Key takeaways:

-

Diagonal and butterfly spreads benefit from BTC near $160,000.

-

$200,000 year-end call options imply less than 3% chance of profit.

Bitcoin (BTC) traders are gearing up for the year-end $8.8 billion options expiry, scheduled for Dec. 26 at 8:00 am UTC. More than $1 billion in Bitcoin options would become active if the price surpasses $200,000. But does that signal that traders are expecting a 72% rally?

Calls dominate, but bears comfortable with Bitcoin below $120K

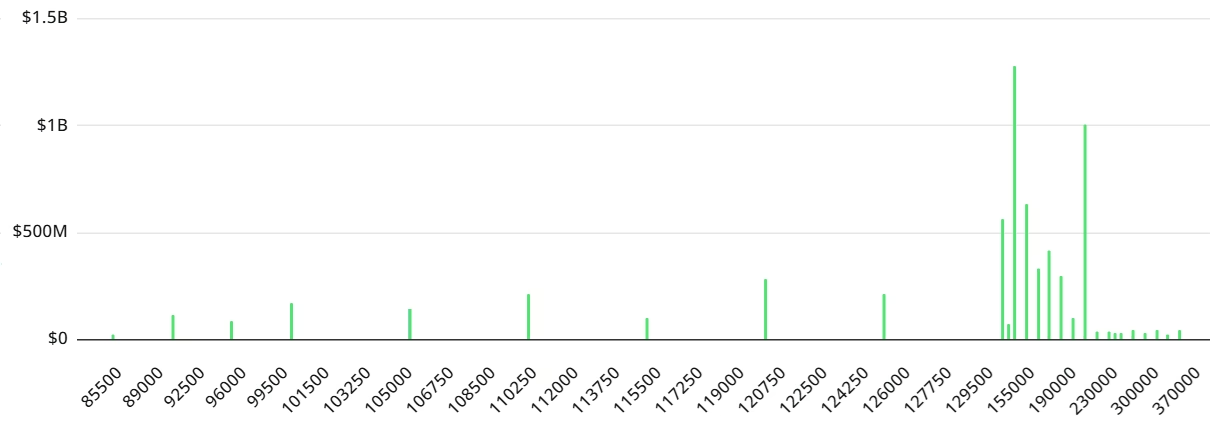

Currently, total open interest for call (buy) options stands at $6.45 billion, while put (sell) options trail at $2.36 billion. This data indicates a clear advantage for call options, though bearish traders appear somewhat comfortable with Bitcoin remaining below $120,000.

Some call options have strike prices set at $170,000 or higher and will expire worthless unless Bitcoin gains 46% from its current level. In fact, if BTC trades near $116,500 on Dec. 26, only $878 million worth of call open interest will hold value at expiry.

Professional traders often use highly bullish call options as part of strategies that don’t necessarily depend on a 70% year-end rally.

