Key takeaways:

Bitcoin (BTC) has historically maintained an inverse relationship with the US Dollar Index (DXY), which tracks the dollar’s strength against a basket of major foreign currencies.

While this correlation shifts over time, Bitcoin’s drop below $114,000 on Friday coincided with the DXY climbing to its highest level in more than two months.

Traders are now watching for Bitcoin to reclaim the $120,000 mark as the US dollar reversed direction and began showing signs of weakness.

The DXY fell to 98.5 on Wednesday after failing to regain the 100 level last Friday. A weaker-than-expected US jobs report for July prompted traders to increase wagers on multiple interest rate cuts by the Federal Reserve, undermining the dollar’s yield advantage, according to Bloomberg.

Reuters also noted inflationary concerns as the US imposed new import tariffs on dozens of trade partners, a move that can raise domestic prices and further pressure monetary policy.

Weak USD can boost Bitcoin, but recession fears cap gains

A softer US dollar can be supportive for Bitcoin’s price, yet the opposite may occur if investors anticipate an economic slowdown or turn risk-averse for any reason.

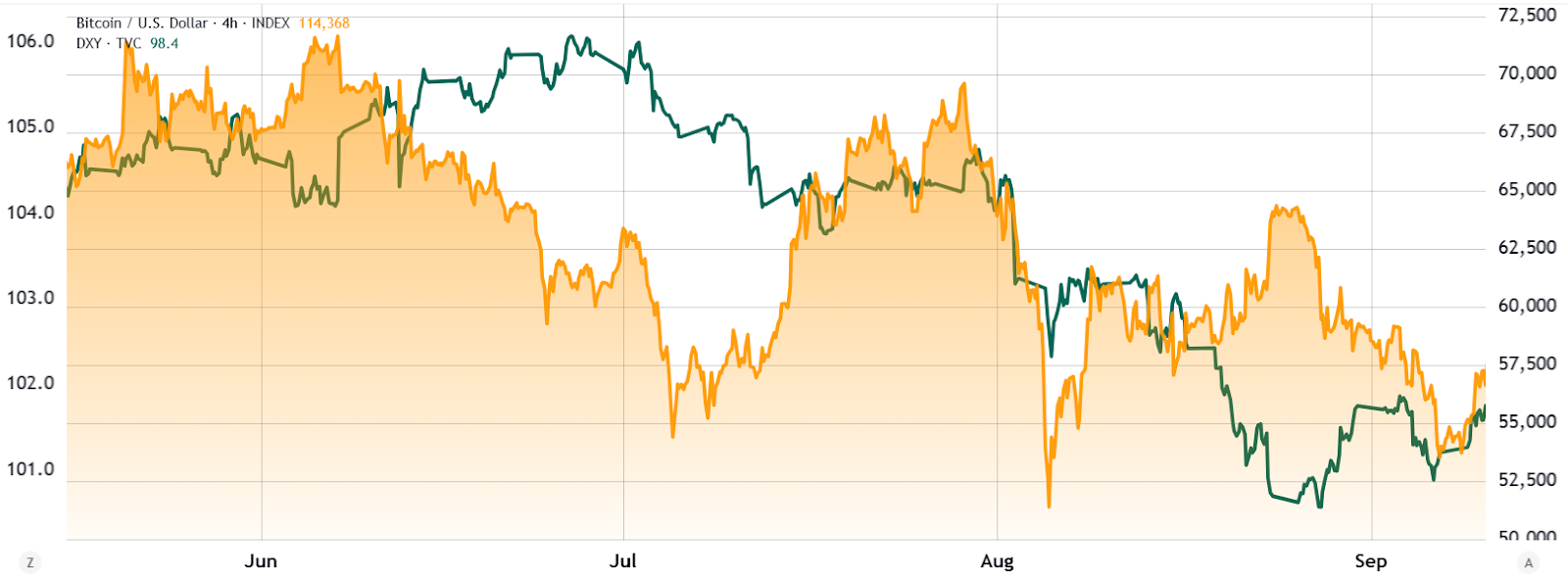

For example, between June and September 2024, the DXY declined from 106 to 101, but Bitcoin repeatedly failed to hold above $67,000 and eventually dropped to $53,000 by early September.

One way analysts gauge market sentiment is by tracking the ICE BofA High Yield Option-Adjusted Spread, a measure of the extra compensation investors demand over risk-free rates for holding lower-rated corporate bonds.

This spread incorporates credit and liquidity risks, making it a widely used proxy for risk appetite. A higher reading signals greater caution in markets, while a lower reading suggests investors are more willing to take on risk.

The spread spiked briefly in August and September 2024, coinciding with a weaker US dollar and falling Bitcoin prices. More recently, it dropped sharply to 2.85 by late July 2025 after peaking at 4.60 in April. This decline matched Bitcoin’s rally from its $74,500 low on April 7, underscoring how improved credit sentiment can support risk assets.

Click Here to Read the Full Original Article at Cointelegraph.com News…