding hits $175M as investors focus on consumer apps

Woo noted that institutional adoption is still a critical step for Bitcoin to replace the US dollar, surpass gold and become a new monetary standard. “That’s not going to happen until you get the large gatekeepers of capital opening up to Bitcoin and pouring money in,” he said.

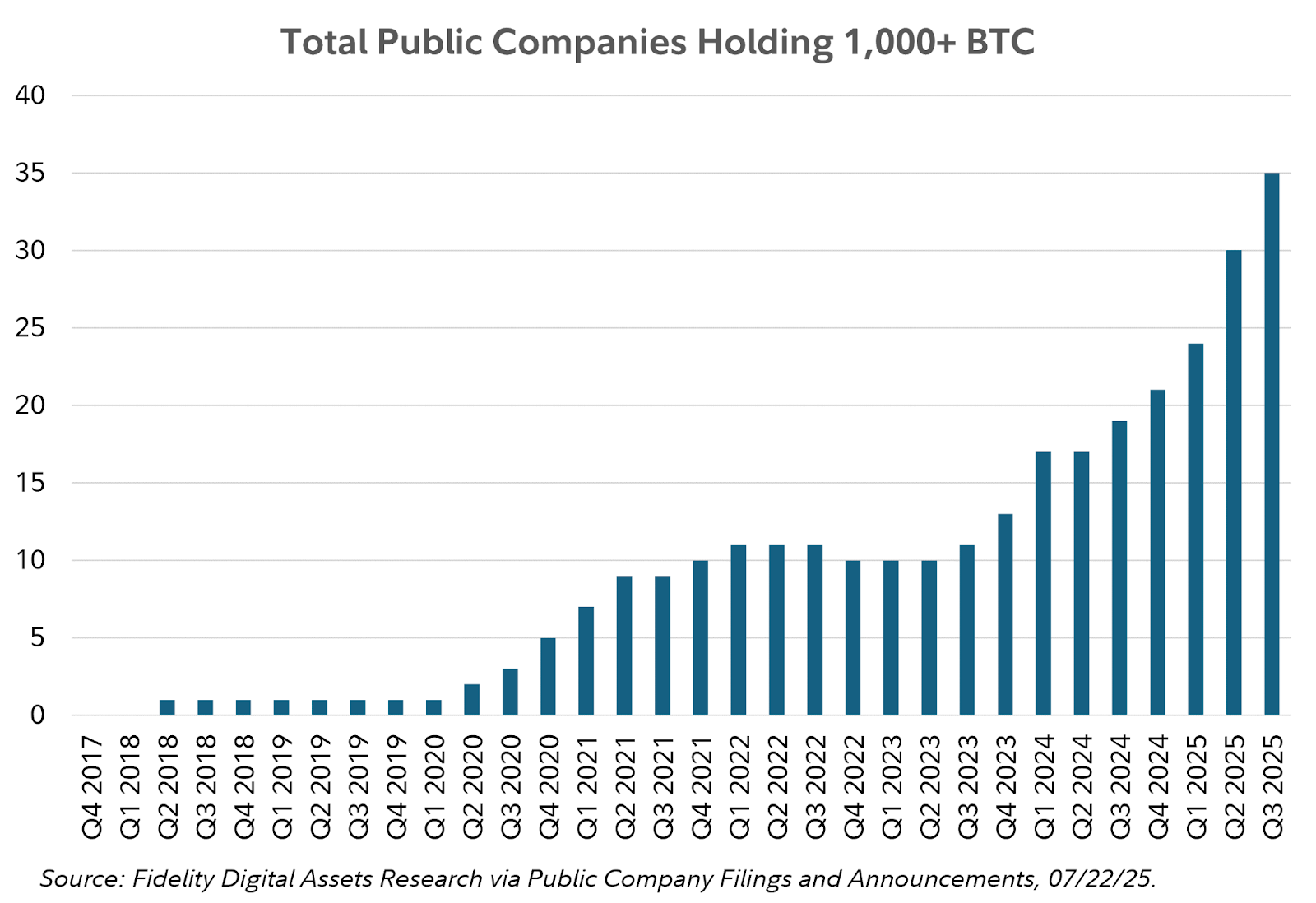

The analyst’s comments come amid a period of accelerating institutional adoption, two weeks after 35 publicly traded companies have surpassed 1,000 BTC or approximately $116 billion in balance sheet holdings each, Cointelegraph reported on July 25.

Nationalization efforts may also target Bitcoin whales, according to Preston Pysh, co-founder of the Investors Podcast Network and Bitcoin venture fund Ego Death Capital.

“They’re going to take the Bitcoin because it’s going to have an institutional custodian that does not want to go to jail,” he…

Click Here to Read the Full Original Article at Cointelegraph.com News…