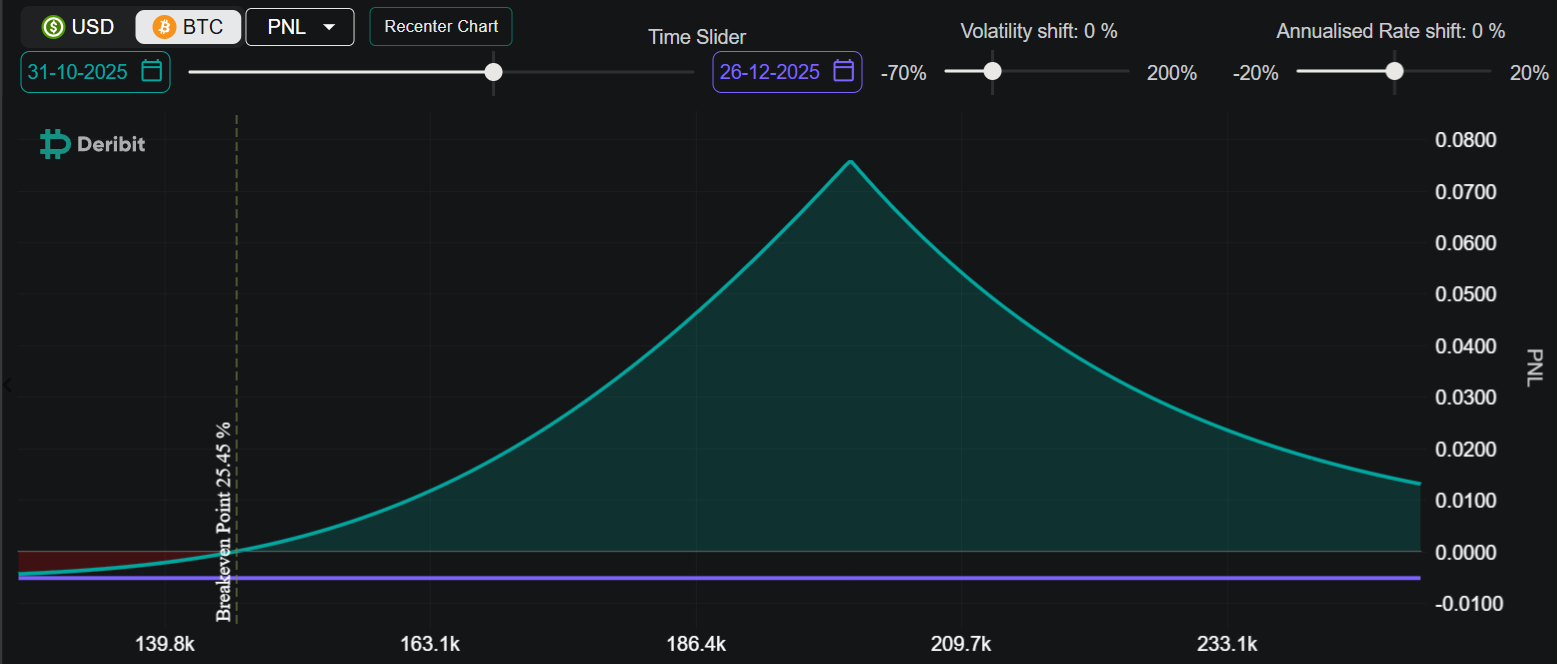

One such strategy, the Call Diagonal Spread, involves buying a $200,000 December call and selling a $200,000 call with an earlier expiry, typically in October.

This setup profits most if BTC exceeds $146,000 by Oct. 31, causing the long-dated call to appreciate while the short-term call expires worthless.

However, BTC prices above $200,000 can actually hurt this strategy. The maximum potential loss is BTC 0.005 (about $585 at current prices), while the maximum gain is BTC 0.0665 (roughly $7,750).

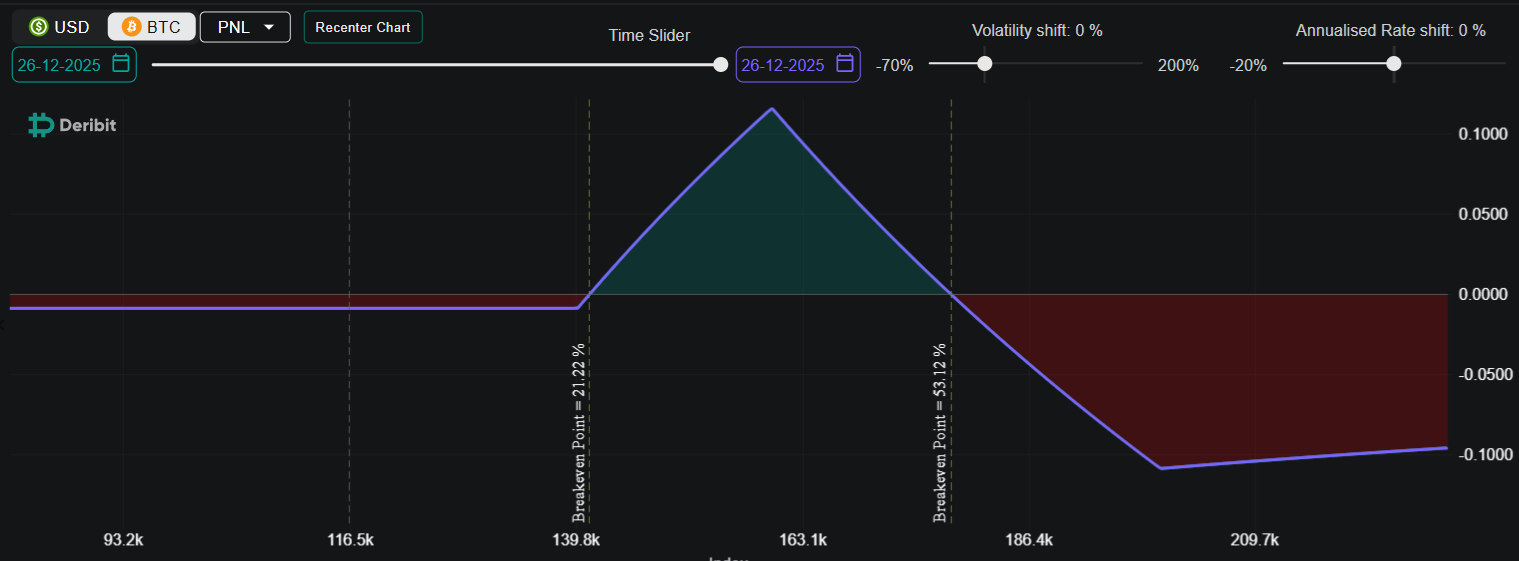

Another example is the “Inverse Call Butterfly,” which consists of buying one $140,000 call, selling two $160,000 calls, and buying one $200,000 call—all with December expiries.

This position profits most if BTC lands near $160,000 on Dec. 26, netting BTC 0.112 (around $13,050). However, losses begin to accrue if BTC climbs past $178,500. Even so, the $200,000 call helps cap potential losses. In this case, the maximum loss is 0.109 BTC, or approximately $12,700.

$900M in Bitcoin put options target $50–$80K

A sizable open interest in $200,000 call options does not necessarily mean traders expect Bitcoin to reach that…

Click Here to Read the Full Original Article at Cointelegraph.com News…