Key takeaways

-

Pump-and-dump schemes in Web3 manipulate a cryptocurrency’s price through coordinated buying along with misleading information and hype to lure investors in before a mass selling of a token, leaving it almost worthless.

-

Decentralized anonymity and 24/7 unregulated trading make the industry particularly vulnerable to these manipulative investment schemes.

-

A pump-and-dump follows four stages, including the token prelaunch, promotional hype building at launch, price pumping through buying action and a coordinated sell-off by orchestrators running off with profits.

-

You can protect yourself from falling for pump-and-dumps by avoiding unsolicited investment advice, being skeptical of social media ads and avoiding schemes with promises of unrealistic returns in short time frames.

Coordinated pump-and-dump schemes have dogged the Web3 ecosystem and crypto market for years. Often described as the Wild West of the digital world, the allure of quick profits has always attracted those looking to manipulate investments at the expense of others who believe unrealistic promises.

With regulations continually playing catch-up, combined with the decentralized design of the industry, these schemes have often gone under the radar for law enforcement. Still, recent efforts show that Web3 is no longer impervious to regulators. For example, in October 2024, Operation Token Mirrors resulted in $25 million being seized and 18 people being charged.

In this article, you’ll learn about “pump-and-dump schemes,” including their definition, how they operate and how to protect yourself from these sophisticated manipulation tactics.

What are pump-and-dump schemes in Web3?

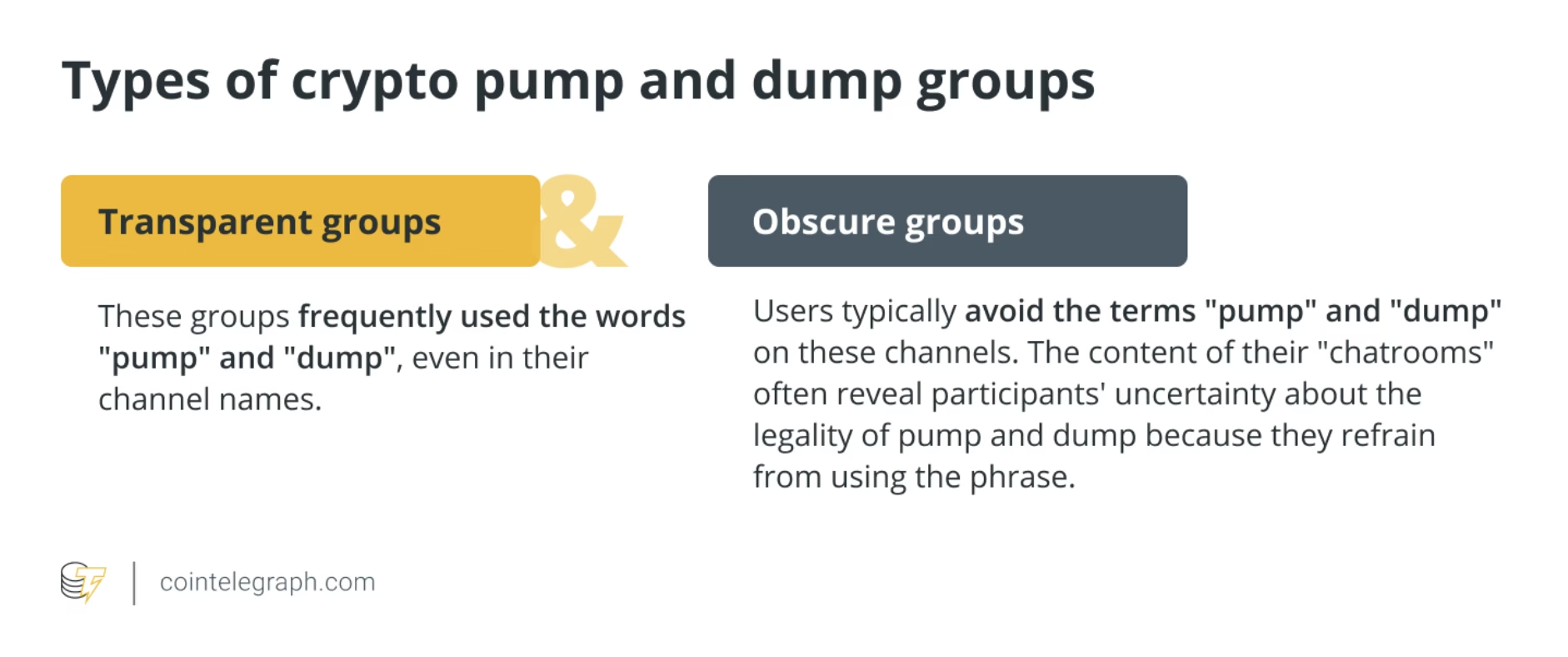

A pump-and-dump scheme refers to the intentional manipulation of a cryptocurrency or blockchain asset’s price. The market price of these digital assets is achieved through coordinated buying coupled with misleading information.

Once the scheme ringleaders achieve their desired price, they initiate a violent sell-off to take their profits. This results in all other investors sitting on severely devalued or worthless tokens. The phrase refers to this process of “pumping up” a token’s price, then “dumping” the token and the price concurrently. As these assets generally have little to no value, the price never recovers, and innocent investors are stuck.

Why do pump-and-dump schemes work in Web3?

The peer-to-peer decentralized design of Web3 makes it a fertile ground for this type of…

Click Here to Read the Full Original Article at Cointelegraph.com News…