Key takeaways:

-

Ether’s futures and options data signal neutral‑to‑bearish sentiment despite recent price recovery.

-

Institutional ETF outflows and a lack of catalysts keep ETH from breaking $3,800.

Ether (ETH) price has gained 9% from the $3,355 low on Sunday, yet derivatives metrics suggest traders are still not confident the bullish momentum will hold.

The recent price action has closely mirrored the broader altcoin market capitalization, highlighting the absence of clear drivers for a sustained rally above $3,800 in the short term.

Altcoin market capitalization reached $1.3 trillion on July 28, coinciding with Ether’s highest level in 2025. Consequently, Ether’s inability to reclaim the $4,000 mark in late July was more likely the result of reduced risk appetite among investors than any specific issue within the Ethereum ecosystem.

Still, that does not mean investors have become optimistic about Ether’s price outlook.

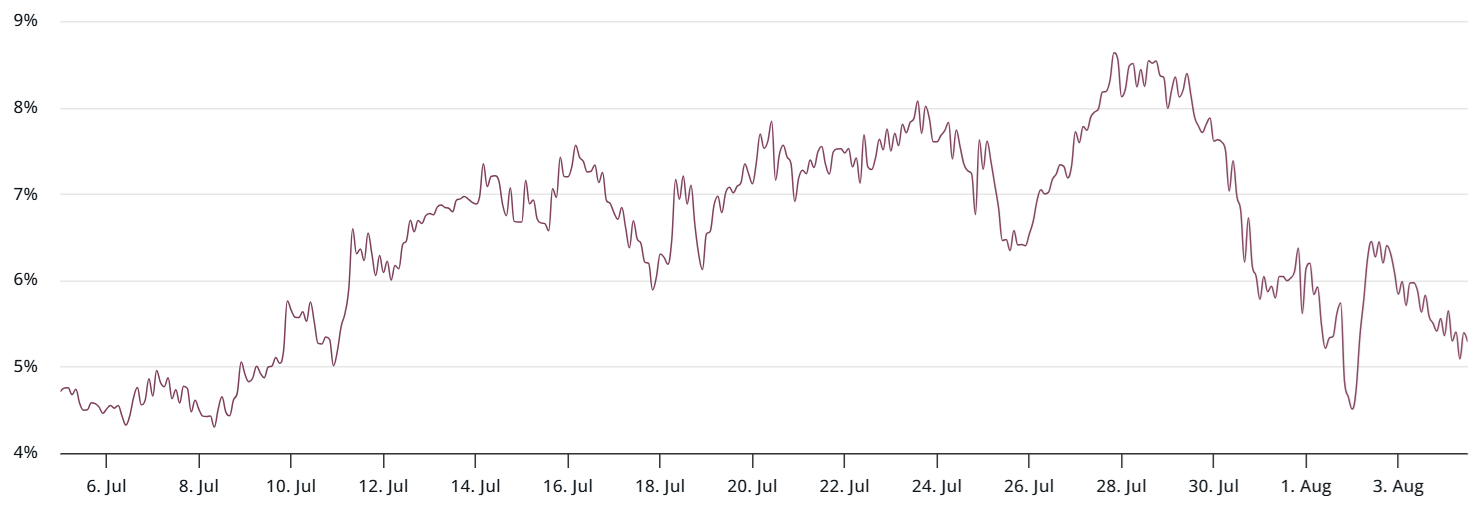

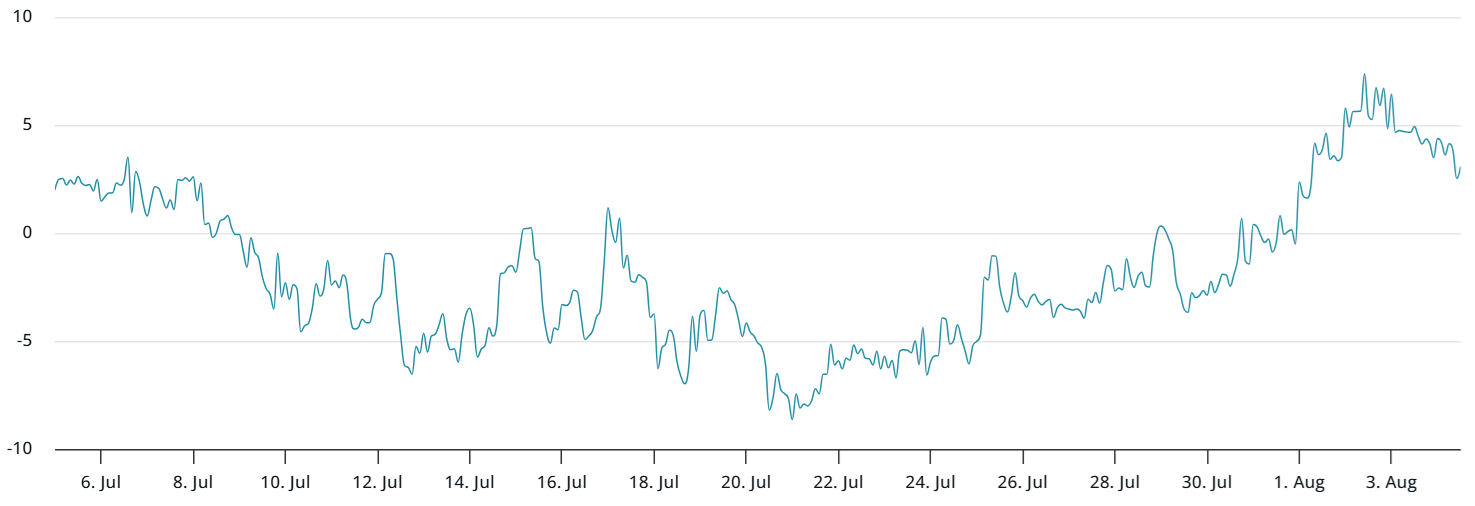

The Ether 3‑month futures premium now stands at 5% at the neutral‑to‑bearish threshold. This is particularly concerning given that even the $3,900 ETH price level, reached a week earlier, failed to turn the indicator bullish.

Ethereum’s TVL decline hurts investor sentiment

Part of investors’ disappointment can be linked to the drop in deposits across decentralized applications (DApps). The total value locked (TVL) on the Ethereum network declined 9% over the past 30 days to ETH 23.8 million.

For comparison, BNB Chain’s TVL rose 8% to BNB 6.94 billion in the same period, while deposits on Solana DApps increased 4% to SOL 69.2 million, according to DefiLlama. In USD terms, Ethereum’s base layer continues to dominate with a 59% share of total TVL.

Ether investors’ reduced optimism has also been reflected in ETH options markets, as the 25% delta skew (put‑call) indicator reached 6% on Saturday, right at the neutral‑to‑bearish threshold.

The skew increases when demand for protective put (sell) options. The current 3% reading suggests a balanced risk assessment, indicating that bullish sentiment has not returned.

ETH lacks institutional demand to break $3,800

ETH prices on Coinbase and Kraken are…

Click Here to Read the Full Original Article at Cointelegraph.com News…