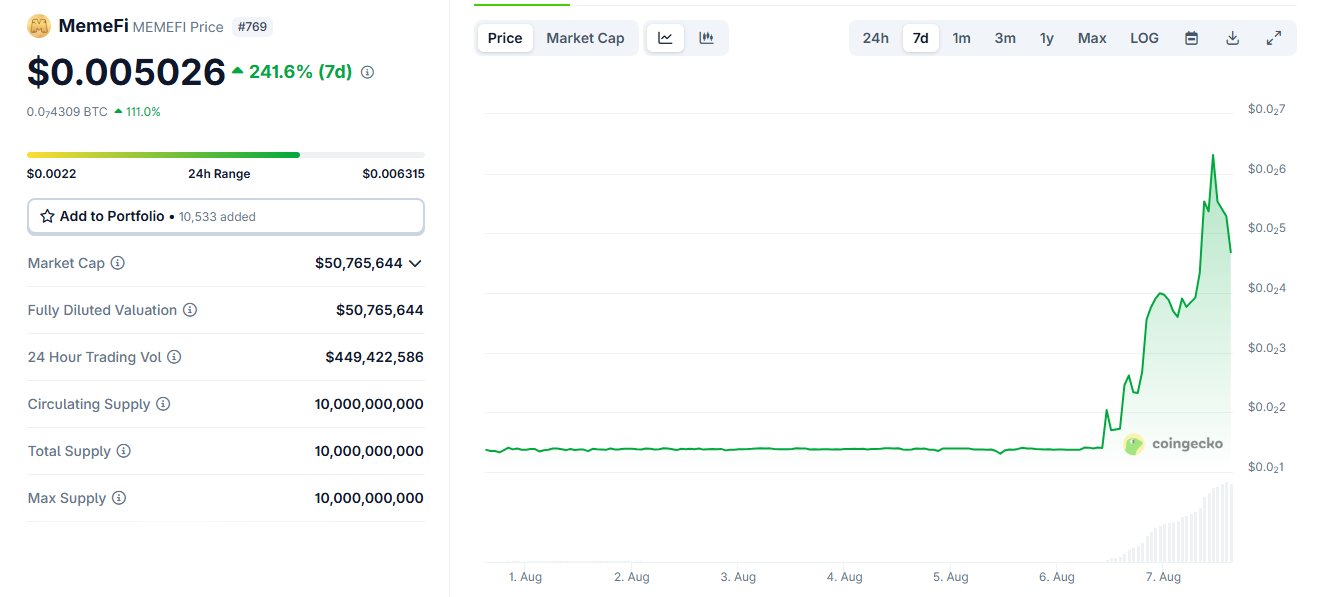

- MemeFi surged 300% after Binance’s futures delisting news.

- A major short squeeze after Binance’s announcement triggered high trading volume and volatility.

- Binance delisting raises doubts about the rally’s sustainability.

MemeFi (MEMEFI), a tap-to-earn crypto project built around Telegram mini-games, has shot up by more than 300% in a matter of hours, pushing it into the list of the top gainers today.

However, doubts are emerging about the long-term viability of the memecoin price action, especially seeing that it comes after Binance announced it will delist the token’s perpetual contracts on August 11.

Why is the MEMEFI price rising?

The dramatic price surge appears to have been triggered by a major short squeeze, following Binance’s decision to delist MEMEFI’s perpetual futures contracts.

As the August 11 deadline approaches, traders are rushing to exit their short positions, creating intense buying pressure that sent the price skyrocketing.

This has forced a wave of short liquidations, reportedly triggering nearly $376 million in trading volume in just one day, propelling MEMEFI to over $0.0063 from levels below $0.002, although it has slightly pulled back to around $0.005026.

Open interest also hit an all-time high of $36.92 million, with the majority of those positions — roughly 54% — being shorts.

As a result, $1.28 million worth of short positions were liquidated on Binance alone, with further liquidations noted on platforms like Huobi.

Binance delisting looms over the rally

Despite the bullish momentum, the looming delisting by Binance has injected a dose of caution into the market.

The exchange confirmed that it will halt trading of MEMEFI and DEFI perpetual futures on August 11 at 09:00 UTC, meaning traders must close any open positions before the deadline or risk forced liquidations.

While spot trading remains unaffected, the end of derivatives trading significantly reduces speculative leverage opportunities.

Binance has warned users that it may adjust contract parameters or stop stabilising the MEMEFI market in the final hours. This warning has contributed to increased volatility and uncertainty.

The delisting decision appears to stem from sustained low trading volumes and reduced…