Key Takeaways:

-

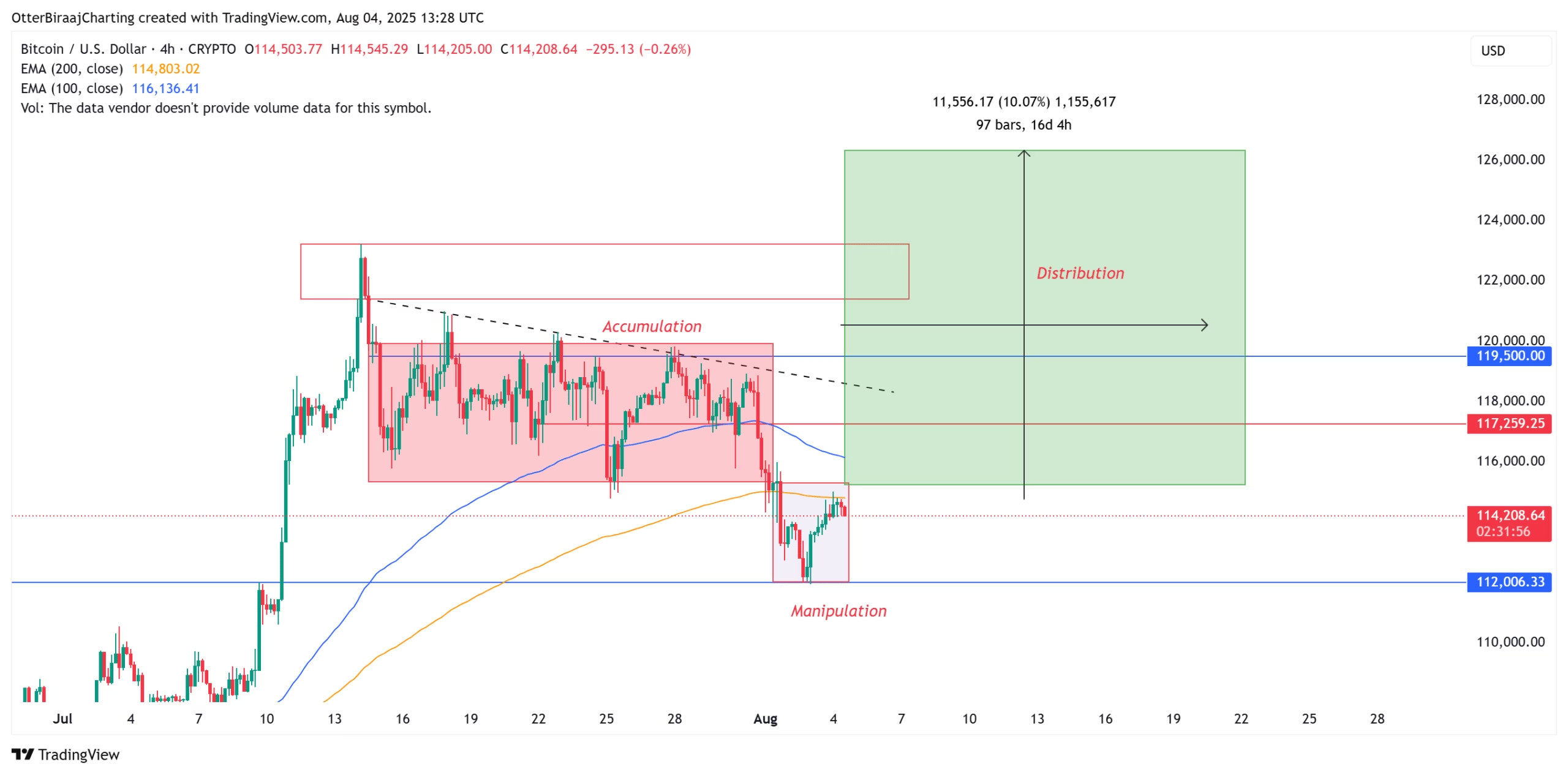

Bitcoin’s Power of 3 pattern shows accumulation, manipulation, and a possible distribution phase targeting $126,000.

-

A $922 million liquidation event caused a major reset in leveraged positions, increasing the chances of a market recovery.

-

Key levels around $115,300 and $116,800 must be cleared, with $120,000 acting as a strong price magnet.

Bitcoin (BTC) dipped to $112,00 over the weekend, but despite a shaky start to August, BTC’s recent correction might have laid the path for a swift recovery.

Bitcoin “Power of 3” pattern aims at $126,000

Bitcoin’s short-term price action is unfolding with a “Power of 3” market structure, consisting of Accumulation, Manipulation, and Distribution (AMD). This setup follows liquidity, reflecting how institutional investors operate compared to reactive retail flows.

-

Accumulation: Price stabilized between $119,500–$115,300, showing a base-building phase.

-

Manipulation: A sharp drop followed, bottoming out around $112,000, suggesting a shakeout to trap late longs and force retail capitulation.

-

Distribution: If BTC firmly reclaims $115,300 on both low and high time frames, the stage could be set for a distribution leg toward $126,000, a technical target aligning with recent resistance clusters.

This pattern, if validated, signals not just short-term recovery but potentially resumes the bull market and catches sidelined or short-biased traders off guard.

BTC absorbs fair value gap, retests key support

Bitcoin has effectively absorbed a key high time frame fair value gap (FVG) between $115,200 and $112,000. This range also coincides with the previous all-time high from May, which is now acting as a critical support zone.

The rapid liquidity sweep into this gap, followed by a price rebound, reflects strength beneath the surface. A support retest of a previous high at $112,000, combined with absorption of imbalanced supply near $115,000, suggests that sellers may be exhausted, increasing the chances of a bullish reversal.

$922 million liquidation event resets market bias

The crypto futures market reflects a significant reset, pointing to a potential shift in sentiment. Over the past few days, Bitcoin’s open interest dropped to $79 billion from $88 billion, signaling a sharp reduction in leveraged positions.

This came alongside $922 million in crypto position liquidations on Aug. 1, the…

Click Here to Read the Full Original Article at Cointelegraph.com News…